Good morning,

Welcome to today’s edition of The Armchair Analyst, a 5-minute daily update on the ASX life-sciences sector.

Today marks the #50th edition of The Armchair Analyst since I started the newsletter back in late November.

I love writing every day, and I want your feedback on how to improve.

Please reply to this email with your thoughts:

What do you want to see more of?

What do you want to see less of?

If I went deeper into one thing in 2026, what should it be?

There are a couple of things I’m working hard on in the background that will be revealed very, very soon.

On that note, today I’ll look at why shares can fall on good news and what happened to Pro Medicus (ASX: PME) at yesterday’s half-year earnings report.

But first…

The Pulse Check

AVITA Medical (ASX: AVH) FY2025 revenue of $71.6M (up 11%), reduced loss of $48.6M (21% improvement YoY). (AVH)

A down half for the healthcare equipment giant Cochlear (ASX: COH). Underlying net profit at the lower end of the August guidance (down 9%), and sales revenue was effectively flat. Interim dividend flat at $2.15 per share. (COH)

🪑 Will be interesting to see how COH trades after CSL and Pro Medicus got smashed on lower-than-expected earnings.

Ramsay Health Care (ASX: RHC) secures ACCC approval to acquire National Capital Private Hospital from Healthscope. (RHC)

Companies that I profiled this week:

Memphasys (ASX: MEM) - A 20-Year Overnight Success: The Memphasys (ASX: MEM) Story.

Cash Injection

Nektar Therapeutics prices upsized $400M US public offering. (PR Newswire)

🪑 There's a lot of money in the US for biotechs right now… usually, Australia is around 6 months. So maybe sometime this year we’ll get a pop in the sector?

M&A, Big Pharma Wants a Wife

Madrigal expands its MASH pipeline through a licensing agreement with Suzhou Ribo Life Science, a Chinese biotech. US$60 million upfront, US$4.4 billion in milestones. (Pharmaceutical Technology)

Under the Microscope

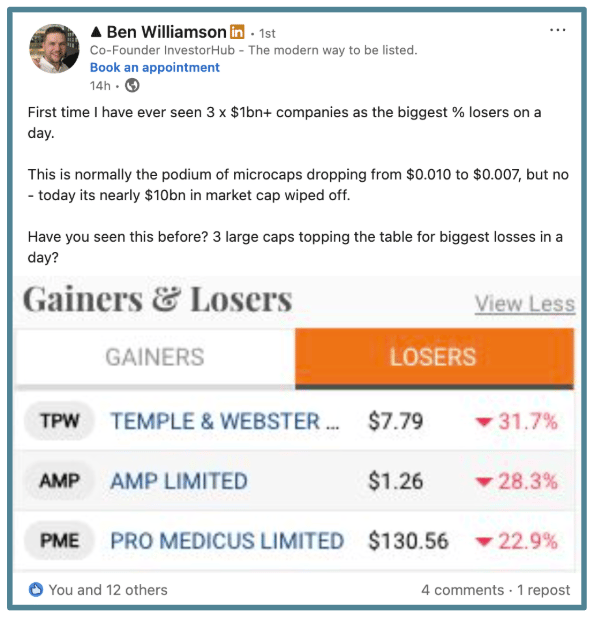

It’s half-year reporting season this week, and it’s been brutal.

It feels like the large-cap equivalent of “confession season”, which usually comes around every quarter for cash-hungry small-cap stocks.

But the big boys can fall too (and sometimes harder).

CSL, down ~15%.

Pro Medicus, down ~23%.

Cochlear this morning (down ~13% at the time of writing).

It’s not just the healthcare front, but other large caps are getting hammered from missed earnings:

(Source, LinkedIn)

But why was Pro Medicus swept up in it all?

231% growth in after-tax profit… 28.4% increase in revenues and down?

You would be permitted to scratch your head as a Pro Medicus investor with the market result…

But the reality is that the results Pro Medicus published were below market expectations, and the stock traded down.

While the results were good, the market was expecting great.

This is reason #2 in my framework for understanding why stocks decline on good news.

The 7 Reasons why Stocks go Down on Good News.

There are essentially seven reasons why shares move down on good news:

Buy the rumour, sell the news

Market was expecting great, but the results were good

Results were good, but delayed

News is good, but no new information

Reality kicks in

Cheap shares floating around

Market sentiment is poor

I covered reasons 5 and 6 in a previous article on Nyrada (ASX: NYR), when the stock declined after it secured ethics approval for its Phase 2a clinical trial earlier this year.

Read the article here: The Problem With Being the Best Stock in the Market

Today, I want to address reason #2: The market was expecting great, but the results were good.

What’s the story?

Pro Medicus sells medical imaging software to hospitals that provides ultrafast image processing for radiologists.

The company operates on a transaction-based pricing model with baseline minimums and then charges clients per exam or image accessed above this price floor.

(Pay as you go)

It’s no secret that Pro Medicus has been one of the best-performing companies on the ASX in the healthcare space.

And while the company had some major contract wins in the first half of the financial year, the market doesn’t evaluate results in a vacuum…

It's all about expectations and reality.

If expectations are high, then there is a much smaller margin for error when results are published.

For stocks with a sub-$100 million market cap, identifying consensus expectations is much harder.

Particularly if they are generating small revenues but are not yet profitable.

Was this profit in line with market expectations? How much did they spend to get there? Is growth in line with what the market was expecting?

My process for evaluating expectations is to return to the beginning, when a company vended an asset or went public.

I read through each major announcement (tracking against the chart) to put myself in the position of a long-term shareholder to make an assessment of what the market was expecting going in to a result.

This works for the smaller companies, but what about the larger ones?

Larger cap companies like Pro Medicus, CSL and Cohclear - that are generating revenues, are profitable, paying dividends and have broad analyst coverage - have consensus sentiment that can be identified.

Each company publishes guidance on what it expects its next half-yearly results to be; whether it meets, beats, or misses that guidance will dictate the share price.

Most analysts also set expectations based on their internal modelling, and by collecting all analyst reports, you can build consensus.

This consensus is essentially the market expectations.

Beat that forecast? The stock usually goes up.

Lower than the forecast? Stock usually goes down.

According to The Capital Brief, RBC Capital Markets analyst Garry Sherriff said Pro Medicus missed revenue “consensus estimates by 2% and EBIT consensus by 10%”.

While Pro Medicus’ numbers were positive in a vacuum, they disappointed relative to market expectations.

THAT is why the stock was down.

Another metric to evaluate market expectations is the P/E ratio.

I spoke earlier in the week, when I covered CSL’s half-year results, about how changes in value can affect P/E ratios.

What I didn’t mention is that PE ratio is also a measure of time.

Use a PE ratio of ~15 (around what CSL is at now).

That means that if I invest $1 today, it will take me 15 years to achieve a return (assuming the same revenue levels).

Companies with higher PE ratios are considered “growth” companies because investors are willing to pay more for today’s earnings, assuming they will grow at a higher rate.

Companies with lower PE ratios are considered more mature, where growth is declining.

Before earnings season, Pro Medicus had a P/E ratio of 117, reflecting its status as a growth company.

Handy tip: you can get the up-to-date PE ratios from Market Index right here:

Looking at the history of the Pro Medicus PE ratio (which you can find for free on Fiscal.ai). The company has only dropped below a PE of 120 a handful of times since 2019.

As PE rises, so do expectations; as PE shrinks, so do expectations.

As of July 2024, expectations for the company were rising; it had signed several contracts and was growing rapidly.

Since then, expectations have fallen, reflecting market sentiment that the company could not sustain such high growth.

If Pro Medicus can return to its ~30% pa growth rate in the next financial results print, I expect the PE ratio to hold around 120x, given the premium valuation put on growth companies.

But miss another print, and the stock will likely be punished.

Expectations vs reality - that’s what moves share prices, not results on their own.

See you all next week,

The Armchair Analyst

PS. If you have any feedback for the newsletter, please reply to this email with your thoughts:

What do you want to see more of?

What do you want to see less of?

If I went deeper into one thing in 2026, what should it be?

Thanks legends.