Good morning,

Welcome to today’s edition of The Armchair Analyst, a 5-minute daily update on the ASX life-sciences sector.

Imagine discovering a blockbuster drug by complete accident.

What was supposed to be a blood pressure medication ended up becoming one of the most famous drugs of all time: Viagra.

Since Viagra came off patent in 2020, the landscape has changed A LOT.

The next company in the Biotech 165 Challenge is looking to navigate this US$3.7 billion landscape with its faster-acting, better Erectile Dysfunction product.

Company #4 of 165 LTR Pharma (ASX: LTP):

But first…

The Daily Pulse Check

Imricor Medical Systems (ASX: IMR | MC: $507M) secures FDA 510(k) clearance for its Vision-MR MRI-guided diagnostic catheter. (IMR)

Cyclopharm (ASX: CYC | MC: $104M) partners with Lucile Packard Children’s Hospital, the first US paediatric site to implement its Technegas lung ventilation imaging device. (CYC)

EBR Systems (ASX: EBR | MC: $443M) reported early sales numbers for the last quarter, ~US$900K. (EBR)

Data from TruScreen’s (ASX: TRU | MC: $11M) 2000-patient study on cervical cancer screening in pregnant women has been published in the Chinese medical publication, Family Doctor. (TRU)

Nova Eye Medical (ASX: EYE | MC: $44M) announces record sales growth for its eye treatment devices with global sales of US$6.1 million, up 25% on the previous quarter. 12-month sales of US$21 million (up 24% on the previous 12 months). (EYE)

ReNerve (ASX: RNV | MC: $14M) secures approval to sell its nerve repair product into public and private hospitals in Hong Kong. (RNV)

Clinuvel Pharmaceuticals (ASX: CUV | MC: $634M) starts preclinical studies on its controlled-release injectable peptide platform - marking the first pre-clinical study to come out of CUV’s new R&D Centre in Singapore. (CUV)

Firebrick Pharma (ASX: FRE | MC: $17M) has submitted its applications for the registration of its common cold nasal spray in the Philippines. The review process takes six months. (FRE)

Radiopharm Theranostics (ASX: RAD | MC: $88M) increases its stake in Radiopharm Ventures from 75% to 87.5%. (RAD)

The FDA is set to introduce sweeping changes to the oversight of wearables and AI-enabled devices. (Statnews)

OpenAI has launched a beta version of ChatGPT Health, a dedicated AI that answers health-related questions. (OpenAI)

🪑 There is clear consumer demand for this, and it will be very interesting to see how this plays out. ChatGPT Health is the natural next step in personalised AI healthcare.

Cash Injection

Aktis Oncology raises US$318 million in a recently upsized priced IPO - the first US biotech IPO of 2026. (Bioworld)

Private and public biotechs go on $4.9B funding spree ahead of JPM. (Endpoints News)

🪑 During the first full week of January, private biotechs raised at least $2.29 billion in new capital, one of the biggest weeks for new money in the sector for years.

M&A, Big Pharma Wants a Wife

Foresee Pharmaceuticals, Primevera Therapeutics partner on MMP-12 inhibitors, US$10 million upfront, US$574.5 million milestones. (Fierce Biotech)

Roche agreed to pay up to US$570 million to China’s MediLink for global (ex-Greater China) rights to commercialise an antibody-drug conjugate for solid tumours. (Biospace)

Under the Microscope

One of the biggest drug franchises in history was discovered by complete accident.

The story goes that in the 1990s, men who were on the study for a heart pressure medication refused to return their unused pills….

… because these ‘little blue pills’ improved their sex lives so much.

The drug known at the time as 92,512 eventually became Viagra.

At its peak, Viagra earned US$2 billion in annual sales, all the way up to 2020 when Viagra came “off patent”.

When a drug goes off patent, generics are introduced at lower prices, eroding the incumbent's market share.

Normally, this is an 80% drop in market share within the first year, but Pfizer was clever.

It introduced its own generic drug in 2017 to compete with other generics, while maintaining the Vigara brand as a premium product.

(even though the generic and Viagra literally came from the exact same factory).

The landscape for Erectile Dysfunction products has changed significantly over the last 5 years.

Once Viagra (and a number of other ED drugs) came off patent, a LOT more generics entered the arena.

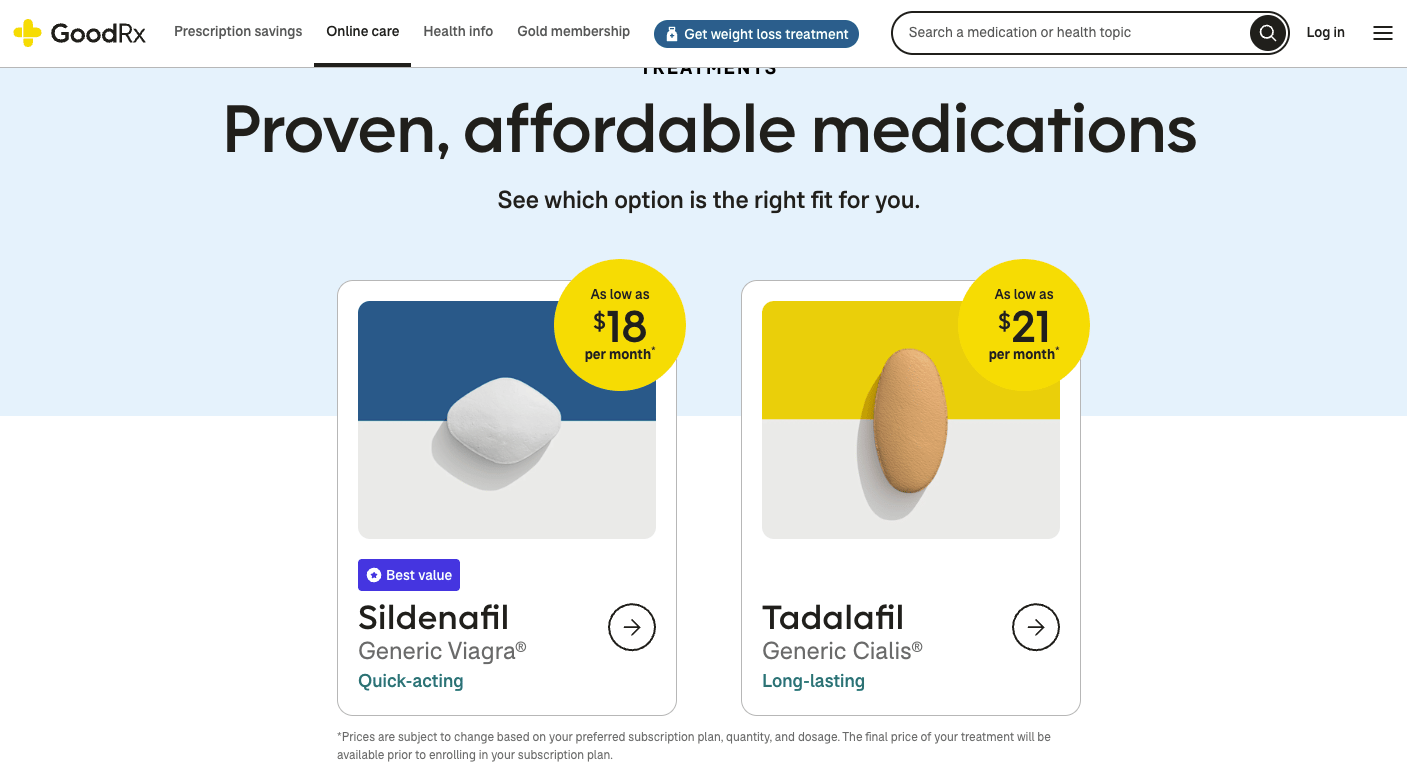

COVID-19 also pushed consumers toward telehealth, which led to organisations in the US, such as GoodRx, Hims, and Ro, that sold ED drugs online.

This provided consumers with much more flexibility and discretion, with the winners among ED providers being those that leaned into consumer choice.

So, what is the state of play?

US$3.7 billion of ED pills are sold every year. US$1.2 billion from the US.

Pfizer (with Viagra and its generic) still owns 45% of the market.

Online and telehealth retailers are emerging as serious competition, and all the innovation has gone into pricing, distribution, delivery, and discretion.

But there is one area that has lagged… is the actual product itself.

That is what LTR Phamra (ASX: LTP) is looking to change.

Faster-acting, safer, and all-around better.

A re-engineered product using existing ED medication, but delivering it via a nasal spray rather than a pill:

So far, LTP has proven that its product works in a small clinical trial: 9 - 12 minute activation time compared to 30 - 60 minutes from competitors.

These are very good results, if they can be replicated in a larger trial (and with the 65+ year-old demographic).

How will LTP commercialise its product?

FIRST, LTP will sell its product via the 503(a) pathway in the US, which allows combination drugs (like LTP’s) to be sold via telehealth platforms such as GoodRx, Hims, or Ro.

This pathway has stiff competition in a relatively unregulated market.

(sorry about that)

As a consumer product, sales will depend on how well LTP markets the benefits of its nasal spray and the strength of its partnerships with online distributors.

THEN, LTP will look to distribute its product via traditional doctor prescriptions; however, it will need FDA approval first (via the 505(b)(2) pathway).

This means it will need to conduct Phase 2 and 3 clinical trials.

LTP has $29 million in the bank and is set to start its Phase 2 trial in 27 patients this quarter.

What is important about this trial is whether the drug has the same effect in 65+ year old males (the main target demographic).

If FDA approval is granted, I expect regulatory approvals around the world to quickly follow suit.

So that’s LTP’s dual pathway to commercialisation, the traditional clinical trial pathway and a shortcut through the competitive landscape of the online telehealth space.

Will it rise to the occasion?

(last one I promise)

Only time will tell.

Ultimately, there is a short-term and long-term bet with LTP.

In the short term, there is a punt on Phase 2 results. In the long term, it is a punt on LTP building a sustainable business in a competitive consumer category.

So while Viagra was discovered by complete accident, LTP has been very deliberate in how it has positioned its product to potentially dominate this consumer market.

A big thank you to LTP’s Executive Chairman, Lee Rodne, for taking me through the story last week.

See you all tomorrow

The Armchair Analyst