Today I want to take a look at Imugene (ASX:IMU | MC: $100M).

From $1.5 billion market darling to $100 million in three years, the company now stands at a crossroads.

One drug, one shot and one big question mark over how the next phase will be funded.

On Monday, the FDA confirmed that data from Imugene’s Phase 1b cancer CAR-T study supports moving towards a Phase 3 registrational study.

There are no two ways about it - this is awesome news for the company and a big de-risking event.

(the share price barely moved though)

Effectively, Imugene now has clarity on its path to commercialisation…

One more registrational Phase 3 study to go.

At an Overall Response Rate of 82% across 17 patients, IF Imugene is able to replicate these results in a larger study it should be enough to get the drug approved.

(based on what the FDA has approved in the past for CAR-Ts).

Yesterday, I watched the full investor webinar from the Imugene team as they talks through the decision and what’s next for the company.

It was hard to ignore the enthusiasm from Dr. Brad Glover’s voice as it is clear that he can now go to the market with a clear commercial pathway.

However, the question of “how this will all get funded” was a lot murkier.

The company’s response: “We will design the study to be as lean as possible… to either go it alone but partnership will be greatly advantageous to us.”

I think that this is the key question over the company right now: Where will the funds come from?

In June, Imungene completed an institutional placement at $22.5M, and only managed to raise $2.42 million of the $15 million in the Share Purchase Plan that was run alongside.

The lack of uptake indicates that existing shareholders are somewhat depleted for funds.

The company had $32M available from the last quarter, with 2.58 quarters of funding remaining. (Source)

It has also effectively put development of its other assets ‘on ice’, and is all-in on its current CAR-T program.

(Source, Imugene 4C September Quarter 2025)

Imugene has everything in place to start up a Phase 3 clinical trial… the data, the pathway, the FDA tick of approval… everything except the money.

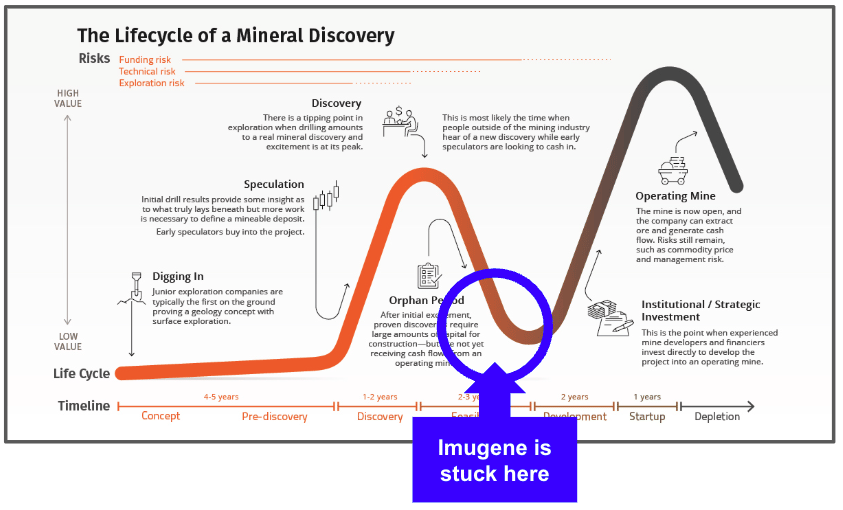

But without funding clarity, Imugene is stuck in the development no-mans-land.

For those of you who follow the mining industry, Imugene’s predicament reminds me a lot of a company at the bottom of the Lassonde Curve.

After making the discovery, building a resource, conducting feasibility studies, everything is in place to build the mine, BUT for project financing.

This is exactly where Imugene is at.

Everything is in place for the Phase 3 trial… but financing.

The development ‘no-man’s-land’ stage is where company share prices can drift the furthest and it creates a destructive cycle where either the company pulls out a rabbit from the hat… or chooses a different path.

There are a few things as well working against Imugene at this time, let’s take a look.

(1) Imugene is facing some macro headwinds: CAR-T’s are out of favour

Over the last few months a few of the Big Pharma companies have pulled their CAR-T therapy programs.

Takeda, Galapagos and Novo Nordisk, just to name a few. (Source)

Also, it looks like the FDA is making it harder to get CAR-T therapies approved - moving from a single-arm trial to a superiority trials over existing treatments. (Source)

So while Imugene has very promising data, the pool of companies that it could partner with is shrinking.

Meaning those companies that are left have much more leverage in partnering negotiations.

(2) Unpalatable self-funding pathway at the current market cap

There is always the option for Imugene to fund the program itself and continue to raise money from the market, and push ahead with the trial.

However, because the company’s market cap is sitting at $100 million the “cost of capital” to raise the funds needed is high.

(as a % of the company’s overall market cap).

We saw how difficult it was for Imugene to raise funds from the last SPP, and if the company is seen as “come raise” then investors tend to hold back their capital before buying shares on the market.

So either way, the market is waiting on funding clarity before tipping back in.

What’s the difficult position Imugene is in?

On one hand, Imugene doesn’t want to tip their hand to the market to indicate that they are “come raise”.

They need the looming prospect of a potential partnership to keep shareholders invested in the story.

On the other hand, Imugene needs to talk about the option of self-funding, so that it has some fallback options (or BATNA - Best Alternative to Negotiated Agreement) when looking to do a partnering deal.

It is not a great place to be… but it’s not all doom and gloom.

The company has the data that it needs to get a deal done, and the FDA green light.

They have streamlined their programs to focus all in on this one asset.

IF the company manages to pull a funding rabbit out of the hat I expect the market will react very favourably.

Particularly given that the size of the prize is big if they get their product to market.

This is what Imugene investors are essentially betting on.

Everyone knows that the data is good, everyone knows that the commercial path is clear, the last (and most important) piece of the puzzle is who is going to pay for it…

See you all tomorrow.

The Armchair Analyst

Jason Segal

Did someone forward this email to you?

The Daily Check-up

Orthocell (ASX:OCC | MC: $275M) records first Hong Kong sales of its nerve repair collagen device Remplar. (OCC)

The TGA provides regulatory clearance for LTR Pharma’s (ASX:LTP | MC: $52M) Phase 2 study on its nasal spray viagra. Patient recruitment starts next quarter. (LTR)

After market yesterday Cosette sent notice to Mayne Pharma (ASX:MYX | MC: $260M) to terminate its takeover deal. Mayne Pharma has rejected the termination notice.

🪑: 🍿

Oncosil (ASX:OSL | MC: $19M) delivers the first commercial UK treatment using OncoSil™ pancreatic cancer brachytherapy device. (OSL)

🪑For context, OSL’s UK operations are targeting 3,600 patients annually and a $138M addressable market.

Immuron (ASX:IMC | MC: $19M) says the Uniformed Services University Phase 2 diarrhoea trial with IMM‑124E and its product Travelan® misses primary endpoint. (IMC)

🪑 I haven’t been following the trial closely enough to form an opinion on these results. Doesn’t look great from the headline, but I’ll take a closer look this week and look to put it “under the microscope”. Let’s see if there is a lesson buried in there somewhere!

4D Medical (ASX:4DX | MC: $1B) secures clinical adoption of its CT:VQ cardiothoracic imaging product at University of Miami. (4DX)

Rhythm Biosciences (ASX:RHY | MC: $38M) partners with NHS England to evaluate its blood-based bowel cancer screening test. (RHY)

Mirum Pharmaceuticals (NASDAQ:MIRM | MC: US$3.36B) acquires Bluejay Therapeutics for up to US$820M adding a Phase 3 liver disease candidate to its portfolio. (Pharmaceutical Technology)

Wave Life Sciences (NASDAQ:WVE | MC: US$3.56B) launches a US$250M capital raise after its stock price tripled on Phase 1 interim data on its obesity drug candidate. (Biospace)

Ozempic, but for pets… yes this is a thing. (New York Times)

🪑 I have a friend who is a vet and I asked exactly how big of an issue is obesity in pets…

His answer: Very.

This week the FDA said it would no longer require toxicity tests on monkeys for monoclonal antibodies in a first step to phase out animal testing. (Financial Times)

🪑 While not ASX listed I think that this news is very good for private Australian company Cortical Labs, who is developing a biological computer made of human brain cells.

Animal testing can be costly, and if the FDA is willing to accept New Approach Methodologies, then it could be quite advantageous to drug development companies.

This topic is discussed this week on the Biospace Podcast: listen here