Good morning,

Welcome to today’s edition of The Armchair Analyst, a 5-minute daily update on the ASX life-sciences sector.

Today, I’ll take a look at how a missed options exercise torched $2M in value for 4DX options holders.

But first…

The Pulse Check

A quiet day on the markets today, with the Australia Day long weekend.

So, here is a bunch of macro news I found interesting this morning…

The US is set to exit the World Health Organisation this week. (Reuters)

Amazon is the latest tech company to introduce an AI-powered health assistant to provide guidance based on medical records. (Pharma Forum)

J&J is set to reach US$100 billion in sales in 2026. (Pharma Forum)

The FDA released draft guidance on accelerated approval for multiple myeloma. (First World Pharma)

Report: Pharma bets big on AI platforms with a flurry of new year deals. (Gene Eng News)

The Report Card

Quarterly Activities Reports:

Arovella Therapeutics (ASX: ALA) | Cash $19.4M (ALA)

Cambium Bio (ASX: CMB) | Cash: $770K (+$2.4M from recent raise) (CMB)

Nyrada (ASX: NYR) | Cash: $7.12M (NYR)

PYC Therapuetics (ASX: PYC) | Cash: $120M (PYC)

Rhythm Biosciences (ASX: RHY) | Cash: $1.6M (RHY)

Vision Flex Group (ASX: VFX) | Cash: $1M (VFX), Receipts of $1M (+22% pcp)

Cash Injection

Anteris Technologies (ASX: AVR) closes USD230M public offering. (AVR)

Medical AI startup OpenEvidence raises US$250M at a US$12B valuation(Reuters)

M&A, Big Pharma Wants a Wife

Microsoft and Bristol Myers Squibb have signed a new pact on an AI-based lung cancer imaging product. (Fierce Biotech)

Bristol Myers Squibb will license a novel T-Cell engager (tumour-activated drugs) from Janux Therapeutics. US$50M upfront, US$850M in milestones. (Fierce Pharma)

Under the Microscope

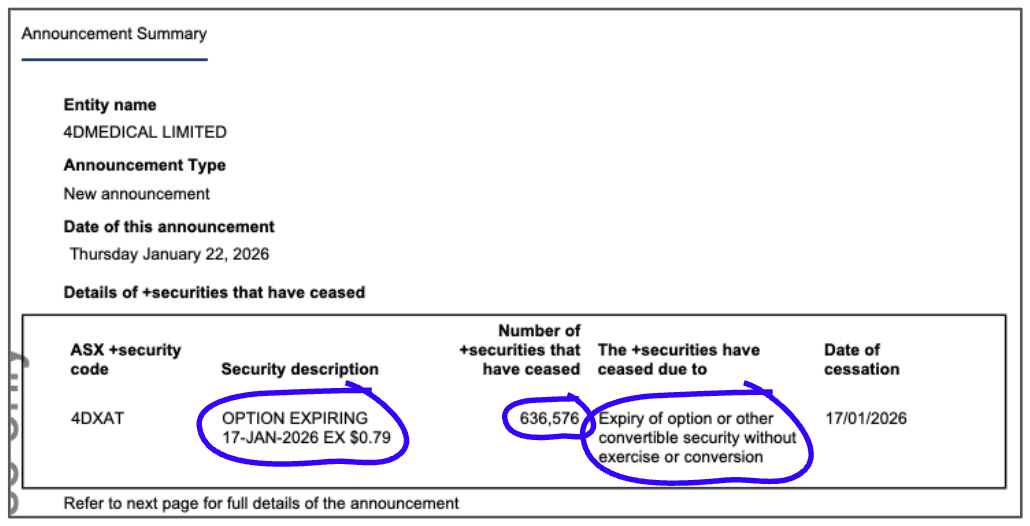

Yesterday, I noticed an announcement from 4DX that most people would’ve scrolled straight past…

Expiry of unlisted options.

Buried was this little nugget: 630,000 options exercisable at $0.79 expired worthless.

… while the stock closed yesterday at $4.13.

That’s roughly $2m of value set on fire.

This is one of those “nothing to do with markets, everything to do with admin” moments.

Next time, call your broker and ask a simple question:

“Do I have any options sitting there?”

And for brokers…

This is the ‘blocking and tackling’ of client service.

One phone call, one reminder, and you instantly become a hero.

As my dad always says (and he was a broker for 30 years), broking is a service industry first, a stock-picking industry second.

Have a great long weekend!

See you all next week

The Armchair Analyst

PS. Next week is the quarterly season, and I’ll do my best to get through them all!