The cash balance is like a clock for small-cap stocks.

Particularly, pre-profit medtech companies with a product in the market but no commercial revenues.

Each time they want to turn back the dial and ask for more money, it gets harder and at a lower price.

It’s not about the capital raise.

It’s about buying time (literally) to prove it can stand on its own and build out a sustainable business.

The trick for investors is understanding just how much leeway the market will offer before the taps run dry, and timing the investment just as the company is about to turn…

(if it turns at all)

Generally, the market is forgiving.

But after several years trying to find ‘product market fit’, I think this iteration of Adherium (ASX: ADR) is truly make-or-break.

What’s the story?

Adherium (ASX: ADR) first IPOd on the ASX in August 2015.

It sells an inhaler attachment that monitors how much the patient uses and how often they take their medicine.

This helps patients adhere to treatment and provides clinicians and insurers with real-world data on their patients’ use.

(Adherence… Adherium… get it?)

Here is a photo I took of the device that looks like a jacket for the inhaler product:

Since it IPOd, the company has had a number of cracks at building a business model… let’s take a look at each.

Business model #1: Direct to Pharma

When the company IPOd in 2015, it had a 10-year supply and development agreement with AstraZeneca (including a US$3 million cornerstone investment).

To the market, this was huge external validation of Adherium’s technology and potential.

The model was to sell Smartinhaler devices directly to pharmaceutical companies, which then distribute them to end users through their own channels.

At the time, the market was pricing in a global pharma rollout…

The problem was that big pharma had little incentive to sell Adherium’s products beyond its own, and the incremental revenue they generated wasn’t worth the effort.

The juice wasn’t worth the squeeze.

So it was back to the drawing board for Adherium (and a few more dilutive capital raises).

Business model #2: Direct to Consumer + Reimbursement

In 2019, the company moved to a reimbursement-enabled model.

Here, healthcare providers (like hospital networks) billed insurers directly and maintained the patient relationship, while Adherium provided the technology platform.

Good in theory, harder in practice.

This model encountered adoption challenges because it placed the burden of device distribution, patient onboarding, and insurance claims processing on healthcare providers.

Sales uptake was slow, and back to the drawing board for Adherium (and a few more dilutive capital raises).

Business model #3 (Today): Remote Patient Monitoring

Today’s model is a Remote Patient Monitoring subscription model in which Adherium assumes all operational burdens.

Activating patients through call centres, handling insurance billing, and managing the entire process, while charging providers a simple per-patient-per-month subscription fee.

This has been the most successful thus far because ADR assumes all administrative burden that healthcare providers don’t want to handle.

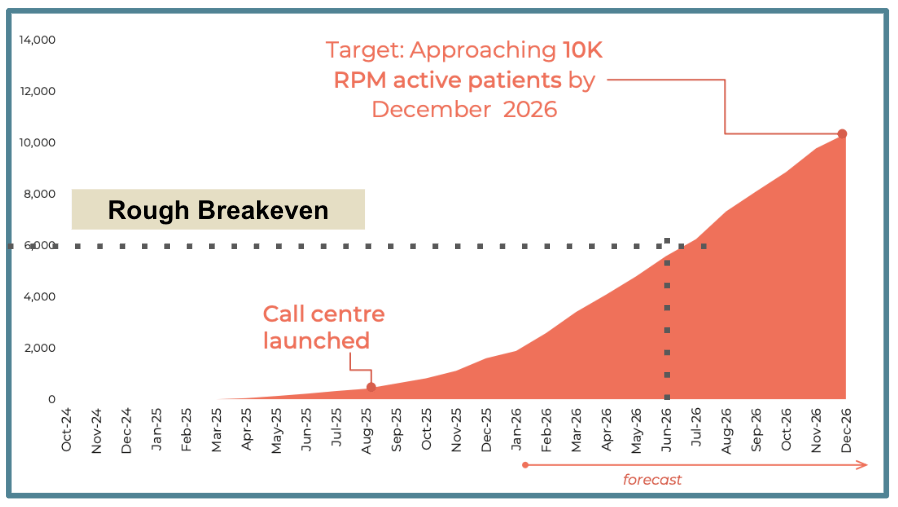

Results speak for themselves. Here is the growth since the program started in April last year:

(Source, ADR Presentation slide 22)

Now I double-checked with the company that these numbers were not “cumulative” but, in fact, the actual revenue delivered each quarter.

Revenues are growing, but costs are rising as well.

By taking on all administrative burden for patient onboarding (with a direct call centre), Adherium is running at ~$1 million in monthly burn.

At a market cap of ~$12 million, it would need to raise its entire market cap each year just to operate.

Unless its revenues grow drastically.

We all know the product works (it’s been on the market for more than 10 years); the question is whether the business model works.

At $55 per patient per month, Adherium would break even at approximately 6,000 patients.

The company currently forecasts that it will get there by June 2026:

(Source, ADR Presentation slide 24)

They essentially have four months to triple the numbers with no churn.

Given the cash burn, any slippage in execution will mean the company will be back hat in hand to the market, asking for more time and capital to secure the patients it needs to build a sustainable business.

Before I dive into the share register (which I think is particularly interesting for such a small company), I want to briefly touch on Adherium’s future planned business model.

While remote patient monitoring is how it generates revenue now, Adherium has grander ambitions…

These are achieved through “Value-Based Care” contracts, which deliver significantly higher margins and revenue and have proven to be a successful business model.

Business model #4 (Future): Value-Based Care

Value-based care is a healthcare model in which providers are paid for improving patient outcomes and reducing total healthcare costs, rather than for theservices they deliver.

It’s cost-saving rather than life-saving… and insurance companies are the customers.

To secure these lucrative Value-Based Care contracts, Adherium will need to demonstrate patient adoption of its product and the actual benefits and savings to the healthcare system if Adherium is used.

This comes through detailed and independent health economic studies that show:

Patients who use Adherium's product actually adhere to taking their medicine

More adherence to taking the medicine actually improves outcomes for insurance companies

This is the “blue sky” business model for Adherium, but it requires significant negotiation, proof, and execution by the company.

A good example of this value-based care model is Livlongo, which does patient monitoring for diabetes and merged with Teledoc in 2020 for US$14 billion.

Some big funds sit on Adheriums regsiter

There are three big institutional shareholders that sit on Adherium's share register:

BioScience Managers: 20.58%

Trudel Medical: 27% (agreed to take up its full rights for an additional $2 million in the next raise)

Regal Funds Management: 15%

So that is roughly 60% of the share register locked up in three big funds.

Trudell Medical has agreed to increase its contribution, but we are still unsure what Regal and BioScience Managers will do.

At this point, this is the third rights issue Adherium has raised in the last two years.

Generally, a rights issue is done at very attractive terms because the company struggles to raise money.

Offering a rights issue gives existing shareholders the chance to pay to play again.

Here are the rights issues that the company has addressed over the last two years:

A rights issue is also known as “crunch raise” because of its attractive terms, but this accelerating rights issues reminded me a little bit of this meme:

Defining the Bet for Adherium

In the short term, I think that defining the Adherium bet is simple…

“Can Adherium prove its ability to deliver a break-even business (by June 2026, the timeframe it set to the market) before it runs out of money again?”

… now this is an extremely risky bet.

The pace at which the company is spending money means that any slippage in execution or timelines will put the company back hat-in-hand.

But if the company gets it right and meets its ambitious sales targets, the market may begin to recognise product-market fit.

This should re-rate the company (particularly if it can beat sales expectations).

In the long term, the bet on Adherium is also simple.

Adherium moves to a value-based care model, with larger contracts, higher margins, and more defined revenue streams.

This will take time; however, with the results of an independent health economic study expected this financial year, Adherium may have the evidence to convince insurers to pay.

The Armchair Take

(Not financial advice, just what I’m personally doing with this investment opportunity. Your circumstances may differ from mine, so make your own evaluations).

My take on this one is that it is quite a risky bet.

I prefer to wait and watch, and I would be happy to pay more for Adherium once it is breakeven.

For those who want more upside, it’s okay to take on the bet that the company will be breakeven by June - and you may get a better price today.

Particularly if the big funds are acting as a backstop to ensure that the company doesn’t go broke.

Product market fit is a tricky bet to make (it’s not like catalyst-style bets in preclinical drug development, with binary outcomes).

You’re betting on a company to build a business within its cash runway.

And the cash balance is the timeframe that it has to deliver something material before diluting the share registry again.

But for what it’s worth, things are trending in the right direction for Adherium…

The question is whether it has the cash runway to get there before the market is tapped dry.

A big thank you to the CEO, Dawn Bitz, for sharing the story with me last week.

See you all tomorrow,

The Armchair Analyst

The Pulse Check

Tetratherix (ASX: TTX) published interim trial results for one of its platform technologies - TetraDerm - for skin scarring. At 12 months, 86% reduction in scarring. (TTX)

🪑 One of the best “presented” announcements I’ve read in a long time. If you’re a company struggling to communicate your story, have a read of this announcement. 10/10 from the TTX coms team.

Rhythm Biosciences (ASX: RHY) signs a 3-year, non-exclusive agreement with 4Cyte Pathology to distribute its colorectal cancer diagnostic to 4Cyte Pathology's network of 1,000+ collection centres. (RHY)

🪑 RHY has been like a newsflow hose in the last 2 months. It does help when you’re in the “commercialisation” phase of development.

I’m heading to the company lunch today. If you have any questions you'd like me to ask, reply to this email.

Clever Culture Systems (ASX: CC5) has released its half-year results, reporting a net loss of $1.32M and revenue of $2.56M.

🪑 Even taking out the grant income from the previous comparable period, revenues were effectively flat / slightly down for CC5. The company is still in the scale-up phase of its business strategy.

Vita Life Sciences (ASX: VLS) FY25 revenue growth of 17.3% to $93.3M and net profit after tax up 18.8% to $10.4M. Total FY dividend of 14.0 cents per share (40% increase).

🪑 The story of this half-year's results was that of strong operating margin improvement driven by growth in Malaysia and Singapore. Dividend payout heading in the right direction. Nice result.

Yesterday, Clinuvel (ASX: CUV) was up 11% on no news. Why? Over the weekend, the FDA rejected accelerated approval for Dis Medicines drug for Erythropoietic protoporphyria, a rare condition for which Clinuvel has the only approved product in the market. (Reuters)

🪑 Always good news when your competitor falls over.

Cash Injection

Botanix Pharmaceuticals (ASX: BOT) secures $45M in a two-tranche placement and SPP done at $0.06 with a 1:1 option also exercisable at $0.06. (BOT)

🪑 I’ve seen some gross raise terms, but this one is far and away the most brutal in 2026. 45% discount PLUS 1:1 option… but that option is exercisable at the raised price.

This is the type of “we need cash, lots of it, desperately” type of raise.

Ooft.