It’s a big call, but I think biotechs can be among the most mispriced stocks on the ASX.

Particularly in the small cap space.

Companies on the cusp of a breakthrough or commercialisation still trade at significantly depressed valuations if faith in the company has been shaken.

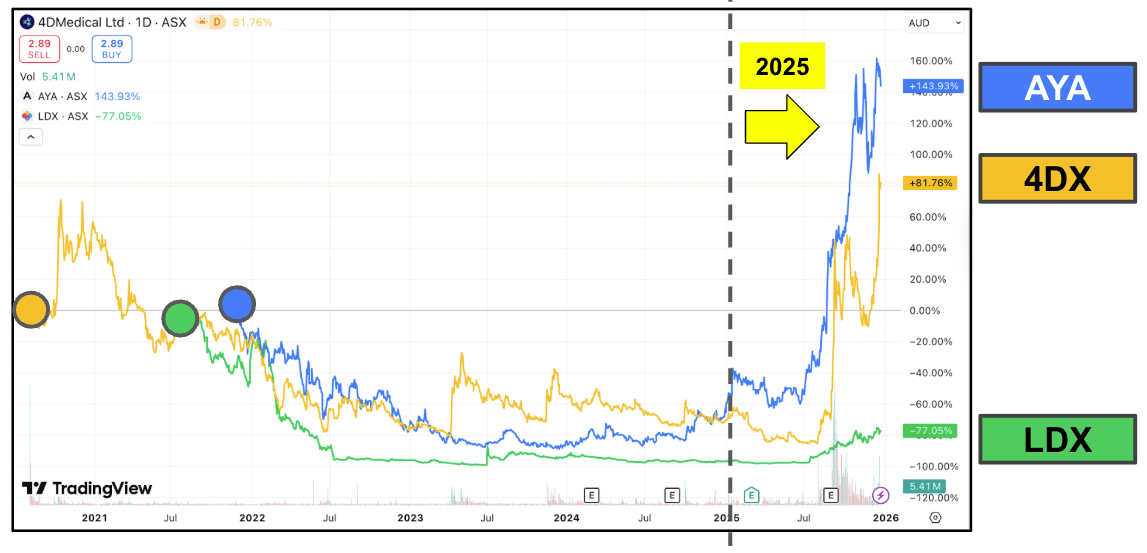

The trick is to identify these just before the market catches up on them, and there are three top performers this year that embody this idea the most: 4DX, LDX, and AYA.

All three companies listed on the ASX between 2020 and 2021.

All three companies were down more than 80% from their IPO price.

All three companies had a stellar 2025 and returned over 500% to investors year to date.

What happened? What are the patterns? What can we learn as we go into 2026?

Artrya (ASX: AYA)

Price: $3.72 | Market Cap $632M | 2025 High $4.29M | 2025 Low $0.55 | High-Low +680%

In a nutshell…

AYA has developed an FDA-cleared AI intelligence platform, Salix, to detect, diagnose and help manage coronary artery disease from CCTA heart scans.

What’s the story?

Seven months after AYA IPOd in 2021, the FDA did not approve Salix’s 510(k) application.

Naturally, the share price languished, but the company still had commercial ambitions and spent the next few years setting up its commercialisation strategy.

So, when FDA clearance was eventually secured in March this year, the company was ready.

The turning point for AYA wasn’t this FDA clearance; it was actually its first commercial deal with Tanner Health.

While FDA clearance was a major de-risking event, the market wanted to see a bit more from the company before rewarding it with a share price rise.

After that AYA continued to execute, securing a second FDA clearance, a reimbursement code, a second customer, a $75M capital raise and its first revenues.

What I learned from AYA

AYA is the perfect example of the old idiom: "Success is when preparation meets opportunity."

Whilst the company had a significant setback after IPO, it wasn’t deterred in its ambitions to commercialise its product.

It was prepared as if the FDA clearance would be a foregone conclusion, and was ready with a commercial strategy once that eventuated.

A good lesson for companies out there: Always be thinking about building a business, not just a technology.

Lumos Diagnostics (ASX: LDX)

Price: $0.26 | Market Cap $233M | 2025 High $0.30 | 2025 Low $0.019 | High-Low +1,479%

In a nutshell…

Lumos Diagnostics develops, manufactures and commercialises rapid point‑of‑care diagnostic tests (think of it like a COVID-19 RAT test).

What’s the story?

Lumos Diagnostics is a true Lazarus story.

Two months after its IPO, the FDA told the company that its COVID-19 RAT test was ‘de-prioritised’ for Emergency Use Authorisation.

Not a great start.

THEN, 12 months later, the FDA actually rejected the company’s FDA 510(k) application.

(and then again rejected the appeal)

The stock went into freefall over the next few months, trading at just 3 cents in 2022, down from its IPO price of around $1.

The FDA finally approved the RAT test in July 2023 after the company narrowed the product's claims… but by then, it was too late.

Funded by a destructive convertible note, Lumos was in a bind.

With the COVID-19 mania winding down, the company pivoted to other conditions, tests for liver issues and women’s health.

In 2024 and early 2025, the company began executing on some goals…

Agreement with a large NASDAQ company, Tenmile joins as an investor, reimbursement codes galore and a BARDA partnership.

But it wasn't until it signed an exclusive US$317M distribution partnership with PHASE Scientific that the stock market started to notice.

Weeks before this deal, the company was still trading at 3 cents.

The company continued to deliver multiple cash flow-positive quarters and a new BARDA partnership.

The stock is trading at 26 cents today.

What did I learn from Lumos’ story?

Interestingly, despite all of the progress that the company had made, it was still trading at 3 cents in June of this year.

When a stock is beaten down so much, it requires some form of undeniable, irrefutable external validation to wake up the market.

That was what the PHASE Scientific contract was about.

For investors who can see the forest through the trees and recognise actual progress before the market realises, it is a HUGE investment edge.

But the edge comes from your willingness to do the work versus the next person and back in an investment thesis.

4D Medical (ASX: 4DX)

Price $3.32 | Market Cap $2B | 2025 High $3.32M | 2025 Low $0.225 | High-Low +1,344%

In a nutshell…

4DX has developed non‑invasive lung-imaging software to generate four‑dimensional assessments of respiratory function from standard X‑ray and CT scans.

What’s the story?

4DX is by far the best-performing healthcare stock of 2025.

It is the 2025 champion of the sector, and its story gives hope to other small-cap ASX-listed healthcare stocks and investors.

The company’s story is a bit different from AYA's and LDX's.

While it didn’t encounter any issues with the regulator early on, it did face one of the biggest challenges for any small-cap tech stock.

Things just take longer, and cost more than you think…

The burn rate was such that 4DX raised $40 million 6 months after its IPO, and revenue from its smaller Australian markets didn’t cover the cash spent on developing the technology.

The market started to lose faith in the company’s ability to develop a sustainable business, and with the dilution, the shares dropped to between 22 and 30 cents this year.

The turning point for the company was when it finally received FDA clearance for its second technology, the 4DX CT: VQ, and a reimbursement code for the product.

Pro Medicus invested $10M into the company, and the customer rollout began.

What is the lesson from 4DX?

There was a raise the company did in February that made a lot of people a lot of money…

$13.9M raised at $0.425 with a 1:1 $0.55 option with $0.75 piggyback.

THIS was the raise to get in before the company took off.

4DX hit an all-time high today of $3.25.

It’s the small-cap investor’s dream to ‘pick’ the raise just before the rocket, and with options to boot.

Wins like this are very healthy for the industry and keep people coming back for the next one.

Why did 4DX work when so many others have struggled?

Again, I think it is about the external validation and execution momentum.

The Pro Medicus investment was external validation…

But it was the company’s ability to capitalise on the momentum and bring in customers that helped carry the stock forward.

I also think there is something to be said for a bunch of investors making money off a stock.

Retail investors love to brag about a win.

They tell their friends, brag about it to colleagues and create an organic FOMO that drives the price even further.

So while existing investors may have found the February raise painful at the time, it was an important part of creating the fever and interest in the stock.

(Particularly when it is done alongside an SPP that gives them the chance to invest too).

So that’s the big three for 2025.

My key takeaway is that there is significant untapped value in sub-$150M market-cap stocks.

Companies that have not taken the straight path and have had to go the long way around to build value.

Spotting these companies early is where the most significant returns are.

Picking the winners when everyone else has stopped believing in them.

It’s a LOT harder than it looks, and most don’t make it, but as 4DX, LDX and AYA showed, there is so much value in truly understanding where a company is BEFORE the market catches on.

Have a fantastic Christmas and a happy New Year.

I’ll see you all next year.

The Armchair Analyst

Jason

Did someone forward this email to you?

The Daily Check-up

4D Medical (ASX:4DX | MC:$2B) secures a third US academic medical centre, Cleveland Clinic, as a customer for its CT: VQ lung and heart imaging product. (4DX)

PYC Therapeutics (ASX: PYC | MC: $877M) Phase 1a data shows its RNA therapy for Polycystic Kidney Disease is safe and well-tolerated. (PYC)

Amplia Therapeutics (ASX: ATX | MC: $62M) extends its preclinical partnership with Korean screener Next & Bio on a combination therapy between ATX’s FAK inhibitors with a treatment for pancreatic cancer and other solid tumours. (ATX)

The CMS has confirmed that Aroa Biosurgery’s (ASX: ARX | MC: $231M) outpatient skin substitute for diabetic foot and venous leg ulcers will continue to be reimbursed until the end of 2026. (ARX)

Imricor (ASX: IMR | MC: $483M) adds Charité University Hospital in Berlin as a second site for its MRI-guided ventricular tachycardia ablation trial.

🪑 I had to look this one up because I swear I wrote about IMR opening a second site in its trial just a few days ago.

Looks like the company is running two different trials right now, VISABL-VT and VISABL-AFL.

Both trials use IMR’s product, but they target different arrhythmias (abnormal heart rhythms) and regulatory pathways.

The VT study is at an earlier stage, while the AFL study is more advanced and closer to FDA approval.

Avecho (ASX: AVE | MC: $33M) is on track with its Phase 3 clinical trial for insomnia, with 190 of 210 patients recruited. Interim results on track for the first half of 2026. (AVE)

🪑 It was an interesting announcement from AVE. Typically, companies wait until recruitment is finished to provide an update… not at 90%.

I think AVE made this announcement because the market is closely watching the listed options, AVEOA. AVE is trading at $0.009, the options are exercisable at $0.012 and expiring on the 10th of May.

The bet is whether the interim analysis results will come out BEFORE or AFTER the options expire. So timing is everything for those listed options.

Cash Injection

Chimeric Therapeutics (ASX: CHM | MC: $11M) goes into a trading halt for a capital raise. (CHM)

🪑 Disclosure: I own CHM.

Neurizon Therapeutics (ASX: NUZ | MC: $58M) goes into a trading halt for a capital raise. (NUZ)

Radiopharm (ASX: RAD | MC: $92M) establishes a US-based At the Market facility with Leerink Partners for up to US$22.4M. (RAD)

The European Commission has proposed new measures to improve health and the healthcare sector, including a new investment facility to help biotechs access funding. (European Commission)

M&A, Big Pharma Wants a Wife

Bristol Myers Squibb signs a US$1B+ with Chinese firm Harbour for its multi-specific antibody therapy. (Biospace)