Good morning,

Welcome to today’s edition of The Armchair Analyst, a 5-minute daily update on the ASX life-sciences sector.

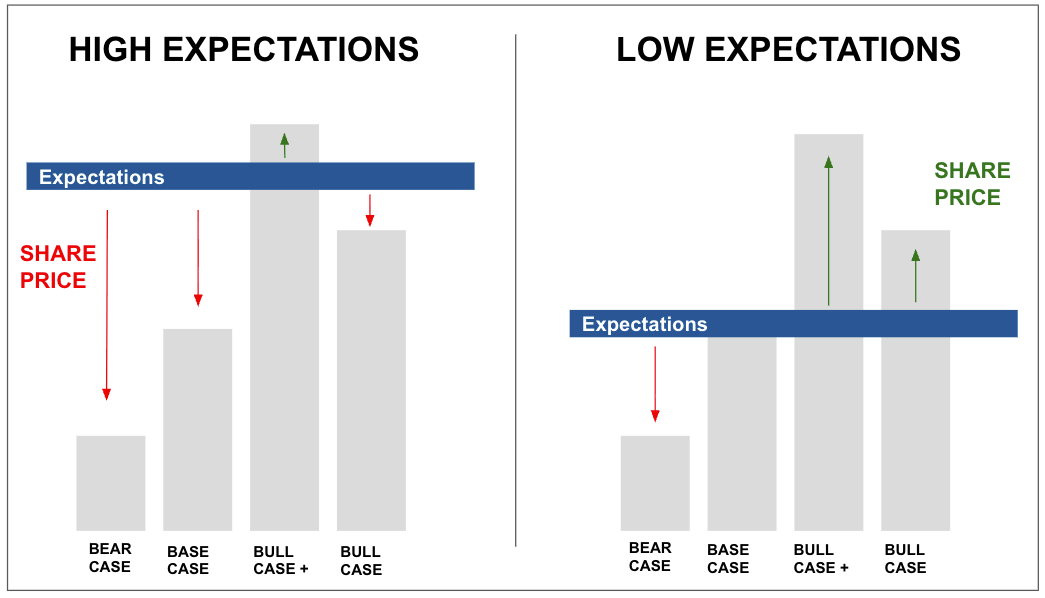

Understanding market movements is all about context.

Today, I’m looking at two announcements from yesterday that didn’t look like much until the market reacted.

Sometimes, the volume tells you everything you need to know.

But first…

The Pulse Check

LTR Pharma (ASX: LTP | MC: $103M) doses the first patients in its Phase II study for nasal spray viagra. (LTP)

Amplia Therapeutics (ASX: ATX | MC: $69M) completes first large-scale GMP manufacture of ~13 kg of its drug capsule, supporting its upcoming Phase 3 pancreatic cancer trials and other planned studies. (ATX)

Firebrick Pharma (ASX: FRE) launches its Throat Spray product in Fiji and the South Pacific through Makans with an order of 216 units. (FRE)

Osteopore (ASX: OSX | MC: $5.6M) signs an exclusive 3-year distribution deal with MontsMed for its 3D-printed orthopaedic implants (OSX)

Entropy Neurodynamics (ASX: ENP | MC: $55M) reports clinically meaningful improvements from the 4-week follow-up assessment of its first patient in the Binge Eating Disorder trial. (ENP)

Cogstate (ASX: CGS | MC: $377) reports 1H26 revenue from clinical trials contracts of $26.9M (+12%, and above guidance), and total group revenue of $104.9M. (CGS)

Compumedics (ASX: CMP | MC: $65M) reports 1H26 revenue for its diagnostics technology for sleep, brain and ultrasonic blood flow monitoring. 1H26 revenues of $30.80 million (+32% on pcp), full year guidance $70 million, EBITDA $9 million. (CMP)

EZZ Life Science Holdings (ASX: EZZ | $89M) appoints Gary Liu as Non-Executive Chair. (EZZ)

Tetratherix (ASX: TTX | MC: $170M) appoints Maurizio Vecchione as an independent non-executive director. (TTX)

Cash Injection

HeraMED (ASX: HMD | MC: $46M) enters a trading halt for a capital raise. (HMD)

Pfizer exits ViiV, while Shiongi doubles its stake to 21.7% in a deal valued at $2.1 billion. (Bloomberg)

M&A, Big Pharma Wants a Wife

GSK licenses a novel enzyme from Alteogen to boost its own cancer checkpoint inhibitor, with a $20M payment and $265M in milestones. (FiercePharma)

Pfizer and Novavax partner on Matrix-M technology to boost the body’s immune response in a vaccine; $30M upfront, $500M in milestones. (Biospace)

The Google DeepMind spinout, Isomorphic, signs another deal with J&J to develop drugs discovered by AI. (Endpoints News)

Under the Microscope

Everyone has a different reason for buying or selling a stock, and a different timeframe for holding.

Instos think differently from retail.

Different mandates, different incentives, different patience levels.

When you zoom out, the market is really just one big cauldron of buyers and sellers trying to agree on a “price” for pre-revenue companies that are, frankly, very hard to value.

That’s why I don’t like judging stocks purely on the announcement itself.

I prefer to look at expectations vs reality.

What was the market expecting going into the announcement, and how did the actual news stack up against that…

Yesterday was a good example.

Two companies put out fairly mundane announcements… nothing headline-grabbing.

But the trading volume? Way bigger than the news deserved.

And that’s usually the tell.

So, what’s the story?

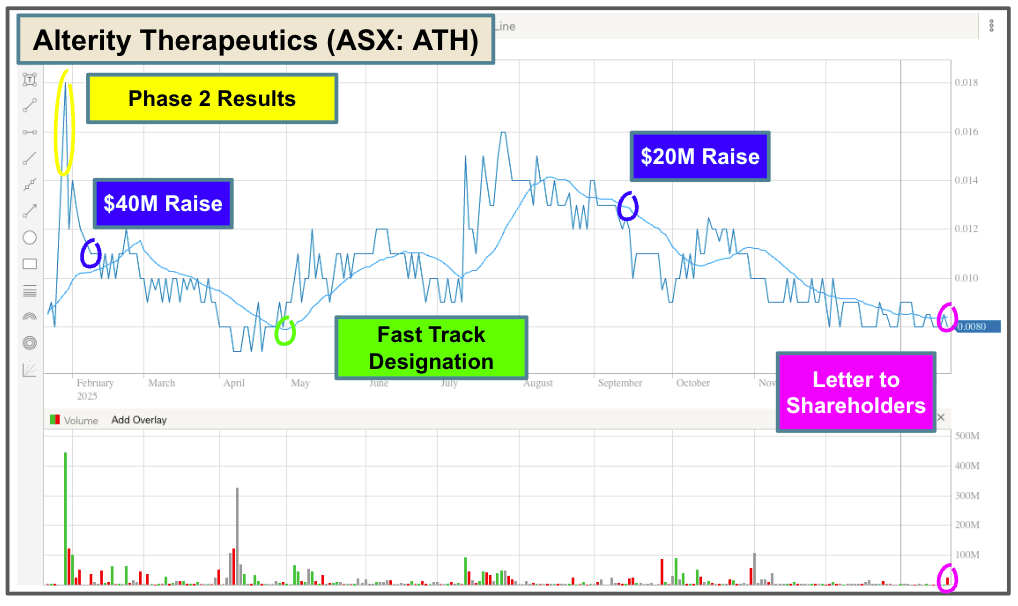

FIRST, Alterity Therapeutics (ASX: ATH).

Last year, ATH completed its Phase 2 trial for Multiple Systems Atrophy with positive efficacy results.

The company has since raised $60 million to fund the next phase of development ($54 million still in the bank).

ATH has secured Fast Track Designation and Orphan Drug Designation for its product, which may lead to accelerated approval.

And yesterday, it published a Letter to Shareholders with some updates.

In the letter, the company updated the timeframe for the “End of Phase 2 meeting” with the FDA: mid-2026.

But, there was no mention of ‘accelerated approvals’ or ‘partnerships’.

(something that the market may have been looking for)

Now, it is likely that ATH was managing shareholder expectations, waiting for the results of the FDA meeting before discussing accelerated approvals.

But the above-average trading volume in the stock likely indicates that investors were not thrilled with the update.

There were buyers to soak up the volume, and I think that this represents a “baton pass” from hot money to patient money…

From retail investors to institutions.

While there was nothing inherently wrong with the Letter to Shareholders, it was a bit of a ‘reality check’ that it may take a little while before the next catalyst drops.

This can happen when companies move from a period of high activity (when the clinical trial is active and retail investors are interested) to a period of lower activity (when they are setting up for the next trial).

Retail exits and instos come in.

Here is the 12-month chart to illustrate…

I do tend to watch these companies a bit more closely.

When there are periods of newsflow vacuum, it can create opportunities to buy de-risked stocks at lower prices.

Before the clinical trial, ATH was priced at ~$0.08; now it has Phase 2 results and $60 million in the bank… and it's still priced at ~$0.08.

The only thing that has changed is sentiment.

Sentiment can shift quickly as ATH moves to a period of higher activity, so I’ll be watching this one closely over the next six to nine months.

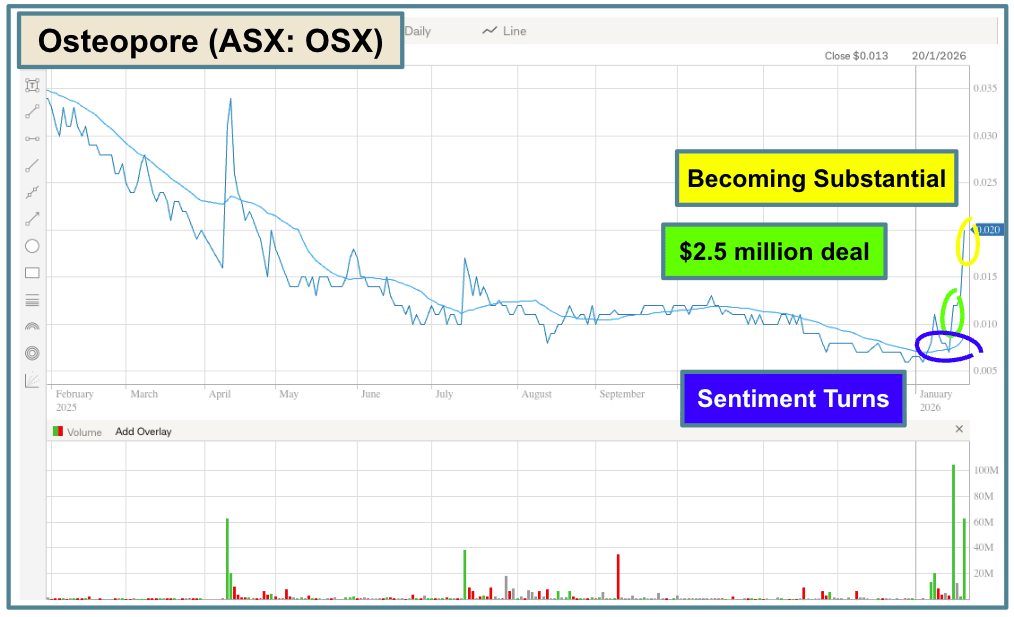

SECOND, Osteospore (ASX: OSX)

Yesterday, OSX traded about $1.4 million of volume on a Change in Substantial Shareholder notice.

Not exactly the type of announcement that you would expect to move the share price.

But what is the context?

Last week, OSX announced an exclusive agreement valued at $2.5 million to sell its dental products in China.

This was a sentiment-breaking announcement, and a genuinely good progress update from a company that was capped at just $2 million at the time.

One of the big challenges, however, for OSX was that it had a big $20 million convertible debt financing facility (with $4.5 million drawn), as an overhang on the company.

Sometimes these facilities can create a death spiral, where the company draws down the facility, issues shares at a discount, and the note holders sell the shares immediately.

Rinse and repeat.

This creates huge selling pressure on the stock.

Yesterday, something changed with all that…

The organisation that had the facility “went substantial” - which means that any trades with movements greater than 1% will need to be disclosed to the market.

This means that the convertible note holder can’t trade its stock in the shadows, and any major movements will be seen by the market, adding transparency over OSX’s biggest risk.

Now this news alone isn’t that amazing.

BUT, it did build momentum on the sentiment-breaking announcement from last week:

The market moves in funny ways…

And I believe that ‘timing the market’ is sometimes more important than ‘time in the market’ for catalyst-driven pre-revenue companies.

Working out a company's sentiment, catalyst sechedule and why stocks move can help us time our investments and make better decisions in the future.

See you all tomorrow.

The Armchair Analyst