The Washington Post reported last week that Trump is planning to down schedule cannabis:

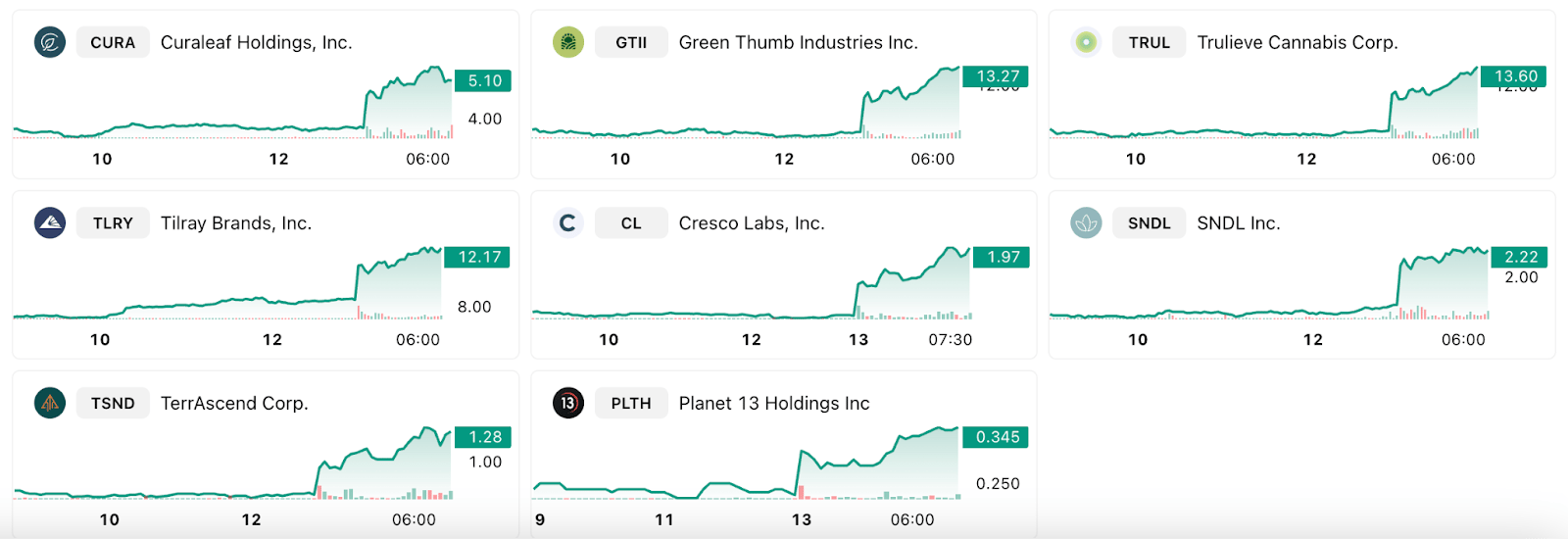

US cannabis stocks are back in the green…

And this could be the thing that sparks the cannabis industry… at least the US markets think so.

(Charts from selection of US cannabis stocks on Friday)

So, what’s the story?

Right now, the regulatory framework for cannabis companies in the US is a bit of a mess…

Okay, it's a really big mess.

Federally, marijuana is a Schedule I drug on par with heroin and MDMA.

But at the State level, most states permit medical use (and some for recreational use).

This results in a patchwork of rules and regulations for licensing, testing, commercialising and distributing cannabis products while preventing large financial institutions from offering standard banking services to the cannabis industry.

This has meant that the cannabis industry still operates in this very grey area of the law, favouring incumbents that can navigate it best.

So, if marijuana is down-scheduled from a federal perspective, it recognises cannabis as having medical uses under the federal law.

Depending on how the law is frame,d it could have significant effects on taxation, medical access, insurance, banking and federal enforcement on cannabis products in the US.

Okay, so how does this affect the ASX cannabis stocks?

The way that I like to break it down is into three categories:

Stocks set to strongly benefit - Are they developing specific medical products that happen to have cannabis as their base?

Stocks set to benefit from attention - Are they a cannabis cultivator that could benefit from the extra investment attention on the cannabis sector?

Stocks that may have a risk increased - Do they sell into the US cannabis recreational market and need to navigate an entirely new set of regulations?

So, let’s take a look at each in more detail.

(1) Stocks set to strongly benefit from down scheduling

In my opinion, the companies that are specifically developing a medical product that happens to be derived from cannabis or cannabinoids will benefit the most.

Down-scheduling effectively means that the US federal government will formally recognise cannabis as having acceptable medical uses.

Institutional investors like clarity and certainty.

S,o accessing capital from US investors should become easier with federal support for the industry.

Also, medical cannabis developers are becoming more attractive M&A targets because acquirers now have a clearer framework for understanding the guardrails the industry operates within.

There are two ASX-listed companies that I wanted to highlight: NTI and AVE

Neurotech International (ASX:NTI | MC: $19M)

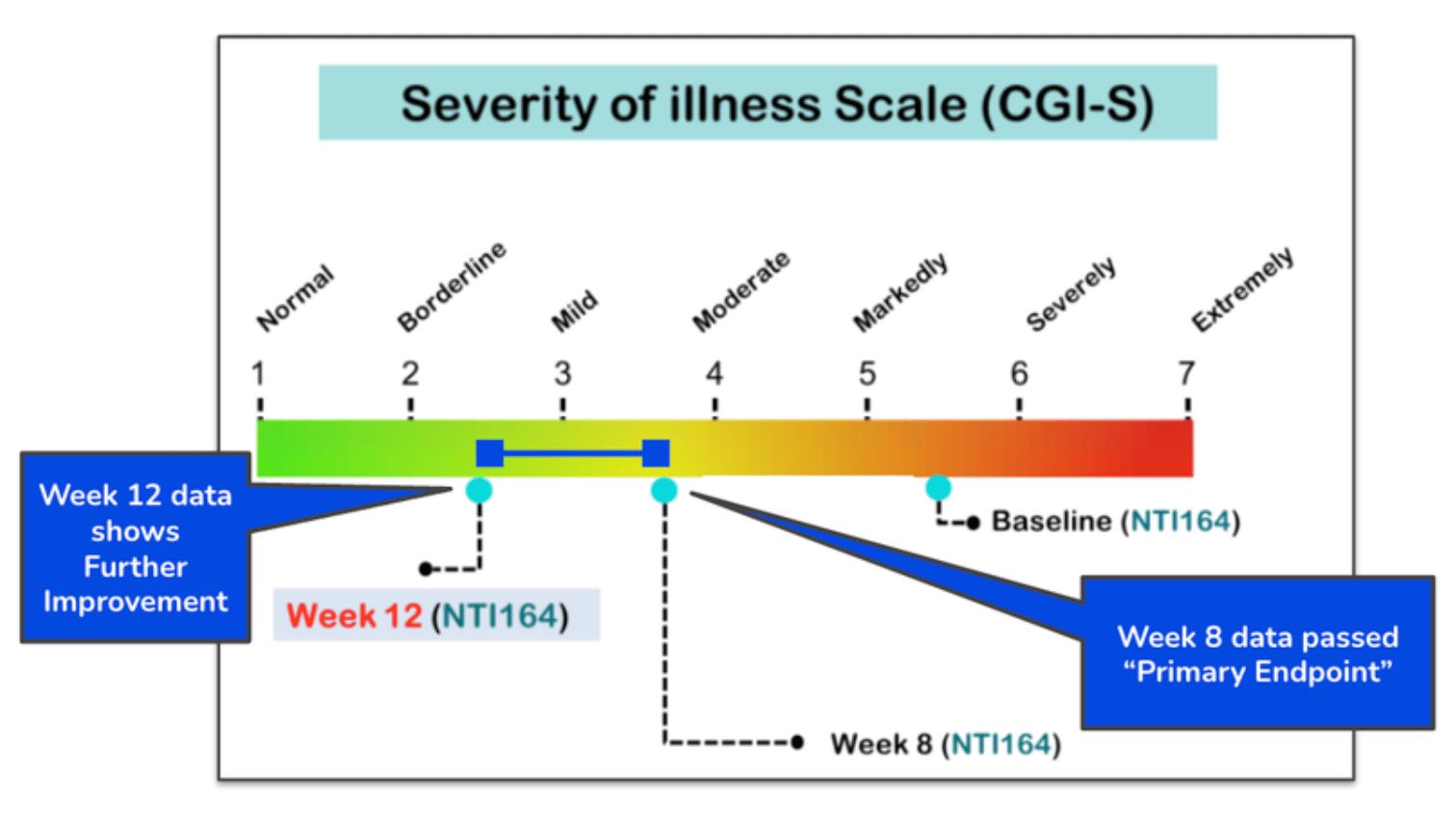

NTI has developed a high potency cannabinoid-based oil that has shown efficacy in reducing the effects of autism in children.

(you only need to check the NDIS budget to work out how much child autism is costing the Australian tax payer).

NTI showed in a Phase 2b trial a 56% reduction in symptoms of people with severe autism after a 12-week period:

These regulatory changes could not come at a better time for NTI as it looks to run a larger Phase 3 registration-enabling study for Autism Spectrum Disorder in 2026.

According to its recent AGM presentation, “securing future partners” is a big part of NTI’s strategy.

I think that finding a funding partner for this larger study will become a lot easier for NTI once it has secured an Investigational New Drug, and if the laws are changed to recognise cannabis as a medicinal product.

NTI is now in a trading halt for a capital raise. (NTI)

Avecho (ASX:AVE | MC: $35M)

Avecho is developing a product for insomnia that uses its proprietary absorbent technology to deliver CBD in a capsule.

Avecho is currently in the middle of a Phase 3 clinical trial and has a licensing agreement with the $25 billion-capped Sandoz to sell its products within Australia.

The deal? US$3M upfront, US$16M in milestone payments and 14% - 19% royalties on sales.

Interestingly, two weeks ago, Avecho applied for patents for its CBD soft-gel cap in the US and Europe.

(Source)

Similar to NTI, I think that AVE’s ability to find a licensing partner in the US (or convince its existing partner to license the US rights) will be significantly enhanced by the federal recognition of CBD as a medicine.

While there are over-the-counter CBD products for insomnia sold in the US, these new regulations may tighten the “grey area of law” that these products operate in.

By being one of the first CBD-based products to undertake a clinical trial (like a proper drug, and not how the CBD products are sold right now in the US), Avecho could be in a very strong position to attack the US market under new federal cannabis laws.

Avecho will have interim results from its Phase 3 clinical trial in the first half of next year.

(2) Stocks to benefit, but only from extra attention on the sector

There is a class of stocks on the ASX that I like to call the "cannabis cultivators”.

They make flower, distribute flower and sell flower.

Generally, to the Australian markets.

This includes companies like:

Little Green Pharma (ASX:LGP)

Cann Group (ASX:CAN)

ECS Botanics (ASX:ECS)

Vitura Health (ASX:VIT)

The Australian cannabis industry has been through a tough couple of years, with three companies being fined by the TGA, including Cannatrek, Little Green Pharma and MGC Pharmaceuticals in 2022.

Then, earlier this year, cannabis distribution business Montu was under fire when it was discovered that one of its doctors wrote 72,000 cannabis scripts in 2 years.

Sentiment toward Australian cannabis companies is at an all-time low, so this rise in US-based cannabis stocks may support a sector rebound as valuation differences between Australian stocks and their US counterparts widen.

This is the benefit I see for these "cannabis cultivators” that don’t directly sell into the US.

(3) Stocks that may have a risk increased

If Trump were to down-schedule marijuana to be federally recognised as a medical product it may affect some of the companies selling into the US recreational market.

There is only one company on the ASX that I’m familiar with: Peak Processing (ASX:PKP | MC: $21M).

Peak Processing just changed its name from Althea Group to reflect its new business model.

It’s effectively like “Visy” but for cannabis drinks - packaging, manufacturing and distribution.

While PKP dominates the Canadian market for cannabis drinks (it provides packaging services to 70% of brands in the Canadian market), its entry into the US may not be so easy.

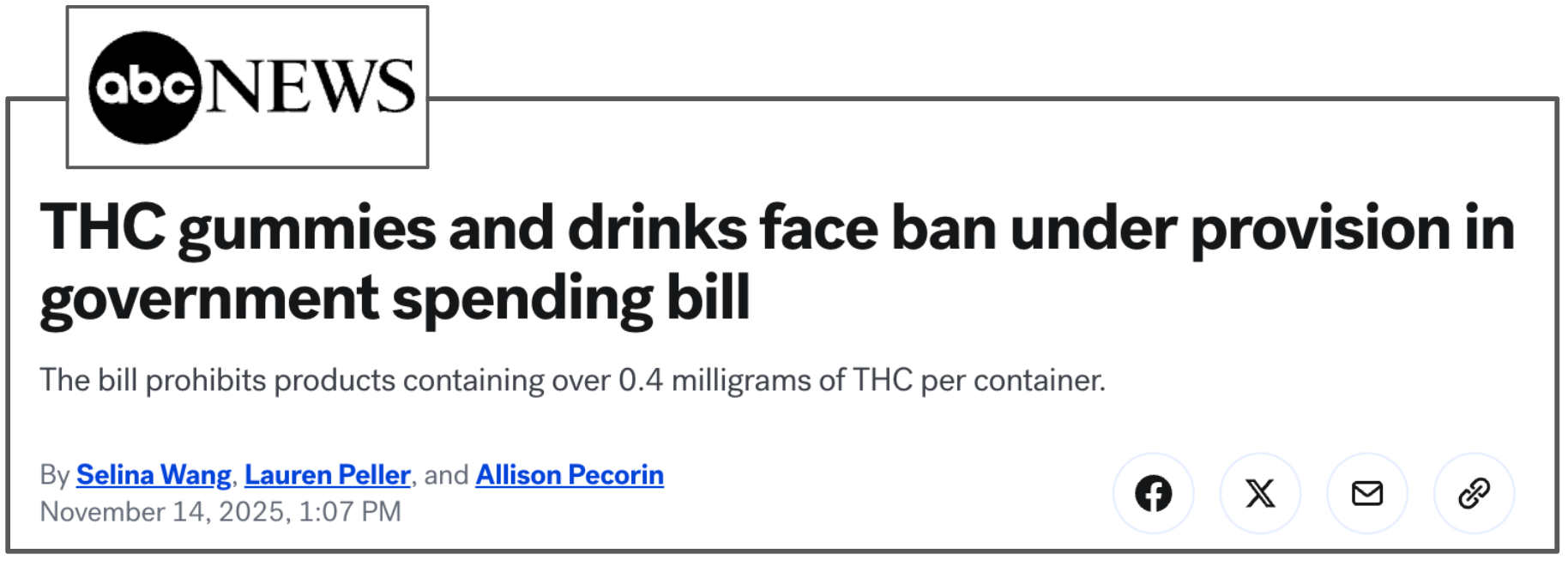

Selling cannabis drinks in the US is done through a loophole in the 2018 Farm Bill that allowed the sale of ‘hemp-derived products’. (source)

This loophole is closing, according to a report by ABC News:

(Source)

If these new federal rules, along with other changes in regulations, take place, it may make it MUCH harder for cannabis drinks to be sold in the US.

The BEAR take

With no way to enter the US markets, PKP’s upside is capped to only selling into Canada, a much smaller market.

The BULL take

Tighter regulations on the recreational cannabis market will weed out a bunch of ‘cowboy’ organisations.

This favours incumbents like PKP that have an infrastructure and distribution edge, IF the rules change to make recreational cannabis legal at a later stage.

Either way, it will be interesting times for the cannabis industry - an industry in Australia that has been in a significant lull.

Is it comeback time for cannabis?

I’m not sure… I’m just The Armchair Analyst.

But at least it should get some more investor attention, especially if US stocks in the sector continue to rally.

See you all tomorrow.

Jason

Did someone forward this email to you?

The Daily Check-up

EchoIQ (ASX:EIQ | MC: $178M) lodges a 510(k) application with the FDA for clearance of its AI Heart Failure detection-assistance product. (EIQ)

🪑 Approval is the last step before the product can be sold and commercialised.

Dimerix (ASX:DXB | MC: $354M) completes recruitment of 286 adults in its Phase 3 clinical trial for a rare kidney disease. Next, DXB will speak with the FDA to align on study endpoints and accelerated approvals. (DXB)

Radiopharm (ASX:RAD | MC: $67M) reports interim results for its brain metastases imaging chemical RAD101; 92% concordance vs an MRI. (RAD)

🪑 Although RAD put “achieves primary endpoint” in the announcement header, I’m not sure that you can meet a primary endpoint at the interim stage… might want to double check that.

Prescient Therapeutics (ASX:PTX | MC: $94M) secures European authorization to start Phase 2a cancer trial on T-cell Lymphoma in Italy. (PTX)

Cann Group (ASX:CAN | MC: $14M) settles $15.3M debt with NAB, closing ~$70M facilities; refinances with a $14.45M loan. (CAN)

4DMedical (ASX:4DX | MC: $1.2B) wins regulatory approval from Health Canada for its CT:VQ imaging product. (4DX)

🪑Strong finish to the year from 4DX. Canadian rollout to start immediately via Philips, targeting ~800,000 annual procedures.

Orthocell (ASX:OCC | MC: $281M) applies for a CE mark and UKCA mark to sell its nerve repair product Remplir into the EU and UK markets. Approval expected in Q3 CY26. (OCC)

Cynata Therapeutics (ASX:CYP | MC: $65M) completes patient enrolment for its Phase 2 stem cell product on acute Graft vs Host Disease. Results June 2026. (CYP)

🪑This marks the second clinical trial recruitment that CYP has completed this month. Two big read-outs coming up for the company next year.

Neuren Pharmaceuticals (ASX:NEU | MC: $2.4B) wins US FDA approval for a new treatment option for its DAYBUY drug for the rare disease Rett Syndrome. The product now can be taken as a powder, not just a pill. (NEU)

Allison Rossiter resigns as CEO of Genetic Signatures (ASX:GSS | MC: $59M). (GSS)

Imricor (ASX:IMR | MC: $455M) adds the University of Virginia as a second site in its MRI-guided cardiac ablation clinical trial. (IMR)

Proteomics International (ASX:PIQ | MC: $82M) reports peer-reviewed data showing its PromarkerD blood test predicts diabetic kidney disease in Aboriginal Australians. (PIQ)

Financial Times report on the US biotech rally and what it means for hedge funds in the sector. (Financial Times)