It’s 2006.

"Temperature" by Sean Paul is on the radio everywhere.

Jessica Simpson is the next big thing.

And everyone has a Motorola flip phone.

You’re a first-year PhD student writing your thesis on DNA Fragmentation, and there is one missing piece to solve your problem for improving IVF fertility.

You hear about an emerging professor at the University of Newcastle who has the exact device that will solve your problems.

It’s still very much a prototype… couldn’t be sold at scale… but it works.

You graduate from university and build a 17-year career at Monash IVF, only to be reintroduced to the technology in 2020… when a small ASX-listed biotech comes to you, hitching its fortunes on the development of its sperm separation device.

… the device that used the research from your same PhD you started all those years ago.

This is (roughly) the story of Hassan Bakos, operations director at Memphais (ASX: MEM).

Last month, MEM secured the CE Mark (equivalent to FDA approval) for its sperm separation device “Felix”, which improves the quality, speed, and cost of the IVF process.

The sperm separation device has been part of MEM since the company’s inception in 2007.

But it took a LOT longer for the company to get to where it is today (ready to commercialise its product).

Here is the original announcement from 2007 when MEM first flagged sperm separation:

(Source, NuSep Announcement 2007)

I found an old AGM presentation that forecasts first sales for “February 2008”.

(Source, NuSep presentation 2007 page 12)

Shortly after this presentation, the company pivoted to acquire a new Gels Business and shelved the sperm separation project.

For 10 years.

During that time, NuSep (as it was then called) was a roller coaster.

Chronic cash shortages, CEO disputes, ASIC investigations, multiple ligitations and an eight-year clean-up job.

(this saga honestly needs its own article…)

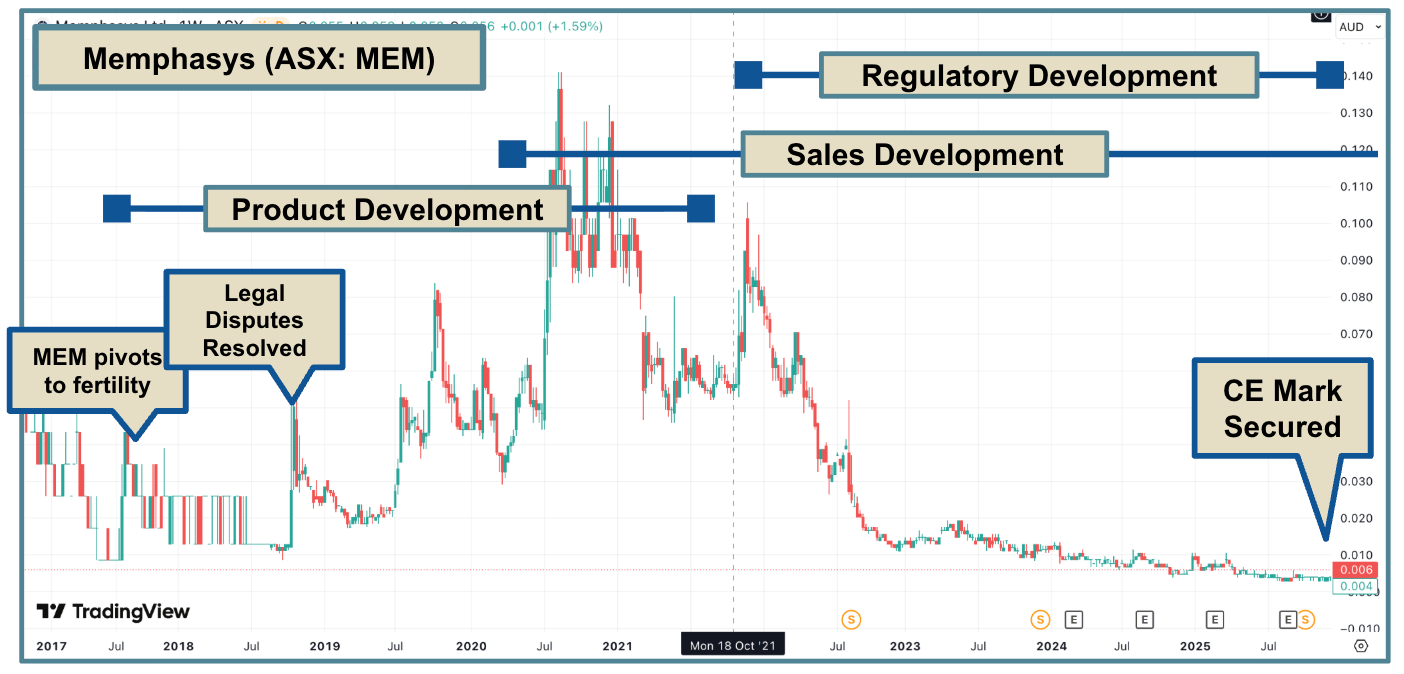

In 2017, the company returned to the sperm separation device, and the MEM that we know today was reborn:

Like many early-stage device companies, MEM fell into the trap of setting sales expectations too high, too early.

It did this before securing proper regulatory approval to actually sell its device in key markets.

This meant that revenues were never meaningful, and the market punished the company.

Here is the “first sale” and commercialisation announcement by MEM again in 2020:

There is commercialisation and commercialisation.

The first kind, the company is able to sell its product in a limited number of markets… sales are slow, and it's not enough to build a business.

The second kind… the necessary regulatory approvals are in place, the company can scale up, and it is unencumbered from making sales.

From 2020 to 2022, the company's story was of the second kind, but the reality was much closer to the first.

So, MEM went back to the drawing board, completed the required trials, and finally secured CE Mark and TGA approvals to sell its sperm separation products worldwide.

The thing is, a company with this much baggage and overpromising on sales is only rewarded by the market well past the point of the turnaround.

But it's a fine line between the turnaround and the undeniable.

For early-stage healthcare companies, this is my favourite hunting ground.

Companies that have been over-punished and are ready to grow.

I took a position in MEM during the recent placement at $0.005 and look forward to the company’s next chapter as it aims to become the flagship sperm preparation method in IVF clinics worldwide.

A little bit more about the company

In a nutshell, MEM is developing a recurring-revenue business selling sperm-separation cartridges to IVF clinics at a 60% gross margin, with a product that is significantly better than anything on the market.

MEM doesn’t drive revenue from the device itself, but rather from the single-use cartridges used in the sperm separation process.

(think of it like selling the ink to a printer)

MEM effectively gives the system away for free but has a ~60% gross margin on cartridges, which sell for $80-$150.

(Typical land and expand model).

The story has been gaining momentum since December last year, when it secured CE marking (equivalent to FDA clearance), enabling sales of its product in Europe and the Middle East

Yesterday, the TGA approved the product in Australia, two months ahead of schedule.

… and India should follow this year.

MEM has not been flat-footed on the sales front, leveraging its work from the last five years, with multi-year distribution and sales agreements already in place:

CFA Italia (Europe): 7,500 cartridges over 5 years = ~$925k minimum

ITL (Middle East & Turkey) Distribution Agreement: $390k initial minimum order

Andro Diagnostics (India): 200+ clinics, $100k Year 1, $150k Year 2 (triggers on CDSCO approval, expected August 2026)

Vitrilife Distribution Agreement (Japan)

MEM is targeting $2M in sales for FY26 and $6M for FY27 - with more sales contracts expected soon.

The value proposition for IVF clinics is clear.

MEM’s product is faster, more consistent, and easier to use than manual techniques, creating greater throughput with less effort.

It also significantly reduces errors… which caused a big scandal last year.

Monash IVF had two separate laboratory errors where incorrect embryos were transferred to patients in Queensland and Victoria.

A Brisbane patient gave birth to a child with no genetic link to her, while a second, separate incident in Melbourne involved transferring the wrong embryo to a patient.

This was a major scandal for the industry and for Monash IVF, leading to a distressed bid for the company (which fell through) late last year.

So the stakes are high to get it right with sperm separation…

Also, MEM is operating in an industry where results matter.

Families looking to have kids are high-intent buyers and will generally pay premiums for services that deliver results.

For MEM’s customers, this is a key differentiator.

If MEM can get its products into a few key clinics in key markets, followers will emerge as customers demand the best products and services.

How big is the market?

There are approximately 5,000 IVF and ART clinics in the markets MEM is targeting for regulatory approval.

(Basically, the entire world except China and the USA for now).

Depending on size, each clinic performs about 1,250 to 2,000 cycles per year.

(A cycle is another word for sperm speration)

At a $80-$150 price point, MEM’s TAM is about $500 million to $1.5 billion in annual sales.

Those are nice big numbers, but getting there is much harder… and there is still a decent level of execution and scale-up risk in the business.

Importantly, staff need to be trained and see the real benefits in changing their behaviour.

In a study conducted with Monash IVF, 100% of lab staff preferred Felxi to the standard method, and more than half preferred it to the “swim up” method. (Source)

But industry-changing behaviours aren’t easy… and do take time.

There is also the looming prospect of a $4 million convertible note (to the second-largest shareholder), due in June and exercisable at $0.0024, to be aware of

I wrote yesterday about the asymmetry in biotech stocks that the market has discarded, yet they are still executing their business plans.

I think that MEM fits this category perfectly.

It is always tricky for a company moving from clinical studies to sales…

But because MEM had five years of thought leadership in the space, speaking with customers and key clinics, they are ahead of the curve on sales and product delivery.

It’s been a long journey to get this product to market, and MEM will still need to prove that its business is profitable…

But with a high gross margin and central manufacturing facility, it is the first time in a long time that things are starting to click.

A big thanks to Hassan Bakos for chatting with me yesterday about MEM and sharing the story.

See you all tomorrow,

The Armchair Analyst

(Disclosure: I own shares in this one)

The Pulse Check

CSL (ASX:CSL) signs a collaboration agreement with Memo Therapeutics, valued at up to US$328 million in milestone payments, for its recombinant IgG technology. (Fierce Biotech)

EVE Health Group (ASX: EVE) launches Libbo an oral film for erectile dysfunction in Australia. (EVE)

Osteopore (ASX: OSX) launches 3D printing services for public and private hospitals in Singapore. (OSX)

The Australian Government is planning a $740m veterans plan to fund social 'rehabilitation' and psychedelic treatments for PTSD. (ABC News)

🪑Good news for a company like Emyria (ASX: EMD) that is delivering psychedelic PTSD treatment to veterans right now.

Medtronic hit with $382M antitrust damages for monopolising the surgical device market through exclusionary bundling practices. (Fierce Biotech)

Cash Injection

Actinogen Medical (ASX: ACW) launches a $5M Share Purchase Plan at $0.042. (ACW)

M&A, Big Pharma Wants a Wife

Eli Lilly and Innovent Biologics partner on oncology immunology development, with a US$350M upfront payment and US$8.5B in milestones. (First World Pharma)

🪑 Another Big Pharma - China deal.

Eli Lilly is set to acquire Orna Therapeutics, a cell-therapy-focused biotech, in a deal valued at up to US$2.4B. (Pharmaceutical Technology)

🪑 CAR-T therapy companies on the ASX rejoiced at the opportunity to add another multi-billion-dollar transaction to their M&A pipeline slide.

Takeda inks US$1.7B AI drug discovery deal with Iambic Therapeutics. (Fierce Biotech)

🪑This is one of the largest AI drug-discovery deals to date, and I expect more to follow; it is the future of the biotech industry.