Good morning,

Welcome to today’s edition of The Armchair Analyst, a 5-minute daily update on the ASX life-sciences sector.

Short-dated, in-the-money options sit at the very top of the ASX risk spectrum.

The next company on my Biotech 165 Challenge popped up on my radar because of some spicy March-expiry options that were marginally in the money.

But once I looked beyond the leverage game of chicken, I found something more interesting.

Beneath the noise, a tiny ASX company is taking its first real swing at AI-driven drug discovery.

Company #8 of 165 Algorae Pharmaceutical (ASX: 1AI)

But first…

The Pulse Check

Noxopharm (ASX: NOX | MC: $23M) completes the HERACLES Phase I trial of its topical cream for lupus. Strong safety/tolerability. Phase II-enabling studies to start soon. (NOX)

Clinical validation data from Rhythm Biosciences’ (ASX: RHY | MC: $48M) cancer screening blood test for detecting colorectal cancer was published in the Journal of Gastrointestinal Cancer. (RHY)

BCAL Diagnostics (ASX: BDX | MC: $47M) published its 4C report. $5.3 million in cash. (BDX)

The Garvan Institute of Medical Research was awarded a $3 million grant by the Medical Research Future Fund. A portion of those funds will be used to evaluate Syntara’s (ASX: SNT | MC: $53M) treatment in combination with standard-of-care chemotherapy in a Phase 1/2 trial. (SNT)

Imricor Medical Systems (ASX: IMR | MC: $637M) adds VCU Health as the third US site for its MRI-guided cardiac ablation trial. (IMR)

Firebrick Pharma (ASX: FRE | MC: $16M) launches its Throat Spray product in Singapore, complementing its nasal spray product for the common cold. (FRE)

Algorae Pharmaseticals (ASX: 1AI | MC: $30M) establishes a $3 million debt financing facility with ScotPac, a specialist in invoice financing.

🪑 A little bit more on 1AI below, but this facility is clearly in place to support the sales and distribution business, helping to smooth out cash flow between when they purchase drugs from India and sell them to Australia. Think of it like a trade financing facility.

Anthropic has launched its own Claude AI for healthcare after OpenAI launched ChatGPT healthcare last week. (Anthropic)

Novo Nordisk oral Wegovy reaches over 3,000 patients in the first week of launch (Biospace)

Cash Injection

Anteris Technologies (ASX: AVR) plans a $US200 million common stock offering and sells its Medtronic stake for up to US$90 million to fund its transcatheter heart valve trial. (AVR)

M&A, Big Pharma Wants a Wife

OpenAI acquires healthcare startup Torch, focused on unifying fragmented health data, for US$100M. (Digital Healthcare News)

GSK agrees to acquire RAPT Therapeutics for US$2.2B, adding an anti-IgE program for food allergy. (GenEngNews)

Under the Microscope

Let’s talk options.

An option gives the owner a right, but not the obligation, to buy or sell a company’s shares at a fixed price before a certain date.

(thanks year 11 textbook…)

It gets interesting when options are tradeable, they have an underlying value based on:

The current price of the stock

How long till the options expire

Most options are pretty ordinary, long-dated, way out of the money, and more like lottery tickets than investments (if the stock does well, the options do really well).

But sometimes listed options are already in the money, or sitting right on the strike price, and are almost about to expire.

That’s when things get interesting.

(Note: trading short-dated options is at the very top of the ASX small-cap risk spectrum. This is not financial advice, just an educational lesson on how they work and an interesting company used as an example.)

Let’s say a stock trades at 10 cents, and there are options with a strike price at 10 cents.

That option has no intrinsic value yet, but it’s effectively tracking the share price dollar-for-dollar from here.

Now imagine the share price moves from 10c to 11c.

The share is up 10%

The option, which might have been trading at 1c, now has 1c of intrinsic value

That’s a 100% move in the option from a 10% move in the underlying stock.

That difference is the leverage.

Options don’t just move with the share price; when they’re close to or in the money, they magnify the move.

Of course, leverage cuts both ways.

If the share goes nowhere, or worse, goes backwards, time works against you, and the option can go to zero very quickly.

That’s why short-dated options are dangerous…

But also why, in the right setup, they can be incredibly powerful.

Now my friend, a stock trader, often sends me announcements or potential trades he's identified in the biotech sector.

So last week I got this text from him:

“Hey AA, thoughts on Algorae Pharma? Some listed oppies are in the money and are set to expire in March. Any big catalyst in the next few weeks? High-risk, high-reward play.”

I looked into it.

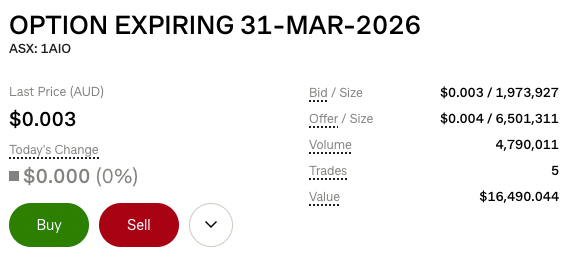

1AI has some options expiring on March 31st with a $0.012 strike price; these are tradeable at 0.003 to 0.004.

BUT the stock is trading at $0.018, so these options are in the money.

Because the options are in the money, any increase in share price increases the underlying value of the option by $0.001.

So if the stock moves to, say, 10% to $0.020, that is a $0.002 increase in the underlying options' value (or a 66% increase from $0.003 to $0.005).

BUT, if the stock falls below that $0.012 price in the next few months… the options expire worthless.

Because it is getting close to crunch time on March 31st, the market is pricing these options $0.002 below their intrinsic value.

Also, as it gets closer to expiry, it is more likely the options will be exercised, so there may be some selling pressure on the ‘heads’ as investors look to cash up to pay for their options.

It’s a big game of chicken and a high-risk, high-reward bet.

I opted not to make the options trade...

(a bit too risky for me)

But what I did find in my research was a company doing some really interesting stuff in probably the hottest space in big pharma right now: AI Drug Discovery.

What’s the story?

Over the last few months, I’ve been reading a LOT about AI in drug discovery.

The space is moving so fast that last week, the FDA and EMA outlined a set of common principles for AI in Drug Development:

(Source: FDA)

So I was really interested to see a company on the ASX playing in this field.

Algorae Pharmaceuticals (ASX: 1AI) is effectively a recapitalised shell by Alignment Capital.

The company was around for 20+ years as ‘Living Cell Technologies’, but never advanced its assets beyond a Phase 1 trial.

The old asset was shelved, and under new management, the company moved in two distinct directions:

AI Drug Discovery: An AI-driven drug discovery platform to identify promising drug combinations in partnership with the CSIRO and UNSW.

Sales & Distribution: License generic drugs from India and sell into the Australian market.

I was most interested in the AI Discovery Platform,

(because this is all I had been reading about in all of the commentary at the JP Morgan Healthcare event).

The theory is simple…

Discovering new drugs is a brute-force numbers game, but if AI can predict what works earlier, it strips out a lot of clinical trial risk.

But in reality, it is much more complex; the human body is not straightforward, and many factors must be considered when balancing drug dosing for safety and efficacy.

Improve potency, and you might ruin stability; fix metabolism, and you might introduce toxicity.

It’s all a great balancing act, and AI has shown to improve things dramatically.

AI-discovered molecules in a Phase 1 trial have achieved an 80-90% success rate, compared to the industry average of ~60%. (Source)

With that backdrop, there is a lot of money being thrown at the problem, with the largest pharma company in the world, Eli Lilly, partnering up with Nvidia to build a $1 billion AI lab:

(Source: Forbes)

Now, how does 1AI fit into all of this…

1AI has built its proprietary AI model in partnership with researchers from UNSW and CSIRO to predict the best drug combinations for clinical use in cancer.

It has access to this giant data centre, which is used for research purposes to run algorithm experiments, and then validate those with the Peter Mac Institute:

The blue sky is that the AI platform gets so good that each new drug combination identified is a new IP that 1AI can license to other drug developers.

Essentially, the “picks and shovels” play to the entire biotech industry.

The main challenge for 1AI is how it will compete with better-funded US start-ups that have this as their sole focus.

This is a key risk for 1AI, and why I think it has diversified its attention to building a profitable sales & distribution business alongside the “blue sky AI bet”.

The sales & distribution business is simple.

Buy generic drugs from India and sell them into hospitals in Australia at a margin.

The sales team right now consists of two former executives of the $5.7 billion-cap EBOS Group (the largest pharmaceutical wholesaler in Australasia).

1AI has already secured three licensing deals with three major generic drug manufacturers in India: Dr. Reddy, Sakar and Cadila Pharma.

So the most important question (for my trader friend, anyway) is:

What catalyst could emerge in the next two months?

Looking at the guided newslflow the most likely known unknown is a fourth licensing deal for the sales & distribution business.

Depending on the quality of the deal could make a material difference to 1AI’s share price.

There may be some progress updates on the AI partnership, and testing Version 2 of the model, but no new data from the first set of experiments…

So for me, the options bet is a bit too high-risk, high-reward.

But what I found underneath it all was a company (with a largely untold story) that was having a crack at something really interesting.

You can read my full investment memo here:

A big thanks to 1AI CEO David Hainsworth for the call yesterday to run through the full story.

See you all tomorrow.

The Armchair Analyst