Annual General Meetings are generally a dull affair…

BUT the CEO’s address, published alongside, can be a very good “sentiment check” for the stock.

Particularly for growth-stage health-tech companies.

It is an opportunity for the management to communicate the strategy and set revenue and growth expectations for next 12-months.

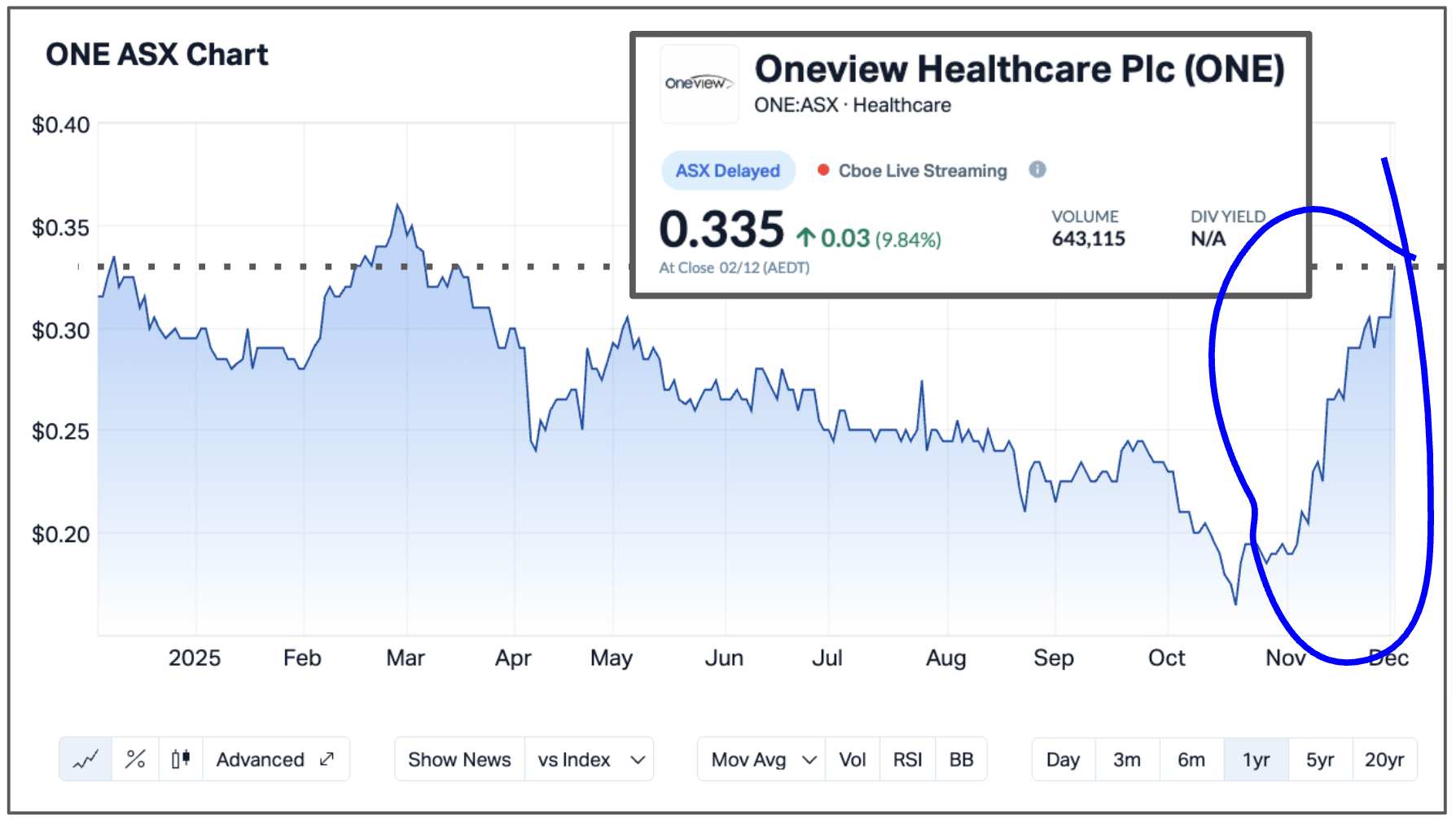

Yesterday, I read the CEO's AGM address for Oneview Healthcare (ASX:ONE | $259M). (ONE)

The market liked it, and so did I.

ONE is a revenue-generating business that sells technology to hospitals to improve patient care and make hospitals run more efficiently.

I’ve been tracking the company for over four years now, and the stock price can move a bit like an ocean…

Moving up on expectation of opportunities.

Drifting downwards when deals take longer than expected.

And consolidating gains when opportunities are converted into revenues.

This is a familiar story for many revenue generating companies on the ASX.

Looking at ONE’s share price over the last few months though, it is clear that the market is starting to “bet” on the company executing some of its longer term (and higher revenue potential) contracts.

And I think the answers as to ‘why’ are buried in the AGM address.

So, what did the CEO say in his AGM address yesterday?

ONE Said: “Several of the late-stage opportunities we’ve been pursuing are expected to close in the coming months.”

🪑 This was the key line that investors are looking for.

The sales cycle to sell technology into healthcare institutions is long… sometimes years.

ONE has hinted at several big deals ever since it signed the Value-Added Reseller agreement two years ago with the largest supplier of hospital beds into the US, Baxter (NYSE: BAX | US$9.7B).

Accounting for the 18-month sales cycle into large healthcare networks, large opportunities that were initiated when Baxter first came online should be in the final closing stages now.

ONE Said: “Just last week we added a new logo in Texas, a 161 bed facility… on a 5-year contract… 300 new endpoints”

🪑 This is effectively a new deal announced to the market.

Back of the napkin calculations would have this deal worth around A$300,000 per year in annual recurring revenue. (1 endpoint = €1.54 ARR)

ONE Said: “One of our largest long-term customers renewed their commitment to Oneview… accepting a pricing uplift [of 20%]”

🪑 Price increases are the tech-sales equivalent of “money for jam”.

This is one of the big benefits of developing a sticky business in a slow moving institution like a hospital.

It’s easier (and likely cheaper) for the hospital to take on the price increase rather than switch providers.

So with this optimistic outlook for ONE, and the share price restored to its highest point since April, the emphasis now moves back on to ONE to deliver.

Can the company close some more deals before the next reporting season?

… I’m not sure, I’m just the Armchair Analyst.

But it appears as though success for the company could be just around the corner, and the market is starting to believe that too.

Did someone forward this email to you?

The Daily Check-up

Invion (ASX:IVX | MC: $6.7M) secures the global licences for its photodynamic cancer therapy for various conditions.

🪑 I’ve been tracking IVX for two years now and THIS was the deal that I was waiting to see - a global licence for its product. It will take a bit of time for me to fully digest this news and expect it to be “Under the Microscope” tomorrow…

LTR Pharma (ASX:LTR | MC: $50M) receives Human Ethics Approval for a Phase II pharmacokinetic study on its erectile dysfunction spray, data mid-2026. (LTP)

Philips will add the CT:VQ medical device product by 4DMedical (ASX:4DX | MC: $854M) to its product catalog for North America. Minimum contract value of US$10M contract. (4DX)

Noxopharm (ASX:NOX | MC: $28M) demonstrates acceptable safety for its topical autoimmune cream in the first part of its Phase 1 trial. (NOX)

BCAL Diagnostics (ASX:BDX | MC: $40M) secures ethics approval for BREASTEST Registry of 24,000 women using its blood test for breast cancer diagnosis. (BDX)

🪑This should generate real-world data for BDX to seek reimbursement for its test in Australia at some point in the future.

Nexsen (ASX:NXN | MC: $34M) appoints surgeon-scientist Professor Shekhar Kumta to its board with experience across Hong Kong, Australia, India and UK. (NXN)

OncoSil Medical (ASX:OSL | $21M) reports interim data showing its product plus chemotherapy delivers a 20.6–22.0‑month median survival rate in unresectable localised pancreatic cancer. (OSL)

Control Bionics (ASX:CBL | MC: $28M) moves to fully acquire Neuro Elite Athletics valued at US$500,000. (CBL)

🪑 I like that CBL has now fully acquired this part of the business, and it is a key traction and proof point that its brain-computer technology can add value in the world of professional sport.

Optiscan Imaging Ltd (ASX:OIL | MC: $120M) launches 50-patient first-in-human head & neck cancer imaging trial. (OIL)

🪑 Funny stock ticker for a biotech company…

Cash Injection

Island Pharmaceuticals (ASX:ILA) raises $1M via the exercise of 14 million $0.07 options. (ILA)

🪑There are still roughly 20 million more 7 cent in-the-money options that expire December next year.

Microbia Life Sciences (ASX:MAP | MC: $45M) secures $3M in an R&D tax rebate. (MAP)

The Big Mover

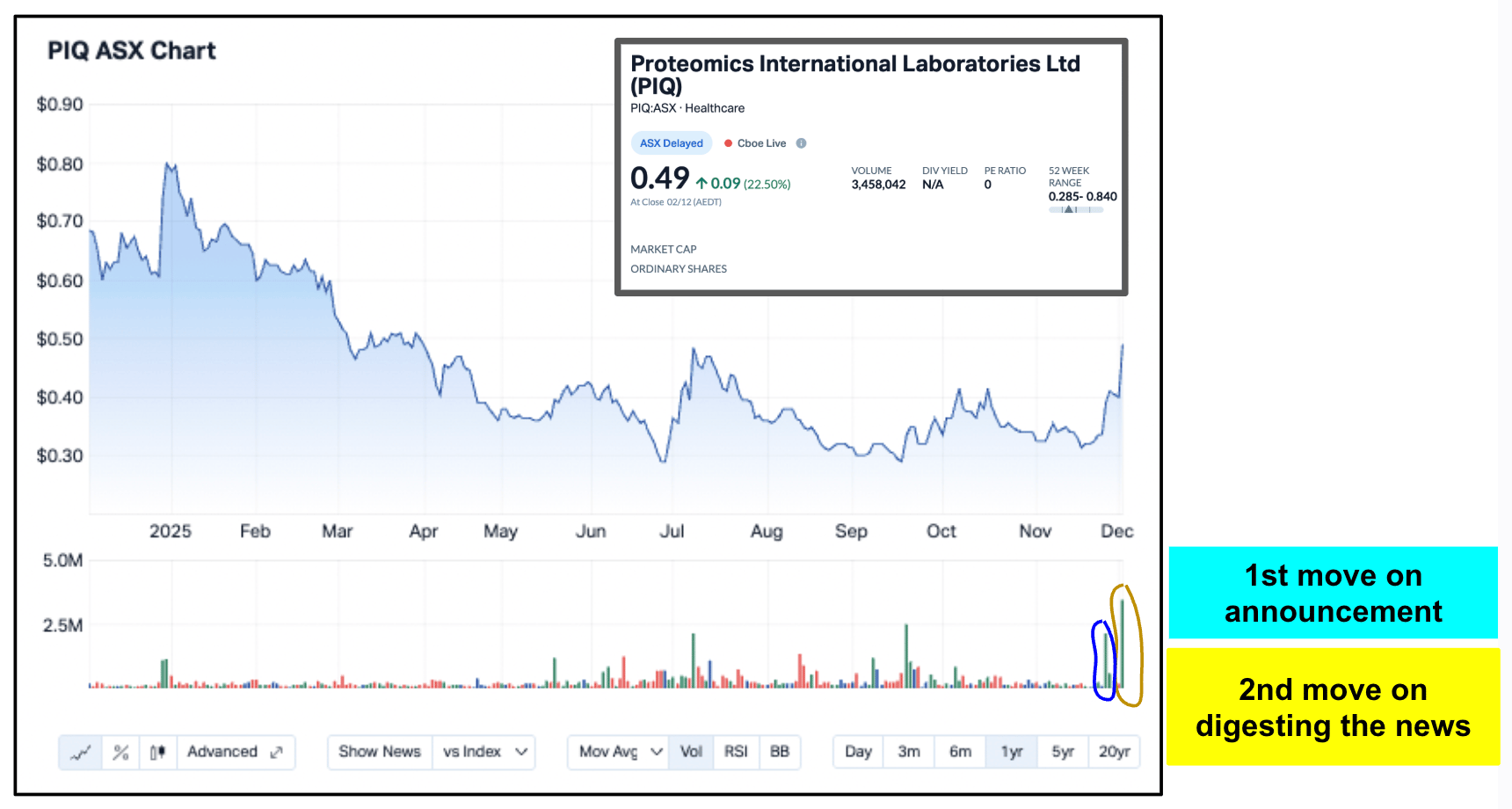

Massive volume yesterday in Proteomics (ASX:PIQ | MC: $80M), the company had its largest volume day in the last 12 months and was hit with a speeding ticket from the ASX. (PIQ)

This appears to be a case of the market taking some time to digest good news.

Last week PIQ secured CMS reimbursement pricing for its diabetic kidney disease test at US$390, and there were some decent volumes in the stock then.

This can happen sometimes when it takes the market a few days to digest a particular piece of news.

I’ll be adding this to my watch-list and tracking PIQ over the next few months.

See you tomorrow.

The Armchair Analyst

Jason Segal