Good morning,

Welcome to today’s edition of The Armchair Analyst, a 5-minute daily update on the ASX life-sciences sector.

Clinical trials are long, expensive and unforgiving.

BUT a positive result can be company-making for any early-stage drug developer.

The prize is big.

When the data drops, the market stops debating what could happen and starts pricing what just did.

A major re-rate upwards… or a massive value wipe out.

The next company in my Biotech 165 Challenge has two major trial readouts in the next 6 months.

Two shots on goal that are five years in the making…

Company #7 of 165 Cynata Therapeutics (ASX: CYP | MC:$71M)

But first…

The Pulse Check

Tetratherix (ASX: TTX | MC: $165M) finalises its global exclusive distribution deal with Henry Schein, the world’s largest supplier of dental products. Commercial launch with Henry Schein FY27. (TTX)

The first patient has been implanted with Epiminder’s (ASX: EPI | MC: $203M) device in its DETECT study for drug resistant eplipesy. (EPI)

Orthocell (ASX: OCC | MC: $272M) publishes its 4C quarterly report. $3.2M revenue, raises $30M this quarter and holds $49.4M cash. Its flagship nerve repair product, Remplir, is now rolling out in major markets, including the US. (OCC)

Immuron (ASX: IMC | MC: $13.4M) reports unaudited sales for the first half of the financial year for its traveller’s diarrhea product - AUD$4.2M (+5% pcp). Its second product for Irritable Bowel Syndrome was launched in Australia just prior to Christmas. (IMR)

Mesoblast (ASX: MSB | MC: $3.4B) receives feedback from the FDA on its chronic inflammatory back pain clinical trial and potential filing of a Biologics Licence Application. (MSB)

Paragon Care (ASX: PGC | MC: $355M) will transition out as the primary wholesaler to Ramsay Healthcare’s (ASX: RHC | MC: $8.4B) retail and hospital pharmacy business. (PGC)

PolyNovo (ASX: PNV | MC: $832M) posts unaudited 1H26 sales of A$68.2m (+26%) from its wound-care devices, delivers A$9.5m operating cash inflow and finishes new manufacturing facility. (PNV)

Last week, the EMA and FDA released joint guidance outlining 10 principles for the use of AI in drug development. (European Biotechnology)

Could Australia realistically become the first country to treat 1,000 patients with MDMA-assisted psychotherapy in a single year, as early as 2026? (Psychedelic Alpha)

🪑 This article is a great read, particularly for investors of Emyria (ASX: EMD) - like myself.

OpenAI just participated in a seed placement for an early stage Brain Computer Interface company in the US - Merge Labs. (Economic Times)

🪑 A brain-computer interface company to watch on the ASX is Control Bionics (ASX: CBL) - I’ve been tracking this one for a while now and own shares. FDA approval, CMS Code, Product in Market, ~$25M market cap.

Cash Injection

Novo Nordisk Foundation is investing DKK 5.5 billion (€736 million) into the BioInnovation Institute to scale biotech and deep tech innovation across Europe. (European Biotechnology)

Under the Microscope

A biotech clinical trial result is the purest form of a known unknown.

A ~60% chance that a drug will progress from Phase 1 to Phase 2 (safety study).

Once in Phase 2… a ~30% chance that a drug will progress to a Phase 3 (efficacy trial)

Once in Phase 3… a ~50% chance that the drug will become registered with the FDA (final trial).

Total start to finish?

Only 9.6% chance that a drug makes it all the way through.

So, with such a high risk, there needs to be a significant reward for a drug that becomes registered.

The reward is big: a period of exclusivity to sell the drug, millions of dollars a year (sometimes billions) in sales, and a ‘company making’ return to shareholders.

But there are opportunities for investors to make money at each of the gates that de-risk the asset and provide a major ‘re-rating point’.

This is what I like to call the “Clinical Trial Result Catalyst”.

Trial result catalysts are what we live for as investors in early-stage drug development, and they provide major opportunities for a share price re-rate.

Before the trial starts, the company will set some pre-determined ‘endpoints’.

These are benchmarks the company must meet for the trial to be deemed a great success.

In a Phase 1 trial, the most common endpoint is “safety” - was the drug well tolerated with little to no side effects.

Is it safe?

The second endpoint, more common in a Phase 2b or Phase 3 readout, is efficacy.

Does the drug work?

This is where most drugs fall down; there needs to be a certain level of statistical significance proven throughout the trial that the drug works.

Because this information is largely unknown, the share price can move UP OR DOWN based on the results.

Particularly in a ‘double-blind, placebo controled, study’ where neither the patients nor the doctors know what the trial participants are getting.

It’s interesting in the lead-up to a clinical trial how a stock trades, as it balances existing shareholders managing risk and new shareholders speculating on results.

This is how I normally see it play out…

As the result approaches, interest builds, speculation creeps in, and new investors enter the stock hoping to be positioned ahead of a positive outcome.

ALSO, existing holders are less inclined to sell because they want exposure to the result.

With fewer sellers and more buyers, prices rise, sometimes quickly.

The trick with these types of catalyst bets is to identify the companies BEFORE the run-up to a result.

There are 100s of examples of this, but let me just give you one from last year:

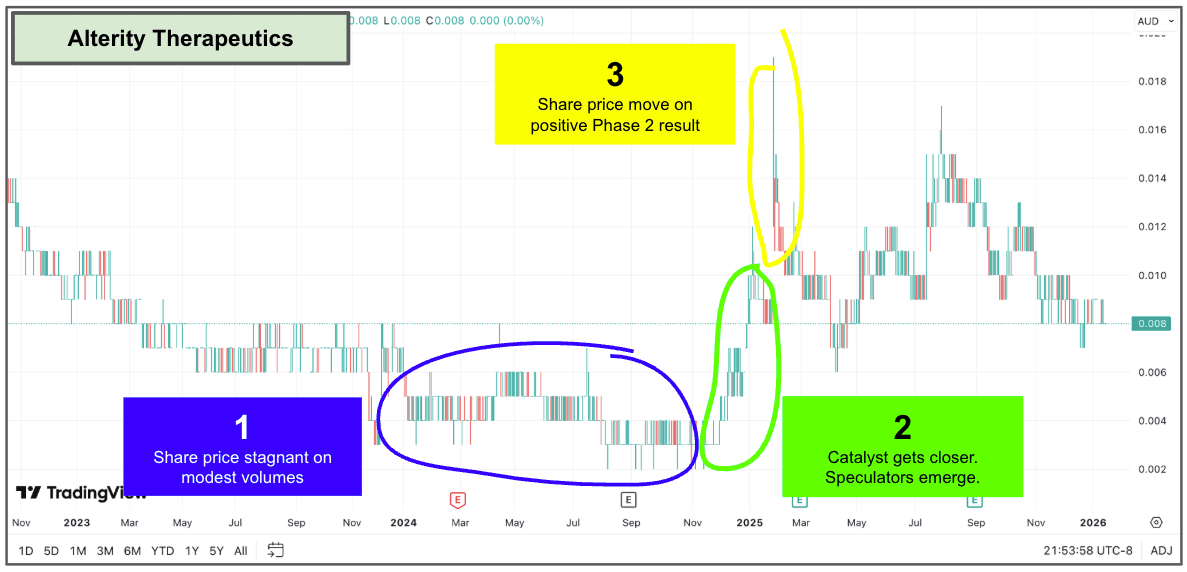

Here is Alterity Therapeutics (ASX: ATH)...

Last year, the company published a positive Phase 2 readout for its Multiple Systems Atrophy treatment.

While the stock price had meandered over the 12 months leading up to the trial result, there was massive volume and investor interest right before the results were announced.

On the day of the results, the share price spiked significantly, and the company raised $40 million on the back of the results to continue developing the asset into the next stage.

A textbook run into positive results.

And a proper re-rate of the company:

It doesn’t always play out like this, and in a risk-off environment, speculators may not show up.

ALSO, if a result goes badly, then it is not uncommon for companies to drop 50-80% on the results of a bad trial.

(Opthea is a good example from last year)

It is a very high-risk, high-reward style bet.

So, how do I like to play these catalysts?

This is a strategy that I learned working at my old firm…

Identify a catalyst early.

Invest when interest is low.

Top slice the investment in the lead up to the results, as speculators enter.

And hold a decent portion of the results.

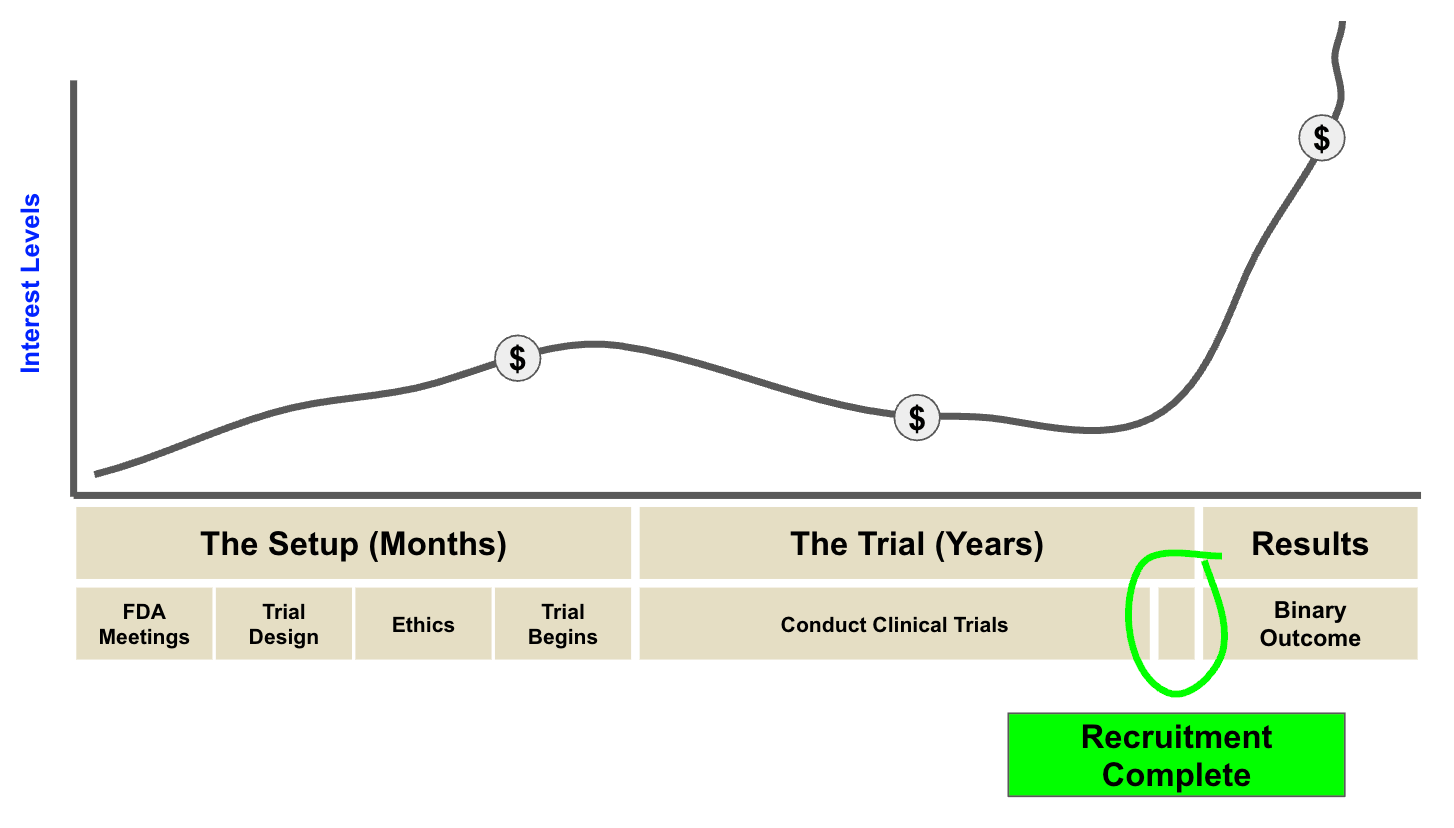

The starting mark for investor interest is generally a “recruitment complete” update by the company.

This is because once recruitment is complete, there is a clear timeframe on when investors can expect results - no more delays.

(Source, Next Investors)

It is also not uncommon for companies to do a small capital raise just before results to shore up their balance sheet…

And then a MUCH larger one if results are positive, to take the company to the next level.

These trials are years in the making, and the most exciting time for investors in early-stage drug development companies.

They don’t come around that often, and thousands of hours of work and millions of dollars of capital go into making these trials happen.

It is rare enough for a microcap biotech to have ONE clinical trial readout coming up…

The company I’m profiling today has two bites of the cherry.

Stock #7 of 165 is Cynata Therapeutics (ASX: CYP)

Disclosure: I’ve been waiting for a pullback in the share price for a while. When the stock dropped to 30 cents last Friday, I bought some shares.

What’s the story?

CYP is developing a scalable stem cell therapy for a range of autoimmune diseases.

Stem cells are like the wild card in a game of Uno… they can become anything.

This property makes them highly valuable for research and as a therapeutic agent.

The challenge with stem cells is that, to obtain them, you need a human embryo (which raises many ethical and legal concerns), a human placenta (which is only available when someone is giving birth), or adult bone marrow.

Stem cells from adult bone marrow are typically obtained from a single donor per treatment.

So not scalable.

CYP has patented technology to address this, enabling the generation of multiple stem cell lines from a single adult donor.

To test its technology, CYP has two clinical trial readouts expected in the next 6 months…

Osteoarthritis Phase 3 (Australia only) and Acute GvHD Phase 2.

If just one of these comes out, it should be a re-rating event for CYP… if both come out, it is game-changing for the company.

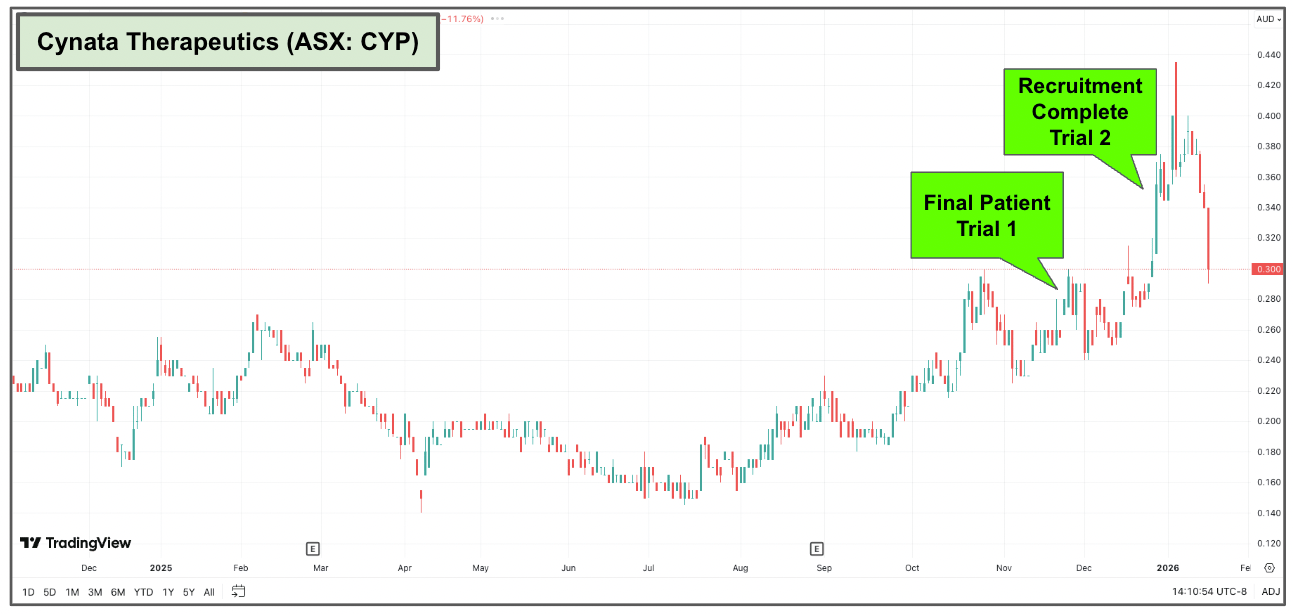

Now, CYP’s share price has already gone on a bit of a run since it announced that it had completed recruitment for both trials late last year.

(The speculators have entered)

I waited for a pullback in the share price so that I too could speculate on the outcome of this trial (and the potential of more investor interest as we get closer to the readout date):

What does success look like for CYP?

The precedent for stem cell companies on the ASX is the $3.4 billion capped Mesoblast.

Mesoblast has a stem cell product on the market right now for a very small subset of Acute GvHD (pediatric patients who are steroid-resistant), and it generated US$35 million in sales last quarter.

The difference between the two companies is that Mesoblast has a product on the market and a successful Phase 3 trial, whereas CYP’s therapy has yet to deliver comparable clinical data.

There is still a significant risk that CYP needs to address in the clinic.

It’s also worth noting that 5 years ago, there was a takeover offer for CYP at US$200M at $2.00 per share.

But due to public scrutiny over the deal, and a conflict of interest between the buyer and CYP’s major shareholder, FujiFilm, the deal fell through.

Five years later, the CYP is much more advanced in the clinic, with two key readouts in the next six months.

When results are finally released, the market reacts instantly.

Meeting endpoints triggers a sharp rerating, or missing them wipes out years of value overnight.

Clinical trials are long, expensive and unforgiving, BUT a positive result can be company-making.

And if CYP can deliver not only one result but two, it should be a material step change in the company’s profile.

If it goes wrong, it goes very wrong.

The “bet” from here is all about managing risk and recognising how investor psychology behaves around catalysts.

At least I can say it’s not boring!

A reminder that nothing in this newsletter is financial advice, all of the opinions are my own, and these are high-risk, high-reward investments.

A big thank you to CYP’s CEO, Kilian Kelly, for the coffee and for walking me through the CYP story.

See you all tomorrow.

The Armchair Analyst