After 6:00 pm, I like to call it “the graveyard shift” for ASX announcements.

Share issuance notices, director movements, cleansing results from an unwanted asset…

So I was surprised to see yesterday significant material announcement filed at 6:54pm for Immutep.

Last night, Immutep announced a US$370M licensing deal with Dr. Reddy to licence its Lag-3 cancer treatment.

With US$20M in cash paid up-front and “double digit royalties”.

This was IMM’s first commercial licensing deal for the product after developing its cancer asset for over 10 years.

It does have collaboration deals with Merck and a bunch of other Big Pharma companies to co-develop its assets, but no licensing deals yet…

… until last night.

IMM has a bunch of active Phase 2 clinical trials with big partners, and it can sometimes be hard to follow exactly what trial is where, what results matter and what “good” looks like.

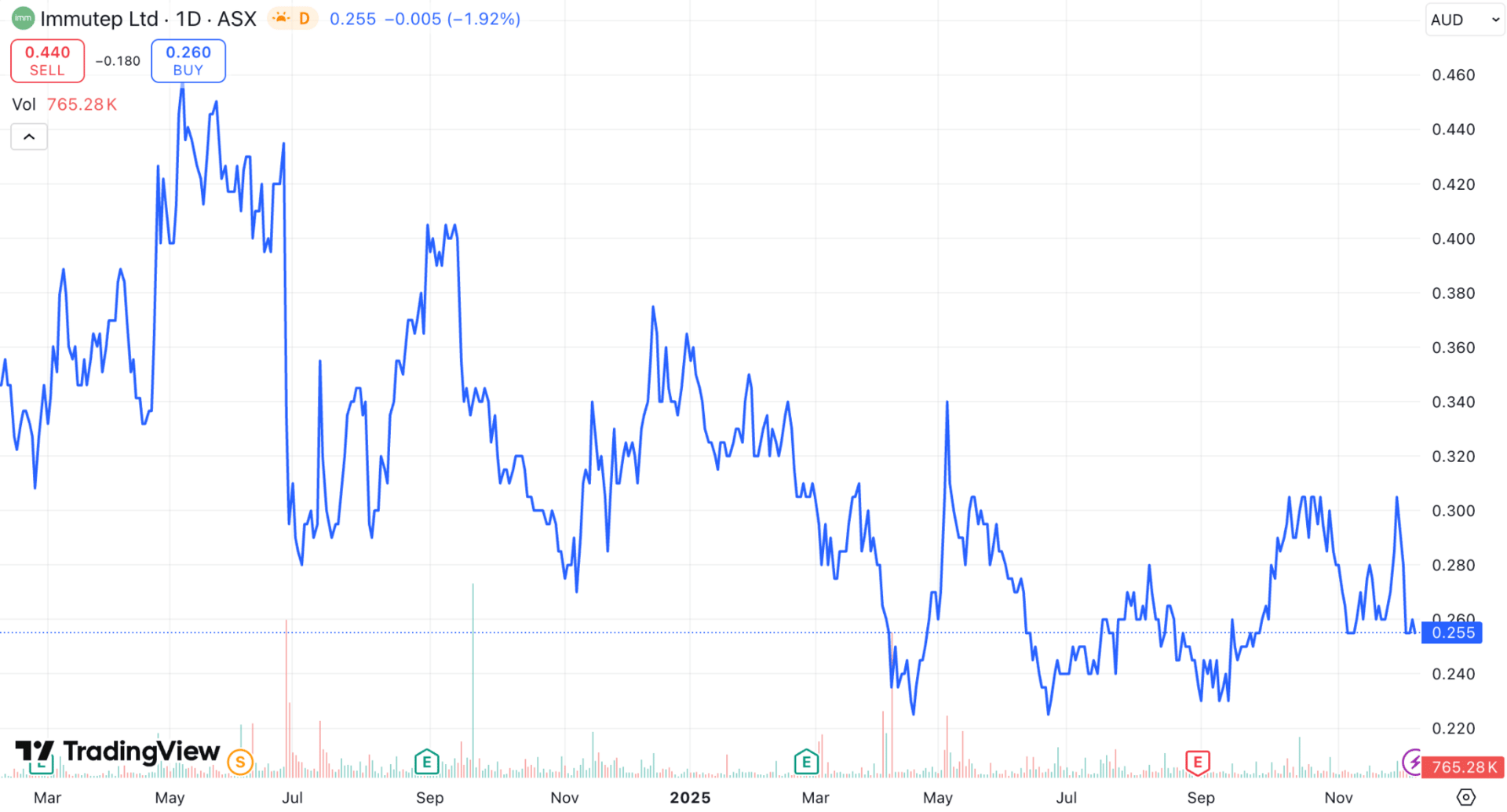

The stock chart looks like a rollercoaster ever since the company raised $100M in June last year.

Every time it wants to break out, the stock is sold into…

The company still has A$109M in cash at the end of last quarter, and this deal adds a further A$30M immediately to the balance sheet.

Right now, IMM has enrolled over 170 patients into its Phase-3 study for Lung Cancer, and the first “futility data” for this trial is scheduled for the first quarter of next year.

(Futility data is essentially answering the question… is it worth continuing the trial based on the results so far)

This deal reminds me quite a lot of the very first deal that Dimerix (ASX:DXB) signed with Advanz Pharma over its asset:

This could be the first domino to fall in a series of multiple deals

The deal was signed just before important interim results

The regions licensed did not include any of the major markets. IMM still has the ability to license North America, Europe and Japan.

Here is how DXB used that first deal, and the results from the interim trial, to close multiple licensing deals in 12 months:

While there is clear upside in this deal, I’m more interested in the competitive pressure that it puts on other Big Pharma companies to also secure rights over a different region.

In particular, IMM’s main research partner MSD (which is Merck’s ex-US brand).

Merck is currently on the hunt for new assets because its golden goose “Keytruda” is set to come off exclusivity patents in 2028 and compete with generics.

Keytruda is a cancer product used in chemotherapy and it accounts for $29 billion in sales revenue for Merck each year.

It is also the technology that IMM is developing in Phase-3 alongside.

Picking Dr. Reddy as a partner was very, very interesting.

It is not one of the household Big Pharma names, but it still has a US$12 billion market cap and is a lead distributor of generic drugs.

Dr. Reddy is currently in the process of developing its own competitor to Keytruda…

So if Merck wants to retain the license to IMM’s drug in other key markets like Europe and the US… it may need to move fast on a licensing deal before it gets pipped at the post.

And just like the Advanz Pharma deal was the domino that started it all for Dimerix, this deal could be the start of a swarm of licensing deals that provides the external validation for IMM’s product.

Because at the end of the day I can only do my best to guess and interpret the science.

It is big licensing deals that make the company “real”.

See you tomorrow.

The Armchair Analyst

Jason Segal

Did someone forward this email to you?

The Daily Check-up

Immutep (ASX:IMM | MC: $375M) signs a US$370M licensing deal with Dr. Reddy (NYSE:RDY | MC: US$12B) for its cancer therapy across all regions excluding North America, Europe, Japan and China. US$20M up front. (IMM)

… at 6:54pm last night.

🪑 See above for my deep dive on the deal, and why I bought shares as a trading position this morning.

BCAL Diagnostics (ASX:BDX | MC: $37M) is set to roll out its DNA blood tests for early detection of pancreatic and ovarian cancer across Australia in January via Sonic Healthcare and ClearNote Health. (BDX)

Regal Funds Management just moved to become a substantial shareholder of Cann Group (ASX:CAN | MC: $7.6M) with 7.96% of the shares on issue. (CAN)

Race Oncology (ASX:RAC | MC: $476M) has closed a private placement for A$3.2M at a 6% premium to the last closed price. (RAC)

Rhythm Biosciences (ASX:RHY | MC: $25M) signs a US marketing partnership with Catch Bio to distribute its genetic cancer risk assessment tests via Catch Bio’s cancer prevention platform. (RHY)

🪑 These co-marketing deals can be a bit of hit or miss. It all depends on whether there are genuine synergies between the two products for these deals to lead to meaningful revenues for the company.

Report: How your personal AI doctor will transform healthcare. (AFR)

🪑 I genuinely think a personal AI doctor is coming MUCH sooner than people think. It’s basically the only way that my wife uses ChatGPT…

If you know a company (even if it’s really early stage) working on an AI for personalised healthcare please respond to this email.

New CAR-T treatments for cancer will need to prove that they're better than existing therapies to win FDA approval says the agency's biologics chief Vinay Prasad (Endpoints News)