Good morning,

Welcome to today’s edition of The Armchair Analyst, a 5-minute daily update on the ASX life-sciences sector.

Big sell-off in the markets on Friday, with the SaaSpocolypse in the US trickling through to risk-on stocks…

A quiet day on the market today, with only a handful of material announcements to dig through.

But that won’t stop me!

Today I’m going to answer a question I’ve been getting a lot from friends: Why biotechs?

But first…

The Pulse Check

Memphasys (ASX: MEM) secures TGA approval for its sperm separation system two months ahead of schedule. (MEM)

🪑 When have you ever heard of a healthcare stock doing anything “two months ahead of schedule”?

Nice work, MEM - I took some in the recent raise at $0.005.

Algorae Pharmaceuticals (ASX: 1AI) finalises Licence & Supply Agreement with Cadila Pharmaceuticals to commercialise two generic medicines in Australia and New Zealand. (1AI)

TruScreen (ASX: TRU) provides a broad market update on sales for its cervical cancer screening test. (TRU)

🪑 This feels like it could have been in the quarterly report two weeks ago.

Paradigm Biopharmaceuticals (ASX: PAR) signs a $1M licensing agreement and royalty agreement with AVet Health for an oral therapy for veterinary osteoarthritis. (PAR)

Opinion: Why Bankers Think There Will Be A Lot More Health-Tech M&A This Year. (Second Opinion)

Ginkgo Bioworks and OpenAI collaborate on an autonomous laboratory, achieving 40% cost reduction in cell-free protein synthesis using GPT-5 (PR Newswire)

Cash Injection

PYC Therapeutics (ASX: PYC) opens its retail entitlement offer, issuing 3 new shares for every 5 held at $1.50 per share, closing 27 February 2026. (PYC)

Under the Microscope

A friend recently asked me, "Why biotechs? It's the hardest sector to make money.”

Trials are expensive, everything takes years, and it's brutally cruel if a clinical trial fails.

Very true, very true.

But it is also one of the most ‘misspriced’ sectors on the ASX.

Stocks that are on the cusp of a breakthrough are priced like smallcaps… until they aren’t (*cough* 4DX last year).

As I said last week, there is no “gold price” for heart attacks.

So, while junior exploration companies can explode on the back of an underlying commodity price move (without advancing the project), biotech stocks need to work much harder.

Often, the proof happens before the move… and the market doesn’t catch on until the momentums already in full swing.

This makes biotechs a more pure investment play.

Biotech investing (particularly at the small end of the market) rewards those who do more work than the average market participant to identify opportunities the market may have missed or forgotten.

It’s like hunting for an antique at trift shop.

Stocks that have been discarded by the market are hidden in plain sight, ready to create something special.

I also like how there are patterns to biotech investing.

Companies go through waves of investor interest around particular catalysts (namely clinical trial readouts), which makes “timing the market” a crucial part of the puzzle…

And finally, I like how the economic structure of developing new drugs, with market exclusivity and pricing power for a certain period, makes the prizes big.

This creates a clear M&A exit opportunity for early-stage drug developers and greater certainty about company value as it approaches drug registration.

Biotech investing isn't the norm.

And maybe that's why I like it so much.

Over the weekend, I read a brilliant white paper by the Verdad Fund out of Boston.

With numbers and facts it backed up a lot of what I felt about investing in biotechs:

The biotech sector is cruel, but there is massive upside in discarded stocks

Biotech is a lot about “Backing the jockey, not the horse”

You can't value biotechs on fundamentals; it is a catalyst-driven industry

Sub-sectors matter; stocks can be “cheap” relative to peers, creating asymmetric upside bets.

There is a clear exit for most biotechs, and Big Pharma’s M&A chequebook is open

You can read the full whitepaper here:

I want to go a bit deeper into point #5:

There is a clear exit for most biotechs, and the sector is driven by M&A….

Why is this?

It all comes down to the economic framework for how drug developers make money.

Once a drug is approved by the FDA, the company gets a period of exclusivity during which generic drugs cannot enter the market.

So a blockbuster drug owns the whole market for a period of time.

It’s like a monopoly for a short period, generating potentially billions for the big pharma company.

Keytruda: peak sales US$29 billion per year.

Humiria: peak sales, US$21.2 billion per year.

Drugs like these are the backbone of Big Pharma's earnings, and justify the spending on research for drugs that didn’t quite make it.

… but there is an important part of the innovation flywheel.

The drugs stop being exclusive.

The monopoly ends, and generics enter the market and compete on price.

It’s already starting to happen with Ozempic in other markets outside of the US:

But big pharma companies have an obligation to shareholders to continue growing and generating returns…

Not just MATCH what it did last year but actually BEAT it.

Because blockbuster drugs are always coming off patent, this creates a flywheel that keeps Big Pharma continually seeking new assets to fill its pipeline.

There is always a “patent cliff”.

This creates an ecosystem where Phase 2 and Phase 3 drug developers have something Big Pharma wants.

Leading to big exits for shareholders of companies that get acquired.

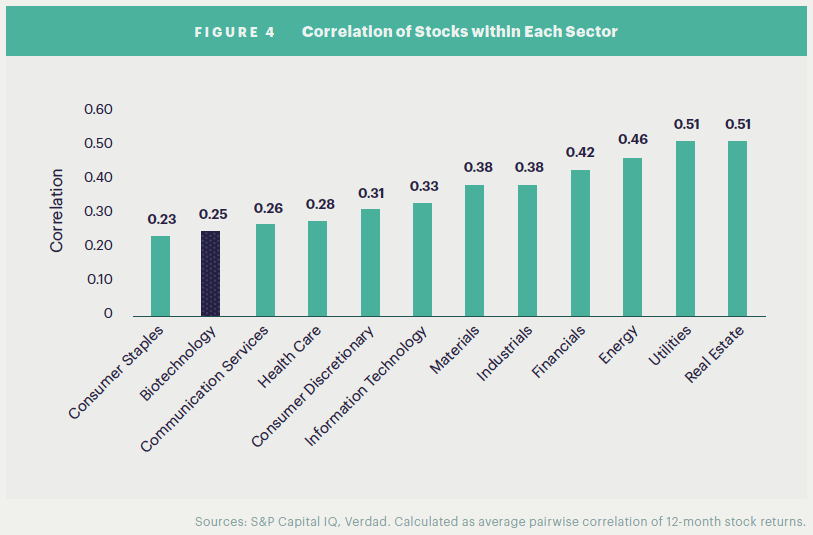

While higher interest rates are bad news for biotechs, they are the least correlated sector with the broader economy.

(Source: Biotech Investing, Page 8)

Which means that through rain, hail or shine, a good biotech can perform.

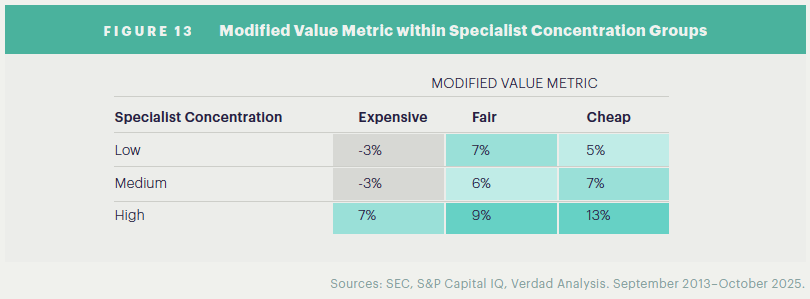

According to research, the best predictor of success is backing the experts and buying cheap stocks.

(Source: Biotech Investing, Page 19)

A lot harder to do in practice…

“Cheap” is always relative.

I think many companies underestimate the value of actually going through a Phase 3 trial or completing a transaction when they call themselves cheap.

(Yes, a phase 1 company is “cheap”… but it’s still just in phase 1)

The main takeaway from all this is that biotech investing IS NOT the same as fundamental analysis.

Play the catalysts.

Back the jockey.

Identify “cheap” stocks, but don’t discount the value and effort in running a clinical trial.

And recognise that most biotechs are working towards one thing: a takeout.

Biotches are one of the best places to look for a diamond in the rough, the discarded stock on the cusp of something special.

See you all tomorrow,

The Armchair Analyst