Eight stock placements between the 8th and 9th of December, with US$3.2 billion raised.

This week, the US biotech market crushed it.

What happened and how did we get here?

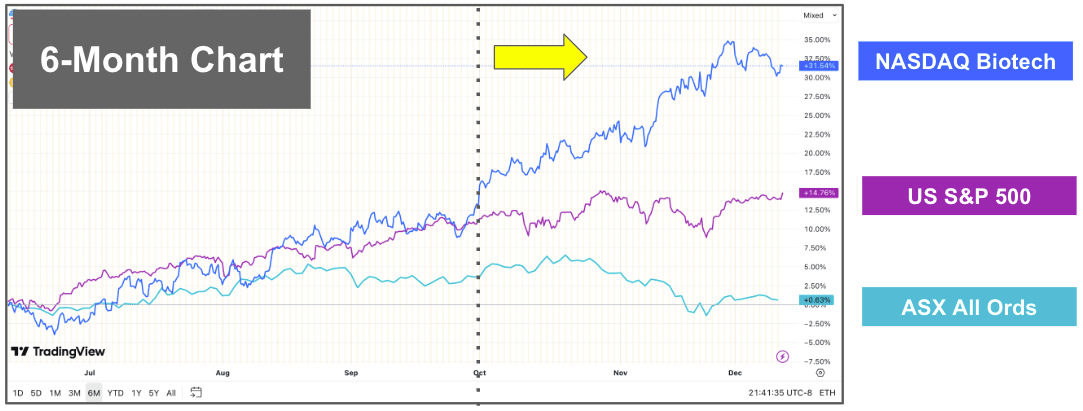

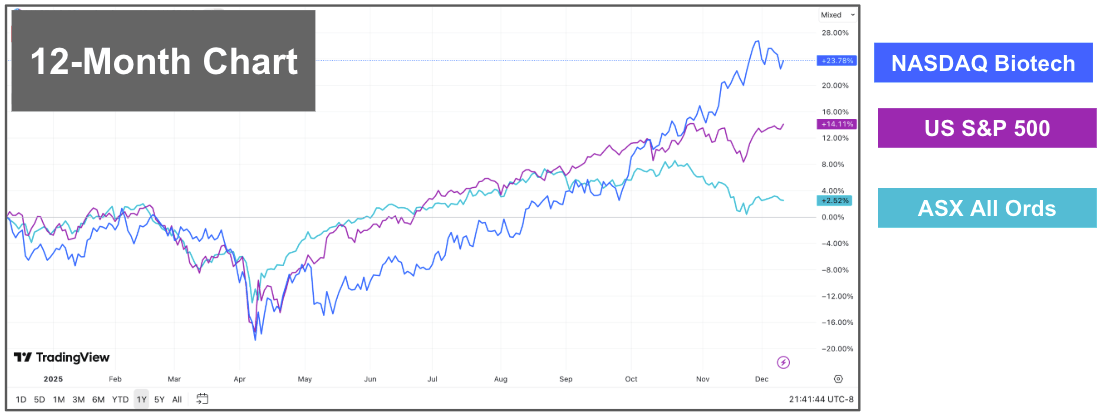

Ever since October, the NASDAQ Biotech index has broken away from the broader US S&P 500, climbing 31.5% in the last six months.

Looking at the 12-month chart we can see that there was significant underperformance between May and October and now the index is outperforming.

Here is what happened.

MAY 2025: Donald Trump announced his “Most Favoured Nation" drug pricing policy.

A policy to force drug manufacturers to cap drug prices for US patients to the lowest price offered in other developed countries.

This, coupled with the looming tariffs means that investors are risk off in the biotech sector.

JUNE/JULY: Some M&A activity started to creep into the sector as biotechs were trading at lows.

Sanofi acquires Blueprint Medicines for $9.5 billion

J&J acquires Intra-Cellular Therapeutics for $14.6 billion

Merck acquires Verona Pharma for $10 billion

… and some other smaller deals close too.

But the sector still remains muted.

JULY: Trump sent a letter to 17 Pharma CEOs giving a 60-day deadline to respond to “Most Favoured Nation” policy.

Biotechs now under the microscope.

SEPTEMBER: The US Fed announced its first rate cut.

Biotech drug development companies thrive in a low-interest-rate environment.

Cheaper access to capital and stronger valuations make it easier to fund long, costly drug development programs whose profits are realised later.

SEPTEMBER: Trump signs first deal with Pfizer

Some biotech companies are starting to recover. The NASDAQ biotech index is now at parity with the S&P 500 on the 12-month chart.

OCTOBER: Trump signs second and third deals with AstraZeneca and Merck.

NOVEMBER: Trump signs deals with Eli Lilly and Novo Nordisk.

NOVEMBER: Three big M&A deals are announced:

Pfizer acquires Metsera for US$10 billion

Merck acquires Cidara Therapeutics for $9.2 billion

Abbotts acquires Exact Sciences for US$23 billion

AND Eli Lilly becomes the first ever $1 trillion biotech company

Biotechs are finally back in vogue in the US… the macro tailwinds are here.

DECEMBER: Largest week of public offerings in biotech history with US$3.2 billion across eight companies.

Now, I think this is just the beginning.

… and let me tell you why.

Big Pharma is facing a US$176 billion patent cliff over the next few years.

This means that US$176 billion in annual drug sales will be coming off exclusivity patents.

Its a US$176 billion hole that Big Pharma needs to fill.

With M&A as the fastest answer to Big Pharma’s problem it is now on the hunt for promising drug development opportunities.

Finally, biotechs are being rewarded for good results with exit liquidty.

This is incredibly important because investor attention and activity for a macro theme always flows down like a waterfall from the top.

First, the M&A deals come.

Then, the mid-cap, later stage companies are able to raise capital.

Then, investors speculate on earlier stage technologies.

Finally, the small cap and micro cap stocks start to re-rate.

So, what can we learn from the US$3.2 billion in financing announced this week?

Seven of the eight companies raised capital immediately following positive market reactions to clinical data readouts.

So, companies are being rewarded for good news both with market reactions AND capital injections.

Not just M&A anymore.

This is very important for smaller cap companies developing drugs in clinical trials.

Raising capital will become easier if investors know that good results are being rewarded by the market.

(If there was no market reaction to good news then investors wouldn’t be as interested in speculating)

There was also very high levels of demand in the placement, five of the eight offerings were upsized from the original amount.

This indicates that there is still more capital available for good biotech results.

I couldn’t find a pattern in these companies to identify which therapeutic area would be in the spotlight next - indications spanned obesity, oncology, immunology, rare diseases, and nephrology.

But I think this is a good thing.

It means investor interest was strong across the board for biotechs, regardless of the indication.

While this is news is all good for the US biotech market… What about Australia?

I think that the Australian biotech landscape is about six months behind.

We are just starting to see some interest return to the sector, but no major M&A deals just yet.

When these start to flow through, as US companies look overseas for better priced assets, the Australian market should go through a similar cycle as the US.

This is what I am betting will happen in 2026… but who knows, I’m just the Armchair Analyst.

See you all next week.

Jason

The Armchair Analyst

Did someone forward this email to you?

The Daily Check-up

EBR Systems (ASX:EBR | MC: $425M) implants its first patient with its WiSE System along with a specialised pacemaker in a 6-month study to assess safety and efficacy in providing totally leadless CRT. (EBR)

Atraya (ASX:AYA | MC: $635M) generates the first fee-per-scan revenues from foundational US customer Tanner Health. (AYA)

HITIQ (ASX:HIQ | MC: $12.7M) wins Australian Sports Commission 'The Park' grant. (HIQ)

🪑 Umm... HIQ, It would be great to know how much the grant was for if you’re going to mark the announcement as price-sensitive.

Rhythm Biosciences (ASX:RHY | MC: $32.6M) updates its ISO accreditation for its blood-based predictive cancer diagnostics product. (RHY)

🪑 3 announcements in 4 days for Rhythm Biosciences. Now, this is just me speculating, but when there is that much news in a condensed period of time usually there is a capital raise on the horizon. Friendly wager that it comes before Christmas.

Immuron (ASX:IMC | MC: $12M) issues performance rights to management under its employee incentive scheme. (IMC)

🪑I normally don’t highlight these administrative announcements but the timing of this one stood out given the company’s clinical trial results that didn’t meet the primary endpoint two days ago. This announcement could have waited for the deadzone between Christmas and New Years I think.

The Australian Federal Government and the States are at odds over funding for hospitals in a classic “who pays for what” standoff. (AFR)

FDA approves the first AI tool to evaluate fatty liver disease from images of liver biopsies. (Fierce Biotech)

Formation Bio inks US$600M deal for ex-China rights to a next-gen immunology asset from Lynk Pharmaceuticals. (Fierce Biotech)

A clarification on yesterday’s ‘Under the Microscope’. Immuron’s ATM facility was with a US company and any shares traded from them would have been on the NASDAQ, not the ASX. (The Armchair Analyst)

Quick update on my Immutep trade from earlier this week. I bought shares at 32 cents, stock traded as high as 39.50 cents today. Looking good.

Cash Injection

4D Medical (ASX:4DX | MC: $1.09B) secures $30.2 million in funding from the underwriting of 4DXO listed options at $1.365 per share. Share price is $2.04. (4DX)