Good morning,

Welcome to today’s edition of The Armchair Analyst, a 5-minute daily update on the ASX life-sciences sector.

A big 24 hours for CSL, Australia’s largest healthcare stock.

CEO out, earnings in, and back-to-back share price drops for the stock.

But how to play this as a retail investor?

TLDR: I’m avoiding catching the falling knife.

But first…

The Pulse Check

CSL (ASX: CSL) announces the retirement of CEO Dr Paul McKenzie, effective immediately. (AFR)

CSL (ASX: CSL) reports H1 FY26 revenue of US$8.332B (down 2%) and NPAT of US$0.401B (down 80% due to a one-off restructuring cost), with an unchanged interim dividend of US$1.30 per share. (CSL)

Rhythm Biosciences (ASX: RHY) enrols the first physician in the ColoSTAT Access Program, marking the first commercial deployment step for its colorectal cancer blood test. (RHY)

🪑 This Access Program appears to be a stepping stone toward full commercial ramp-up.

Noxopharm (ASX: NOX) anti-inflammatory mechanism has been published in a scientific journal: Nature Immunology. (NOX)

🪑 For NOX, this news is a big deal. It independently validates its novel mechanism of action for a range of autoimmune conditions.

Amplia Therapeutics (ASX: ATX) has initiated two US sites for the AMPLICITY pancreatic cancer trial. (ATX)

Bioxyne (ASX: BXN) secures initial purchase orders for GMP-manufactured psilocybin capsules, supplying 250 doses to authorised prescribers in Australia for treatment-resistant depression. (BXN)

🪑I wonder who their customer is… 🤔Emyria?

ECS Botanics Holdings (ASX: ECS) secures a non-exclusive distribution partnership with Nimbus Health to sell and distribute its OzSun medicinal cannabis product in Germany. (ECS)

Four Biotech companies hit the US IPO Market this week. (Bloomberg)

🪑This is the busiest biotech IPO week since 2021. Only eight companies went public in 2025; now four have gone public in one week. Together, these stocks are set to raise over US$900 million.

Google’s AI drug discovery spinoff, Isomorphic Labs, has unveiled a new drug design system that is set to outperform AlphaFold 3. (The-Decoder)

Under the Microscope

It has been a brutal 24 hours for the ASX biotech darling CSL.

The CEO was shown the door, and disappointing half-year results capped off a tumultuous 12 months.

I don’t follow the stock closely (much too large for my taste), but it is an important beacon for the entire sector.

(It’s kind of like following BHP or Rio Tinto for the junior mining punter… it is good to see where the industry is heading, but I won’t watch every earnings call).

Different investment, different risk profile.

Here is my Armchair take on what is happening and why I am steering clear for now and trying to avoid catching a falling knife.

What’s the story?

CSL is Australia’s largest healthcare stock.

Capped at ~$83 billion, it is a true blue-chip company that develops and manufactures plasma-derived therapies, vaccines, and specialty biologics used to treat rare and serious medical conditions worldwide.

CSL shares are down 41 per cent (more now) since the middle of 2024 amid a series of profit downgrades, notable new drug failures and an aborted plan to spin off the Seqirus vaccines business.

(Vaccines are not in favour right now under RFK Junior’s “Make America Healthy Again” regime in the US)

It’s been rough.

Yesterday, at 4:05 pm in an after-market announcement, CSL announced the retirement of its CEO.

(normally it is the small-cap speckies that bury these types of announcements in the after-market rush… )

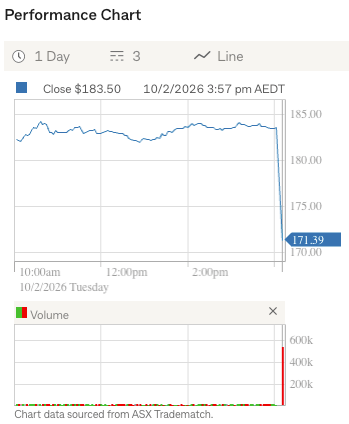

Big drop in the share price on the after-market match:

This morning, the company published its half-year report, with results confirming CSL is meeting its revised (lower) expectations… and struggling to reclaim its status as a high-growth “market darling.”

But honestly, it's an ugly look to have an abrupt CEO departure on the eve of reporting half-year results.

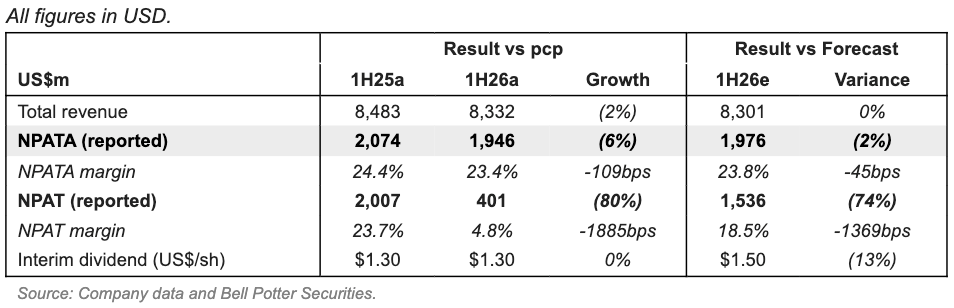

Here is a concise table put together by the Bell Potter analyst team:

Some other things of note in the earnings report:

First-half net profit fell 81% (due to one-off restructuring costs). Big dropped, skewing the nPAT Margin.

Gross margin of 51.2% is well below the 57% pre-pandemic level and reflects very slow growth relative to the prior year.

Full-year earnings growth guidance reaffirmed for 2 to 3 per cent

Full-year revenue growth guidance reaffirmed to 4 to 7 per cent.

Interim dividend flat at US$1.30 per share

Against the October 2025 updated projections, the result could be seen as a stabilising pass…

But the October 2025 updated projections were already disappointing, so context matters.

There was no new shock… but also no “beat and raise” moment that would justify a re-rating.

The trouble with CSL is that it is now moving away from its status as a “growth company” and into a “mature business”.

Why is this important?

One way to value a revenue-earning company is by applying a P/E multiple (price-earnings multiple).

It tells you how much the market is willing to pay for $1 of a company’s profit.

P/E of 10x → investors pay $10 for every $1 of earnings

P/E of 30x → investors pay $30 for every $1 of earnings

Companies considered high-growth are generally valued at higher PE multiples because investors expect rapid earnings growth.

So a $1 of earnings today is worth more if the company is growing.

Those with declining earnings growth or moving from growth → mature will have PE multiples shrink, placing pressure on the company’s value.

(and for public companies, this means price)

So, for a stock like CSL, which has traditionally traded at a high earnings multiple (say 32x in June 2024), it is now down to ~19x as of last financial year, according to Yahoo Finance:

As growth shrinks, so do value and earnings multiples.

If you think CSL can return to its previous growth levels, the stock may be getting cheap as it trades through the turbulence.

But if it is in decline, earnings multiples may remain compressed as investors view it as a mature company.

I’ll be on the sidelines, watching closely to see how it trades today, particularly as the company discusses it on the earnings call at 10:00 am.

Shoutout to my friend who bought CSL last week… RIP.

See you all tomorrow,

The Armchair Analyst

P.S. I’ll be in Sydney next week. From the 18th - 20th. If you’re an ASX-listed biotech company and are interested in being profiled on The Armchair Analyst, reply to this email, and I’ll set up a time.