Good morning,

Welcome to today’s edition of The Armchair Analyst, a 5-minute daily update on the ASX life-sciences sector.

Yesterday was one of the most brutal sell-offs in the tech sector.

The cause?

AI sentiment shifted from “this is going to help SaaS companies” to “this is going to replace SaaS companies”.

While the tech sector had a big selloff, I think that medtech software stocks are uniquely insulated from the SaaSpocolypes for one reason…

Regulations.

But first…

The Pulse Check

Lots of investor presentations today for the Euroz Hartleys healthcare conference. I’ll be listening in throughout the day.

Very good lineup, with every company presenting at a significant inflection point.

BCAL Diagnostics (ASX: BDX) gains early traction after the launch of its Avantect ovarian and pancreatic cancer blood tests. 11 days in and already 1,000 enquiries, 60 bookings, and 20 tests completed at $1,495 per test. (BDX)

🪑 Great first week and a half for BCAL.

Neuren Pharmaceuticals (ASX: NEU) received FDA feedback on the development of NNZ-2591 for HIE and Pitt-Hopkins syndrome. The result was that an additional animal study is needed before the IND is approved. (NEU)

🪑 While this does delay Neuren by about 6 months, the company expect to be in the clinic at the end of 2026.

Trajan Group Holdings (ASX: TRJ) reaffirms FY26 guidance, expecting net revenue over $170M and nEBITDA exceeding $16M. (TRJ)

🪑 Perfect timing for this news, as my Trajan 1-Page Wonder is set to land tomorrow.

A quick word from me on these results.

The prior company guidance was $170 - $180 million in revenue and $16 - $19 million in nEBITDA.

The wording is important here. Trajan says it “still expects to exceed $170 million and nEBITDA expected to exceed $16 million. By how much? Who knows.

But it's very different to the wording used the other day by AROA Biosurgery, who used “upper end of the guidance”.

Assuming the market is priced for guidance to hit in the middle, this wording doesn’t give confidence it will get there… so I expect this update to be met with slight disappointment.

Nyrada Inc. (ASX: NYR) releases a ‘Fact Sheet’ for its Phase 2a clinical trial to reduce ischemia-reperfusion injury in heart attack patients. (NYR)

🪑 The NYR communication team is on point once again.

While there is no new information in the fact sheet, it is an easy document for investors to return to for trial information and expectations, in a way that makes sense to them.

10/10 communication, for any ASX-listed CEO or Investor Relations reading this with an upcoming trial, this Fact Sheet is a must.

The US Congress has reauthorised the Rare Pediatric Disease Priority Review Voucher program to September 2029. PRVs are a tradeable asset, with one recently selling for US$200 million. (Fierce Pharma)

🪑 Good news for Neuren (ASX: NEU), who could be eligible.

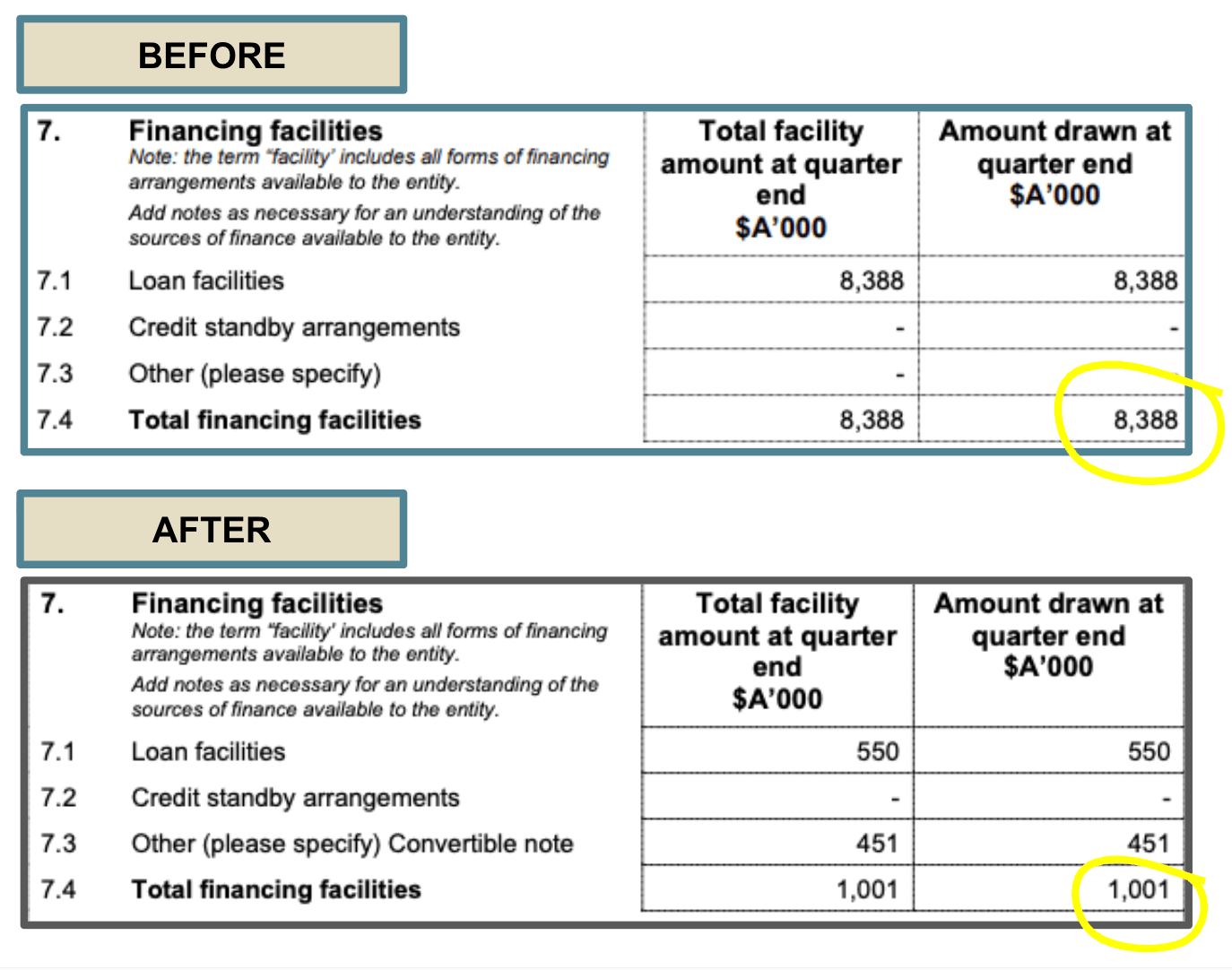

Yesterday, after the marketclosed, Adherium (ASX: ADR) updated its 4C report after mistakenly reporting $8 million in debt; the actual amount was closer to $1 million. (ADR)

🪑 I’m looking forward to meeting with the CEO today at an investor lunch, but luckily, they managed to fix the issue beforehand! That is a HUGE $7 million ‘fat finger’ mistake:

Merck & Co. projects $70B+ in annual revenue opportunities by the mid-2030s, as it prepares for a post-Keytruda future with an expanded pipeline. (Fierce Pharma)

Cash Injection

Advance Opportunities Fund just converted another $500,000 worth of shares in Osteopore (ASX: OSX). (OSX)

BARDA launches US$100M antiviral prize to develop broad-spectrum therapies for tropical diseases (including Zika and Dengue Fever). (Fierce Biotech)

🪑 I wonder if Island Pharmaseuticals (ASX: ILA) is eligible for this one?

Veradermics lands upsized US$256M IPO with its oral Rogaine product for hair regrowth. (Endpoints)

🪑 Biotech stocks in the US continue to show strength, driven by upsized IPOs.

Under the Microscope

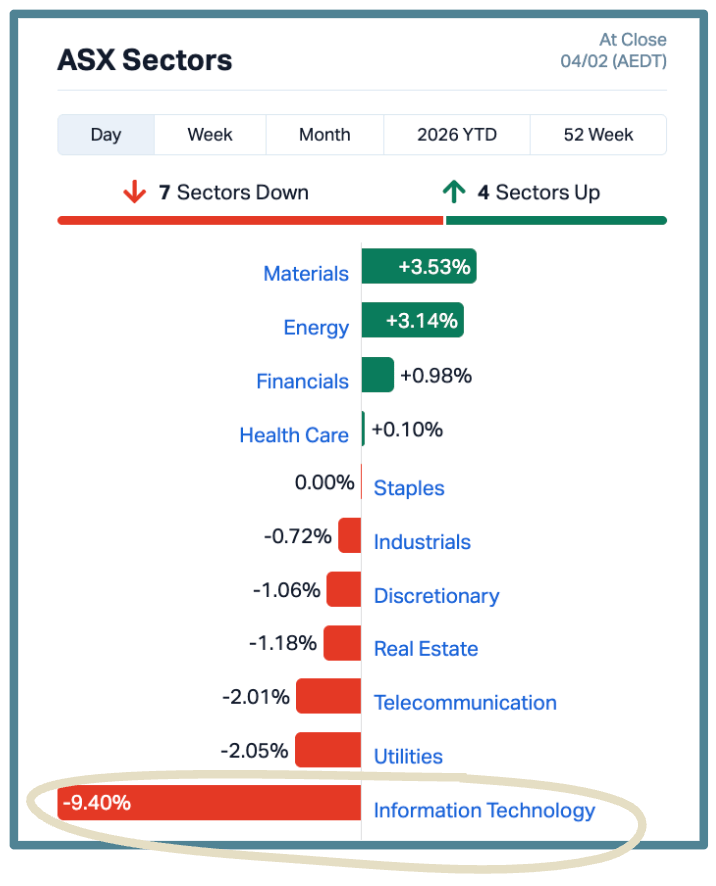

Yesterday was one of the biggest “red” days for ASX-listed tech stocks in a while:

This trend followed big sell-offs in the US tech stocks:

(Source, Yahoo Finance)

AI has been a major driver of growth in the tech sector over the past 18 months, but now it appears to be the cause of the issues.

In a very short period, sentiment on AI has shifted from "AI will be very useful for companies" to "AI will replace companies."

Analysts are calling this the SaaSpocalypse:

So, what happened?

On Tuesday, Anthropic launched a new suite of AI automation tools, Claude Cowork, designed to automate tasks across legal, sales, marketing and data analysis.

This triggered a panic sell-off, as AI could replace core software and outsourcing business models rather than just support them.

On the ASX, core names such as Xero (down 15.90%), Wise Tech (down 10.68%) and TechnologyOne (down 10.47%) were all affected.

While conventional wisdom holds that AI will be the future, this is the first major hit to the SaaStablishment.

The SaaS business model is very attractive for investors.

Annual recurring revenues are predictable when matched against churn, high margins and once a product is developed… It's all about scale.

The challenge with SaaS companies is that the barriers to entry are low, and their biggest moat (defensible business position) is in the “switching cost” for existing users.

But with AI advancing so quickly, this moat is eroding.

Unlike traditional SaaS tech stocks, Metech has an additional moat to defend against AI ‘copycats’…

Regulations.

Companies like Blinklabs (BB1), Pro Medicus (PME), EchoIQ (EIQ), Atraya (AYA) and 4D Medical (4DX)... those who assist in detecting issues, will be largely insulated from the SaaSpocalypse.

This is because:

Approvals take time and are highly regulated.

Software is patentable.

Structured cash flows are in place through insurance reimbursement codes.

This creates a high barrier to entry for any hyperscalers looking to develop an AI product to compete.

Where I see a risk for medtech is in companies that support hospital or patient workflow management or patient records.

However, after tracking Oneview for over five years and realising how complex and challenging the decision-making framework is within hospitals, particularly around IT infrastructure changes… I think that this sector will be protected for now.

The most at-risk healthcare companies are likely to be those in telehealth.

AI companies are going hard at personalised health.

(My wife uses ChatGPT often as her personal doctor… and I’m sure this is the case for many people).

OpenAI recognised this trend and launched ChatGPT Health earlier this year, and shortly after, Anthropic released Claude for Healthcare.

This is the field that AI hyperscalers are choosing to play in.

So while the SaaStablimshment crumbles in the face of AI, the medtech sector should be well protected from the SaaSpocolype.

See you all tomorrow,

The Armchair Analyst