Good morning,

Welcome to today’s edition of The Armchair Analyst, a 5-minute daily update on the ASX life-sciences sector.

We’re only two weeks into 2026, and the first marquee healthcare capital raise has launched.

Yesterday, the AFR reported that 4D Medical (ASX: 4DX) would be raising $150 million at $3.80 per share. No options.

Today, I’m unpacking the art of the capital raise, and how companies get it right (or very wrong).

But first…

The Daily Pulse Check

Yesterday, Entropy Neurodynamics (ASX: ENP | MC: $51M) reported results from its 6-patient Phase 2a binge eating disorder study with oral psilocybin. (ENP)

Argent (ASX: RGT | MC: $5M) signs a binding agreement to buy AusCann’s 48% equity interest in CannPal Animal Therapeutics for 20 million RGT shares. PLUS, an option to acquire the Neuvis drug delivery platform for $2M worth of shares. (RGT)

Rythm Biosciences (ASX: RHY | MC: $39M) updates its colorectal cancer risk assessment product to include genetic, clinical, and lifestyle factors for greater accuracy. (RHY)

Proteomics International (ASX: PIQ | MC: $129M) appoints David Morris as CEO. (PIQ)

🪑 Very commercial and sales-focused experience - highlights the direction for PIQ in the next few years.

Big board shuffle at Mayne Pharma (ASX: MYX | MC: $244M). OUT Frank Condella, Patrick Blake, Anne Lockwood, IN Professor Bruce Robinson (Cochlear rep). (MYX)

🪑 The fallout from the failed company acquisition continues.

AVITA Medical (ASX: AVH | MC: $155M) publishes results for the fourth quarter with $17.6 million in sales of its wound care products, down from the $18.40 million previous comparable quarter. (AVH)

Racura Oncology (ASX: RAC | $520M) is collaborating with Emory University to better understand the mechanism of action of Osimertinib, the current standard of care treatment for non-small cell lung cancer, and Racura’s RC220. (RAC)

🪑 I had to double check this, but yep… Race Oncology changed its name.

Early quarterly results from ECS Botanics (ASX: ECS | MC: $9.5M), positive operating cash flow from cannabis product sales of $218,000. (ECS)

🪑 Generally, when a company publishes its quarterly report this early, it is happy with the results.

A Phase 3 Rheumatoid Arthritis trial of Lynk Pharmaceuticals’ JAK1 inhibitor in China has hit its primary endpoint. (Lynk Pharma)

Cash Injection

Arkin Capital closes US$100 million Fund III for early-stage, global biotech investments. Arkin Capital now manages over US$600 million in biotech-focused assets. (VC Wire)

M&A, Big Pharma Wants a Wife

AbbVie and RemeGen kicked off the 2026 J.P. Morgan Healthcare Conference with a $5.6B licensing deal for RemeGen’s solid tumour antibody. (Pharmaceutical Technology)

Novartis licenses SciNeuro’s antibody program designed to cross the blood-brain barrier and target Alzheimer’s. US$165 million upfront, US$1.7 billion in milestones. (Fierce Biotech)

Eli Lilly and Nvidia are partnering to build a new $1 billion AI drug discovery lab. (Fierce Biotech)

Did someone forward this email to you?

Under the Microscope

We are only two weeks into the year, and the first marquee capital raise is in the books.

4D Medical (ASX: 4DX) is raising $150 million at $3.80 per share, with a market cap of $2.3 billion.

It’s amazing to think that this stock was priced under 30 cents just six months ago.

And the last raise 4DX did was at 42.5 cents, with a 1:1 option and a piggyback option to boot.

Two very different raises.

THE FIRST RAISE is the ‘crunch’ raise, which makes everyone who participated a lot of money, with lots of options.

THE SECOND RAISE is the ‘set up the future’ raise, leveraging the momentum and liquidity in the stock raise money at a lower cost of capital.

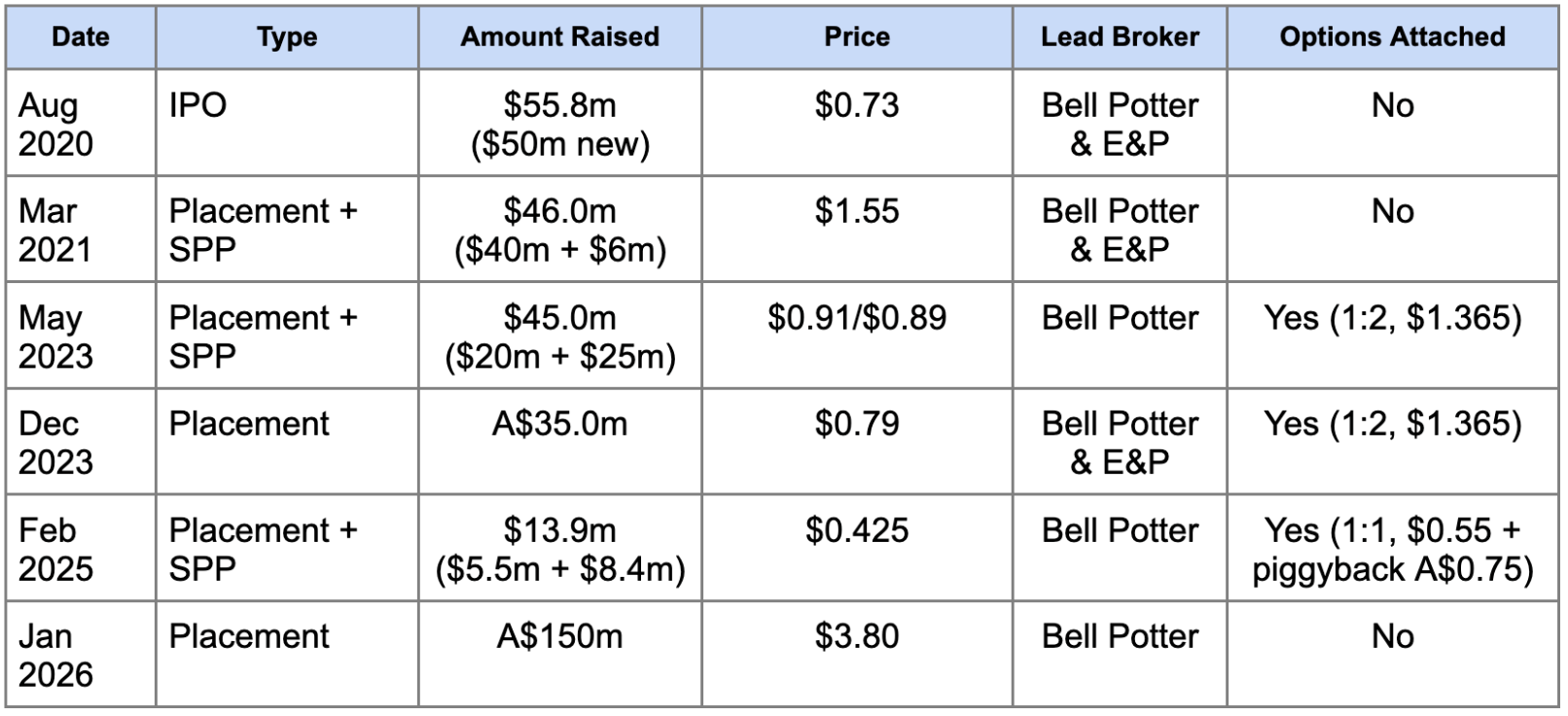

Here is the history of 4DX capital raises.

The February 2025 crunch raise was obviously the best one for investors…

But knowing which crunch is the last crunch is not that easy.

Raising capital is one of the pillars of the ASX-listed small-cap ecosystem.

It allows pre-revenue companies to buy time to develop their assets, technologies, companies, whatever, into a profit-making enterprise.

… and investors the chance to buy stock at a discount.

Pricing and sizing a raise is often more art than science, and the management teams that know when to pull the trigger give themselves the best chance of success.

The idea is…

Raise money when the share price is weak, sentiment is poor, and the register is thin - the cost of capital is high.

Raise money when momentum is strong, liquidity is deep, and investors are competing for allocation - the cost of capital is low.

Sometimes, a capital raise at a steep discount can work in the company’s favour…

Like 4DX’s crunch raise in February.

These types of crunch raises can create advocates for the stock, individuals who champion the story.

This type of raise, coupled with good execution, can be a recipe for success.

But generally, a bad raise is when the capital is expensive, particularly if those funds are not put to good use.

This is why great management teams raise capital before they need to, not when the bank balance is flashing red.

With FDA clearance secured for 4DX’s medical imaging product, the risk now shifts from clinical and technology development to sales and marketing execution.

But with the funds from the $150 million ‘set up the future’ raise, 4DX has the balance sheet to rapidly accelerate sales.

By leveraging share price momentum, 4DX was able to raise capital at a low cost, protecting existing shareholders and maintaining a tighter share register.

It will be interesting to see how the stock trades over the next few months as it approaches inclusion in the All Ords index (where passive index funds become a real buyer of the stock).

Rebalance is set for the end of March.

At a $2.3 billion market cap, 4DX is now also at a stage where larger funds can buy into the stock.

I see this raises a big baton pass (like in a relay race).

From retail investors supporting the story since IPO (and yes, in the crunch raise too), to a more institutional share register with index funds.

Now that the money is in for 4DX, the only question that matters is how well it can use these funds to translate into real business value.

If 4DX executes well, this may be the last raise it ever makes.

… but waste the capital, and the shareholders will be unforgiving.

See you all next week.

The Armchair Analyst