Why do biotech companies exist?

It’s a strange question to ask, but it’s worth asking.

Because if discovering drugs were just about science, we’d leave it to universities and government labs.

And for the most part, that’s exactly where breakthroughs start.

Governments are good at funding early, uncertain research in academia that may never pay off.

And academia is not built to do the long, expensive, unglamorous work of turning a discovery into a medicine someone can actually use.

That is where the biotech company comes in…

The bridge between the benchtop and the patient.

This was the discussion I had with the Executive Chairman of Clarity Pharmaceutics (ASX: CU6), Dr Alan Taylor, earlier this year.

I think that it frames how Clarity operates and why it feels like a true Blue Chip biotech stock.

First, a little bit about Clarity…

What’s the story?

Clarity Pharmaceuticals is a late-stage radiopharmaceutical company developing a number of diagnostic and therapeutic products for prostate cancer.

Market cap is circa $1 billion with $220 million in the bank.

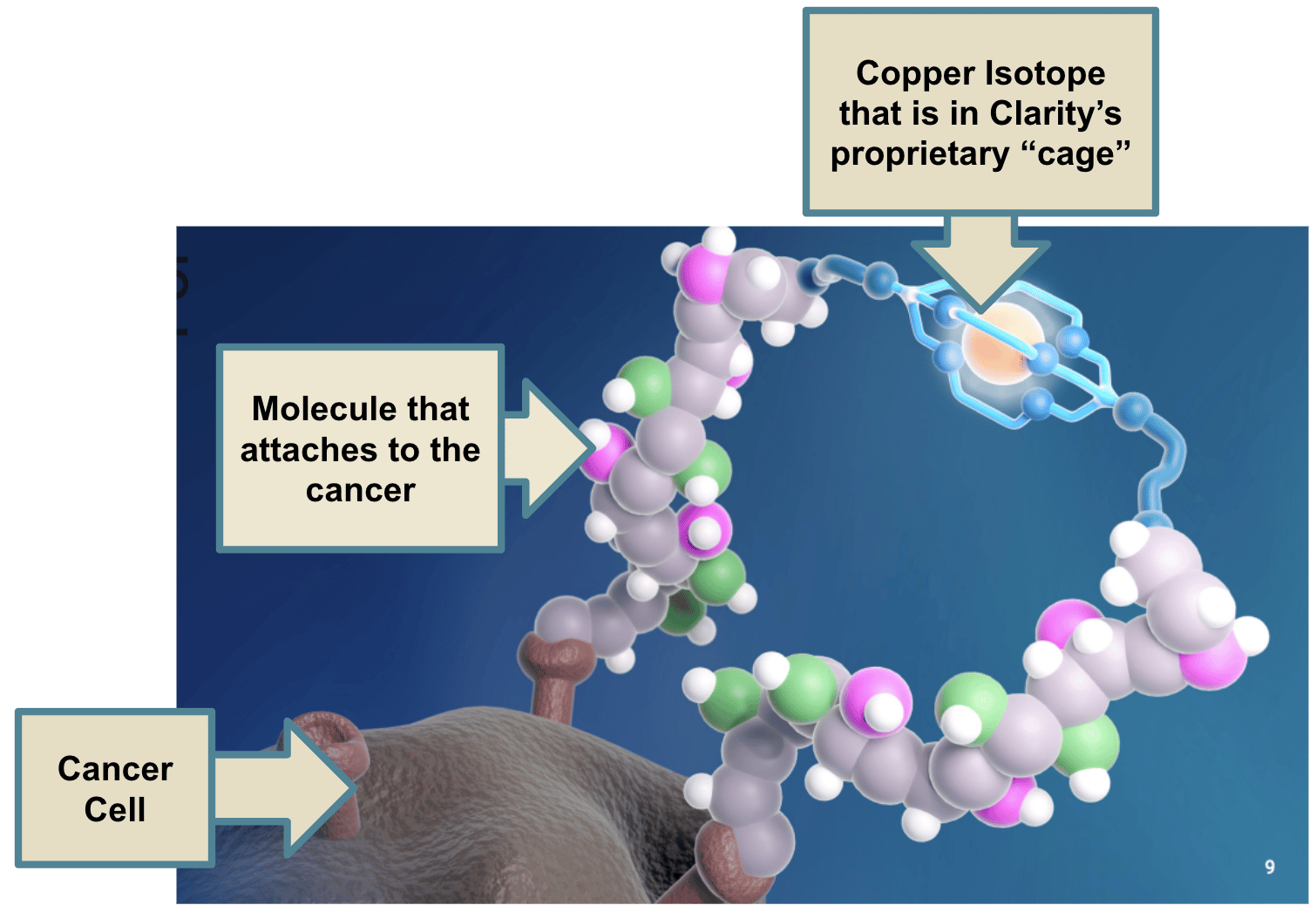

Its product is a molecule that both attaches to a cancer tumour and holds a copper isotope that lights up when under a scan:

The two diagnostic products in the market for prostate cancer are:

Lantheus’ Ga-68 PSMA-11, which achieved blockbuster status in 2024 with US$1 billion in annual sales.

Telix (ASX: TLX) Illuccix product, which generated $783 million in revenues for 2024 (predominantly targeting European markets)

So the prize is big… if Clarity can bring a product to market.

Clarity’s product addresses two key problems these competitors face.

FIRST, its copper isotope has a longer half-life (~12.7 hours) than the 1-hour and 2-hour for isotopes used by its competitors.

If it brings a product to market, Clarity can operate isotope manufacturing from a central facility, rather than needing facilities near the hospital. Broadening treatment availability and reducing costs.

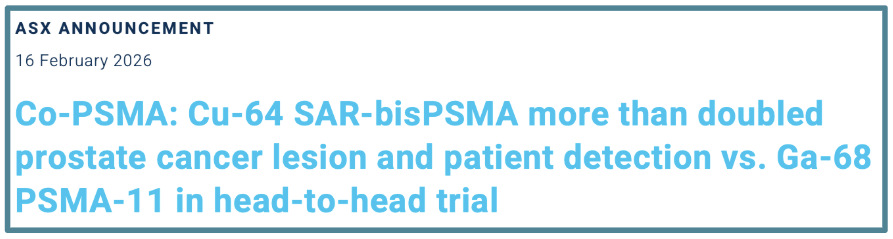

SECOND, Clarity’s product has been shown to be more sensitive (better at identifying more lesions).

In fact, today the company reported that it identified more than twice the amount of lesions as Lantheus’ product.

(Source, Clarity Pharmaceuticals)

Now, Telix and Lantheus have much larger market caps than Clarity because they have products on the market and are generating sales.

However, Clarity is not far behind, with several Phase 3 registrational studies currently recruiting, with enrolment for the AMPLIFY and CLARIFY trials expected to be complete in the first half of this year.

The company hasn’t been without its challenges, however.

Like any early-stage public biotech company, its share price can be volatile.

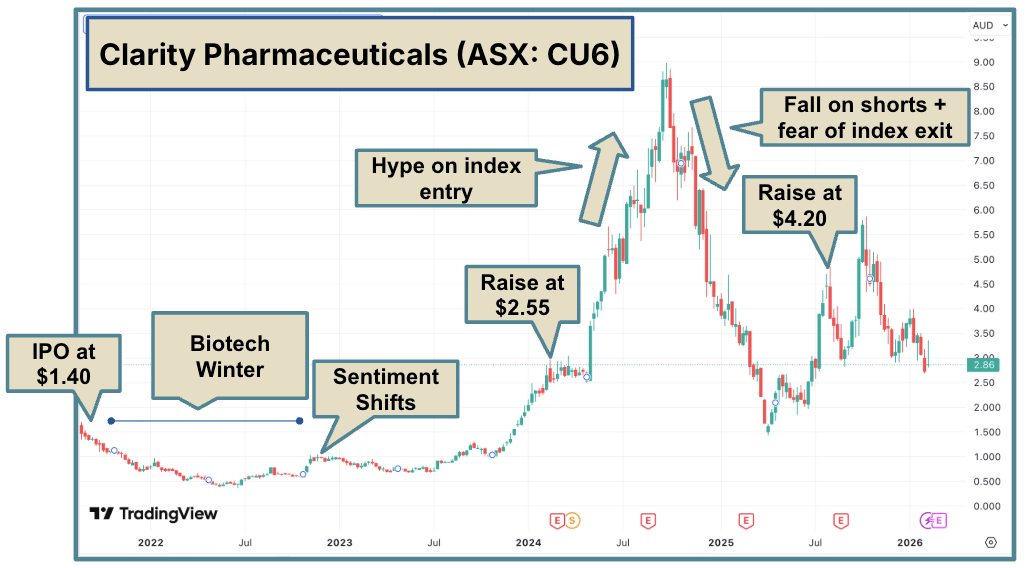

After its 2021 IPO (the largest raise for a biotech company to date at $92 million), the share price drifted.

Predominantly on the back of the biotech winter of 2022.

While Clarity continued to execute on its goals, the market was very much “risk off” for early-stage companies.

But it managed to stretch its pennies through to a more bullish market and to early results from its trials.

Then the sentiment broke, and things went up (fast).

Investors get excited about good news, overbuy the stock until it reaches ~$8, then reality sets in…

Things will take longer and cost more than expected.

There were decent short positions on the company, and fears about an exit from the ASX 200 sent the stock back down to ~$1.50.

But throughout, Clarity continued to conduct its clinical trials.

The big raise was the $200 million, 1-day raise at $4.20 that caught the market off guard.

From there, the market has been trying to find a base for the stock and is likely looking for more results (like today's) to trigger its next proper re-rate.

While the share price has been relatively volatile over the past 24 months, the Clarity story was just… different.

It felt more like a larger pharmaceutical company that belonged on the NASDAQ rather than the ASX.

Multiple Phase 3 trials, modest cash burn relative to its activity… and while it has been “come raise” in the past, it has always managed to raise at a higher price than the previous one.

… going back since 2013 (a fair effort)

Someone described to me the difference between the NASDAQ and the ASX for biotech companies.

The NASDAQ is like the English Premier League.

The best companies, the best access to capital, the best coverage, and more stringent and higher stakes.

While the ASX is a bit more like the Championship Division 4.

Sometimes you have to win scrappily.

There is less capital available, far less coverage, and the referee (the ASX) can sometimes be asleep at the wheel.

Clarity feels like that Premier League-level team playing in our markets.

Why is this?

I think this is because, at its core, Clarity believes its role is to be the bridge between the benchtop and the patient.

It goes back to the question: Why do biotech companies exist?

Shareholder communication is strong, the story is simple to understand, and every dollar is treated with respect.

While the company is running multiple Phase 2 and Phase 3 clinical trials, it never feels like it will run out of money.

A testament to this is the company's most recent capital raise: a $200 million raise at a premium to the last share price.

Closed in 1 day without a trading halt.

(and off the back of a huge fall in the share price).

What you won’t see in any Clarity slide deck is an “M&A transactions” slide… because that’s not the game.

Clarity aims to become the next major pharmaceutical company from Australia, born of Australian science and developed with Australian capital (retail and institutional investors alike).

Is Clarity a good investment right now?

Without giving a definitive answer (because I’m not licensed to give general financial advice), I’ll frame the Clarity “bet” as I see it.

If you believe Clarity will bring a product to market, the prize is substantial.

This may take another year, but once it has a product in the market… the company should be generating free cash flows to fund other programs.

(At that point, it is no longer a binary research bet; it is more about sales and execution)

The challenge right now is that a number of shareholders are underwater on the $4.20 raise, which it will need to churn through…

Also, at a $1 billion market cap, upside is priced in.

However, if it can reach a Phase 3 result with its $220 million balance sheet, the story starts to come together.

There is, of course, a binary risk associated with a clinical trial result, but the data published to date have been positive.

Essentially, the “bet” is that Clairty gets a phase 3 readout with the $200 million raise and gets as close as possible to bringing a product to market before running out of money; at that point, the upside is a US$1 billion per annum prize.

… notwithstanding the positive (or negative) binary result that comes with a Phase 3 readout.

There are some key lessons that I wanted to highlight about Clarity as to why I think it has succeeded thus far, that any small-cap ASX-listed company can apply:

Constant communication with shareholders, more is better - be a presence.

Treat each dollar with respect; the capital markets are a tool to bring the product to market. Don’t waste those dollars.

The story and value proposition need to be simple enough so that the average retail investor can explain

So what is the purpose of a biotech company?

If you treat it as the bridge between the benchtop and the patient…

Then you might end up making a lot of money for shareholders along the way - because making money is a necessary part of completing your mission - not just the mission itself.

A big thank you to Dr. Alan Taylor for sharing the Clarity story with me.

See you all tomorrow,

The Armchair Analyst

The Pulse Check

Clarity Pharmaceuticals’ (ASX: CU6) diagnostic product doubled prostate cancer lesion detection compared to the current market standard of care. (CU6)

🪑 More on this in a bit, but TLDR: Great result.

Medibank has expanded its funding agreement with Emyria (ASX: EMD) to support eligible customers accessing Emyria's psychedelic treatment for treatment-resistant depression and PTSD in Victoria. Set to open in Q2 CY2026. (EMD)

🪑 What I like about this news as a shareholder is that it is more validation that Medibank is seeing the programs as working.

Medibank wouldn’t have expanded the programs into Queensland and now Victoria if there had been hesitation about patient outcomes and the economic value to Medibank.

Australian Clinical Labs (ASX: ACL) reports 1H26 revenue down 1% to $365.4m, statutory profit down 52.4% to $5.6m, but underlying profit up 9.1% to $13.1m, with an increased interim dividend of 3.75c per share. (ACL)

Australian Clinical Labs (ASX: ACL) CEO Melinda McGrath will finish up in August 2026. (ACL)

🪑 While there have been a number of high-profile CEO’s leave off the back of poor half-year results *cough* CSL, ASX… this one does not appear to be it. Still down ~10% on open.

Chimeric Therapeutics (ASX: CHM) appoints Dr Bradley Glover as Non-Executive Chair. (CHM)

🪑 Ex-Imugene, so it appears to be still within the Hopper circle. Good luck! (I’m a shareholder)

PPE manufacturer Ansell (ASX: ANN) published its half-yearly results today. EBIT growth 15.3% to US$146.9M, operating cash flow growth 71.8% to US$91.9M for the first half of FY26. Guidance maintained. (ANN)

🪑 Decent half-year results from Ansell, but looking at the PE ratios over the last two years it has grown from 12x earnings to now 33x earnings… indicating that strong performance is expected.

CSL (ASX: CSL) increases its on-market buy-back program up to USD $750 million. (CSL)

The FDA approves Novocure’s wearable Optune Pax therapy, marking the first new treatment in the US for locally advanced pancreatic cancer (LAPC). (Oncology Nursing News)

🪑 I’m trying to determine whether this is good news or bad news for Oncosil (ASX: OSL), which has its own LAPC device approved in Europe (where it holds a CE Mark).

On the one hand, the 40% surge in Novocure’s share price indicates investor appetite for validated pancreatic cancer therapies; however, Novocure now has a first-mover advantage in the US for a tough indication.

OSL abandoned plans to advance its product in the US after slow patient recruitment prevented it from completing its pivotal trial. Its key focus is now all on the European and Australian markets.

Cash Injection

Adherium (ASX: ADR) secures $1.34 million at $0.003 and announces an Entitlement Offer to raise a further $6.18 million. Major shareholder Trudell Medical has committed $2 million under the entitlement offer. (ADR)

Botanix Pharmaceuticals (ASX: BOT) went into a trading halt for a capital raise last Friday. (BOT)

ReNerve (ASX: RNV) secures $517K in an R&D Tax Incentive Refund. (RNV)

M&A, Big Pharma Wants a Wife

Alkermes Completes $2.1 Billion Acquisition of Avadel Pharmaceuticals for its narcolepsy treatment. (Chemanager International)

Big pharma company BioMarin closes US$850M of unsecured debt notes to fund the acquisition of Amicus Therapeutics. (BioMarin)

🪑 It’s not just cash reserves that big pharma is using to make acquisitions, but they are also leveraging up.

This means that big pharma is even more “risk on” when it comes to defending their pipelines and acquiring smaller companies.

January 2026 ranks as the highest first month for biotech deal volume (US$31.16 billion in M&A and licensing transactions) in the past eight years. (BioWorld)