Good morning,

Welcome to today’s edition of The Armchair Analyst, a 5-minute daily update on the ASX life-sciences sector.

Today I’m taking a look at the biggest merger in the Australian cannabis industry: Little Green Pharma (ASX: LGP) and Cannatrek.

The background.

The deal.

And how I think the stock will trade based on past mergers that I’ve seen.

But first…

The Daily Pulse Check

Osteopore (ASX: OSX | MC: $2M | Debt $4.5M) signs an exclusive licensing agreement with Essex Bio-Technology for its bone regenerative dental, orthodontic and maxillofacial products in China. Valued at over A$2.5M (12M Yuan). (OSX)

🪑This is a pretty material for the company, given its market cap of $2M.

Oneview Healthcare (ASX: ONE | MC: $295M) released its quarterly 4C report after market yesterday. (ONE)

🪑Sales numbers were steady, but what did catch my eye was the “Baxter Outlook” section.

It appears that ONE is getting agonisingly close to one of the ‘big’ Baxter deals that have been promised for a while now, with a ‘top 10 hospital system in the US’.

Proteomics International (ASX: PIQ | MC: $129M) secures Canadian patent for its esophageal cancer blood test. (PIQ)

Orthocell (ASX: OCC | MC: $275M) secured the first right of refusal to distribute Marine Biomedical’s bone regeneration technology (and increased its direct investment to 11.7%). (OCC)

Watch: Interview with FDA Commissioner Marty Makary: Vaccines, Autism & the FDA: What Medicine Got Wrong

🪑10 minutes in, and the FDA Commissioner references Australian biotechs as a beacon of speed and efficiency for the FDA to aspire to (we must be doing something right!).

Donald Trump just announced “The Great Healthcare Plan”, which will affect insurance and drug prices in the US. (The White House)

Cash Injection

Zelira Therapeutics (ASX: ZLD | MC: $4M) secures US$32M in funding from ThirdGate Capital to fund the next stage of its clinical development for the rare disease Phelan-McDermid Syndrome and autism. (ZLD)

🪑Sorry for the late send, but it was because I was reading through this announcement about four times to try to understand the deal.

US$32 million goes into a vehicle

ThirdGate Capital gets 50%

Zelira gets 39.70%

Existing investors and management - the rest.

Just on a valuation basis, it gives ZLD a post-money interest in the vehicle of US$26M… not bad for a $4M market cap minnow.

I’ve been watching this one for a while because my friends at Securities Vault are the third largest shareholder - well done guys.

Vitasora Health (ASX: VHL | MC: $44M) has now completed its $11M equity placement in full, with the final cash coming in from the cornerstone investor. (VHL)

M&A, Big Pharma wants a Wife

Sino Biopharmaceutical to acquire Hygieia Biomedical for $172M to expand siRNA chronic disease pipeline. (Reuters)

Charles River Laboratories acquires nonhuman primate supplier K.F. for $510M to secure control of its animal supply chain. (Fierce Biotech)

Boston Scientific plans to acquire Penumbra for about US$14.5 billion. Penumbra makes heart devices to remove clots from blood vessels. (Biopharma Dive)

Enjoy the email? Forward this on to a friend.

Under the Microscope

On Wednesday, Little Green Pharma (ASX: LGP) announced a proposed merger with Cannatrek.

The Green New Deal that had nothing to do with Climate Change…

The total combined entity value will be ~$112M at an LGP share price of ~$0.15 with ~$15M in the bank.

Ownership split will be 39.50% to LGP Shareholders and 60.50% to Cannatrek shareholders, with more of the deal details below:

Yesterday, I had a good chat with a friend who had been working in the cannabis industry for a while to get the inside scoop on the deal.

So, what is the story?

Cannatrek was one of the very first cannabis companies in Australia.

Being the first mover, it had a large market share.

Also, it had one ‘hero product’, a cannabis strain (T25 Topaz) that was very popular due to its high-THC and long shelf life.

As sales increased, the company raised funds, including its largest, a $13 million investment from River Capital in December 2022.

However, a series of poor business decisions over the next few years led Cannatrek to lose its lead.

In particular, it was way too late on distribution and telehealth.

Here was the timeline:

FY2023 - The Golden Era: Revenue doubled to approximately $90 million and a net profit after tax of $14.56 million. T25 Topaz best product on the market. River Capital invest $13 million.

FY2024 - The Dark Era: The company experienced a significant downturn, with profits wiped out, resulting in an after-tax loss of $9.2 million due to competitive pressures and increasing costs. Market share eroded.

FY2025 - The Reset: Revenue declined for a second consecutive year; however, a major restructuring effort led to a turnaround in profitability, with the company posting an after-tax profit of $3.2 million. The CEO shelved, and clean up crew installed.

My friend put it best…

Three years ago, Cannatrek was a titan of the industry; now, they are an afterthought.

Little Green Pharma took a different approach - their idea was own the supply chain first.

But while LGP was also early to the cannabis game in Australia, it wasn’t able to crack the cultivation challenge and found it difficult to grow a good product at good prices.

To win back market share, LGP launched a quality product at a discounted price, Cherry Co.

AND to claw back the margin, LGP focused heavily on distribution through its facilities in Denmark and Western Australia.

LGP’s Australian facility never really scaled, however…

But with this merger, LGP now has access to an elite GMP facility right here in Sheperton.

Like any conusmer business, the cannabis industry is about how much it costs to make and how much does it sell for.

Dollars in, dollars out.

So, in a nutshell…

This deal is good for LGP because:

It gets a strategic facility at a good price (Shepperton Facility)

Another ‘hero brand’ in its portfolio

Balance sheet muscle (with another $12M from Cannatrek)

This deal is good for Cannatrek because:

It taps into LGP’s distribution network

It can now expand internationally with LGP’s networks in Europe

The listed vehicle provides a liquidity exit for investors in the company

At the end of the day, LGP was a smaller player with the right strategy, while Cannatrek was a larger player with the wrong strategy.

This deal puts the two companies on the right path, with the right balance sheet and scale to execute.

How the stock trades after the merger

This is where things usually get uncomfortable.

When a private company merges into a listed vehicle, a few very predictable things happen:

Private investors finally get liquidity

The merged company hits growing pains

The true value of the business takes time to show up

And critically… the share price usually goes down before it goes up.

Because this isn’t just a merger, it’s a liquidity event.

I want to give you an example from a personal trade of mine, of when a merger killed the share price.

For three years, I was invested in Original Juice Co. (ASX:OJC).

(I do sometimes dabble in stocks outside of healthcare)

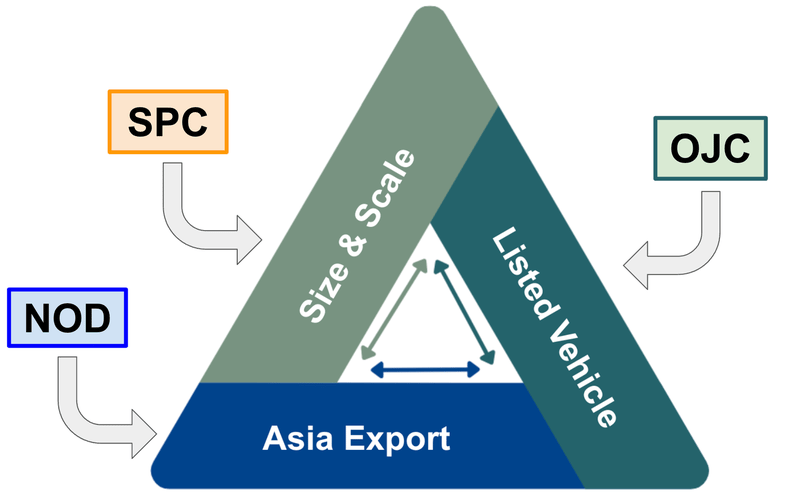

In late 2024, the company, out of nowhere, announced a three-way merger with two private companies SPC Group and Nature One Dairy.

Here is what each group brought to the table:

A capital raise at the time valued the group at ~$280 million.

Fast forward to today, and the market cap is just ~$70 million.

(Source, OJC 2-year share price chart)

Three things happened when the merger took effect, and they’re textbook:

Private SPC investors suddenly had liquidity. Shares that were previously locked up now had a bid. Sell.

Legacy OJC investors who were substantial were no longer substantial. They now had an exit on the market without upsetting the apple cart and disclosing to the ASX.

Synergies take time (and markets are impatient). Integration is messy, and it can take some time for mergers to digest.

The result was relentless selling, not because the business was broken, but because liquidity arrived.

Now, if I liked the business BEFORE the merger, I could buy the combined company at a fraction of its pre-deal value.

That is the real trade in these merger-style deals.

Let the liquidity event play out, and pick up the pieces when the business synergies start to click.

This is what I like to call: The Merger of Liquidity

But this doesn’t always play out like this.

Some mergers DO immediately add value to the shareholders.

Take the most famous Australian healthcare merger of the last 10 years, between Sigma Healthcare and Chemist Warehouse.

This was a genuine industrial merger, combining Sigma’s pharmaceutical distribution with Chemist Warehouse’s retail muscle.

With $60m in projected annual cost synergies, there were real benefits to scale between the companies.

While the share price ran up on the announcement of the deal and remained elevated through the merger, the shares were flat once it closed.

This is because many of the synergies have already been ‘priced in’ to the stock, and it still takes time to integrate and appear in earnings.

So while the merger announcement was still a huge win for Sigma Shareholders, the actual merger itself has a lot to play out.

This is what I like to call: The Merger of Opportunity.

Now, looking at the LGP deal…

The main question for investors is: What is this transaction more about?

Is it a liquidity event for Cannatreck shareholders OR

Is it a strategic play to align the scale of Cannatrek with the distribution of LGP

The likely answer is both.

But depending on the market's direction, the stock will trade post-merger.

If this is The Merger of Liquidity, then it is very much a ‘wait and see’ game… let the Cannatrek shareholders exit and pick up the pieces at the end.

If this is The Merger of Opportunity, then it might be too late by the time the merger is complete, as the market is sold on the idea of the two companies together.

Which way will it play out?

Who knows… I’m just The Armchair Analyst.

See you all next week.