Last week, both Saluda Medical (ASX:SLD) and Epiminder (ASX:EPI) IPOd on the ASX, both down significantly from their IPO prices.

I spent the better part of this weekend going into each prospectus to find out what went wrong, what’s the opportunity now and what can we learn for next time.

Under the Microscope

There was a saying that my dad had about investing in an IPO.

If I get half my allocation, I’m worried… if I get my full allocation, it's going to be a bloodbath.

Last week was a bit of a disaster for the IPO market.

Two medtech companies, Saluda Medical (ASX:SLD | MC: $320M) and Epiminder (ASX:EPI | MC: $216M) both listed on the ASX last week, both down significantly from the IPO price.

Monday, EPI IPOs at $1.50… by Friday it closed the week at $1.00.

Friday, SLD IPOs at $2.65 and closed the day at $1.27.

Not great for the sector and people scratching their head asking what went wrong?

It is hard to evaluate the merits of each company to deliver on expectations because neither has really done anything.

BUT, we can take a look at how the IPO was priced and the company’s capital structure of each stock to see if we can get any insights.

So, with my “hindsight” glasses on and my forensic accounting blacklight lit… let’s see if we can learn what happened.

First, Epiminder.

Epiminder is a medical device company that has developed an implant to monitor brain seizures.

The company’s #1 investor is the $17 billion capped medical device manufacturer, Cochlear (ASX:COH).

Epiminder has FDA clearance for its product and CMS code. It’s pre-revenue and had around $34 million in expenses last financial year.

At IPO the company raised $125 million at $1.50 - giving it around a 2-year runway and an enterprise value of ~$228M.

On Monday, the company was immediately on the back foot with trading delayed because of the broken ASX announcement feature.

The company then traded down on low-modest volume for the week (around 3.7 million shares traded).

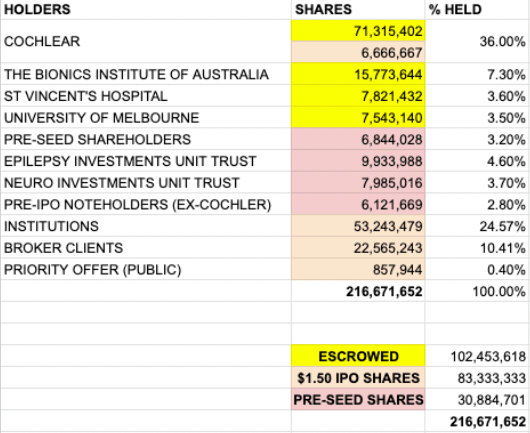

So where did the selling come from?

Let’s take a look at the cap structure.

While main investors were subject to escrow conditions (marked in yellow), other pre-IPO investors were not (marked in red).

Some of these investors in red may have used the IPO listing as a liquidity event to get out money that they had previously invested.

Depending on which class of convertible note the investors were in they would have either had their shares converted at or below the IPO price (plus getting the interest on the loans):

(Prospectus, Page 198)

So to free roll the interest, escrowed investors in these notes may have sold out their position on listing.

With the share price down, IPO investors marked in orange, may have been spooked.

Creating a downward spiral that can only be revived with more buying.

Because the company hasn’t had a chance to impress or deliver on milestones or expectations, it is generally on the brokers to support the company's post-IPO and sell the story…

And if the brokers had used all of their buying to close out the IPO, then there will be much less buying on the screen.

As dad said… if you get your full allocation in the IPO it’s going to be a bloodbath.

The balance of buyers and sellers will ultimately lead to a price where the stock is too cheap to ignore, and then it will find a natural rhythm of supply and demand.

It is the tail of the markets, one as old as time.

UPDATE: The company is already up on market today and a Change of Directors’ Interest Notice buying support coming from the directors. (EPI)

Okay, that was Epiminder, what happened to Saluda Medical?

Saluda Medical is a commercial stage medical device company selling an FDA approved device that senses neurological signals in real time and manages chronic pain.

While Epiminder is pre-revenue (which can be harder to value), Saluda Medical is already making sales and has a forecast sales number for FY2026.

Last financial year the company did US$71M in revenues and is forecast to do US$82M next financial year.

Saluda Investor Presentation, Page 10

BUT, the company had a net loss of US$128M and is expected to have a net loss of US$145M the following financial year.

So while sales are growing, the losses are accumulating too.

This is not uncommon for a growth stage company, BUT the sales ramp up needs to eventually hit a point where the company is sustainable.

Saluda raised A$230M (US$150M) at the IPO at an enterprise value of A$522M, and has a cash runway until the start of FY28 (Prospectus, Page 20).

The company is valued at 5x revenue, which does not on the surface seem unreasonable relative to the valuations of other medtech IPOs. (Source)

Where the valuation gap comes in however for Saluda:

Gross Margins are only sitting at 46%, really the company wants to be up at 60-70%. (Source). While SLD does have a plan to improve its product to get there eventually (Prospectus, page 88), the majority of the IPO will be spent on sales growth.

Anticipated Growth for FY26 is expected to be 16% (or US$11M in additional revenues) - I would want this number to be higher given that 53% of the IPO funding is expected to be spent on sales and marketing.

Essentially, because the company is not cashflow positive it will need to tap the market again in 18 months time.

As the cash balance drops, it will need to build in the enterprise value with more revenues to justify its valuation.

Is 16% year on year growth rate enough?

It appears that buyers of Saluda are skeptical, and are pricing the company with some execution risk in mind.

Now from a cap table perspective, 96% of the IPO shares are subject to escrow.

(Prospectus, Page 202)

This is good, because it only leaves just 6.6M shares from the pre-IPO holders free to sell.

So, there would have been some selling pressure, it would not have been much.

That said, even a small indication of selling pressure may have been enough to tip the scales on debut, and when things go wrong, they can go wrong all at once - as negative sentiment spirals.

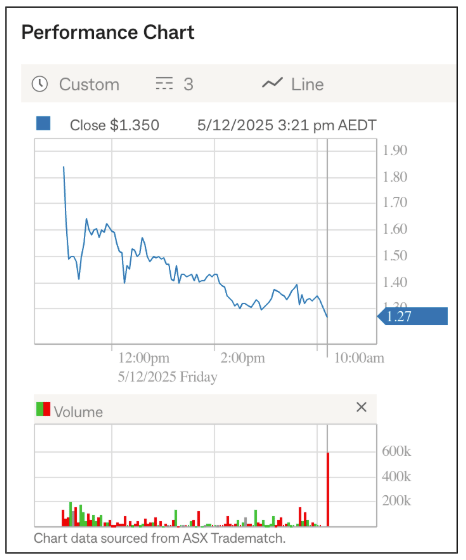

The stock opened at $1.90 (which is already a massive discount to the IPO price of $2.65)... and then it was panic stations from there.

Notably there was also a big seller right at the end of the day for around 600,000 shares.

SLD’s 1 Day chart on Friday 5th December

So while the 5x revenue multiple is generally a “fair” valuation for a company like this, I think that the execution and sales risk haven’t been taken into account to price.

This has meant that the buyers haven’t come to the party once the company listed.

What happens now?

Well, if you like either of these stocks you’re laughing.

Boxing day sales have come earlier for you, and you can get each of these stocks at a significant discount to the IPO.

BUT, there may be some more volatile trading, particularly as institutional funds are looking at positions which are down 33% and 50% within a week.

This would certainly muck up their Christmas Bonus and half-year performance, so unless buyers return soon I won’t be surprised if there is a bit more of a slide.

UPDATE: Both companies opened up green today, indicating that they may have been oversold.

The good thing for both companies is that the money is in the door.

They have the funds to go and execute on the business plan and build the value back in the business.

The unfortunate casualty of these two IPOs will likely be future med tech companies that IPO on the ASX.

However, I do think that the bankers will consider how they price the IPOs in the future to make sure that the risk-reward favours the investors buying into the IPO… even if they have to push back on company valuations.

See you tomorrow.

The Armchair Analyst

Jason Segal

Did someone forward this email to you?

The Daily Check-up

Imugene (ASX:IMU | MC: $100M) secures the FDA’s support to move forward with a Phase 3 Registrational Study for its Azer-cell CAR-T cancer therapy. (IMU)

Chimeric Therapeutics (ASX:CHM | MC: $11M) secures FDA Orphan Drug Designation for its CDH17 CAR-T cell therapy in gastric cancer. (CHM)

🪑 I own shares in CHM.

Telix Pharmaceuticals (ASX:TLX | MC: $5B) doses the first patient in Part 2 of its ProstACT Global Phase 3 prostate cancer trial. (TLX)

Artrya (ASX:AYA | MC: $545M) signs three-year, US$0.3M SaaS deal with Northeast Georgia Health System to deploy its AI coronary CT analysis platform across 5 hospitals. (AYA)

🪑 Just quietly, AYA is the second best performing stock by % gain across the entire healthcare sector on the ASX this year. Up 569%.

Clinuvel Pharmaceuticals (ASX:CUV | MC: $620M) expands its Vallaurix Research and Development Centre in Singapore through a strategic 5-year investment. (CUV)

Memphasys’ (ASX:MEM | MC: $10M) Director of Clinical Partnerships and Growth is in Doha to lead a sales seminar with staff from its regional distribution partner International Technology Legacy. (MEM)

🪑 Not sure this one should be marked as price sensitive MEM… ‘guy does his job’.

The FDA is set to lower the number of trials required for approval of drugs from two pivotal clinical studies down to one for new drug applications. (STAT)

Kazia Therapeutics (NASDAQ: KZIA | MC: US$161M) raises A$50M to develop targeted anti-cancer drugs.

🪑 Kazia is an interesting story of a dual listed NASDAQ and ASX company that de-listed from the ASX in 2023 and chose to stay on the NASDAQ. Still headquartered in Sydney I wonder if it’s helped, or hurt… not sure.

The FDA has approved another CAR-T cell therapy for adults with Relapsed or Refractory Marginal Zone Lymphoma developed by Bristol Myers Squibb (NYSE:BMY | US$106B). (BSM)

AstraZeneca licenses a pre-clinical amyloidosis antibody for up to US$780M from Neurimmune. (FiercePharma)