Good morning,

Welcome to today’s edition of The Armchair Analyst, a 5-minute daily update on the ASX life-sciences sector.

Three main topics are emerging from the JPM Healthcare conference this week.

FIRST, the IPO window is open for US biotech companies, capital is available, and companies are ready.

SECOND, the patent cliff is real, Big Pharma is on a spending spree, and it won’t slow down any time soon.

THIRD, China is emerging as a real opportunity. The Chinese government is aggressively investing in biotech startups, and Big Pharma is paying attention.

The sixth company in my Biotech 165 Challenge is a tiny stock that identified the Chinese opportunity early, and it is now in the middle of one of the year's biggest biotech macro themes.

Company #6 of 165 AdAlta (ASX: 1AD | MC: $11.7M)

But first…

The Daily Pulse Check

Little Green Pharma (ASX: LGP | MC: $42M) and Cannatrek have agreed to merge, creating a $112 million revenue behemoth. (LPG)

🪑This is probably the biggest news in the Australian cannabis industry in the last 3 years. It happened yesterday, and I saw it just after I had pressed send!

Early quarterly results from Alcidion (ASX: ALC | MC: $188M). (ALC)

$15.4 million in total contract value sales for the quarter

FY26 revenues of $43.1M (up 40% on the prior corresponding period, and more than the entire FY25)

AND, this doesn’t include the potential revenue from the big (at least $35M) deal with the University of Sussex - which is still being finalised.

🪑 This was a genuinely transformational quarter for the company.

I bet that the ACL board couldn’t wait to get this quarterly out when they saw the numbers come through.

Yesterday, Neuren’s (ASX: NEU | MC: $2.5B) distribution partner Acadia presented sales for DAYBUE at JP Morgan Healthcare. Guidance of $385m to $400m for CY2025. Net sales to reach US$700m in 2028. (NEU)

Vitrafy Life Sciences (ASX: VFY | MC: $75M) enters exclusive 12‑month strategic partnership with IMV Technologies to integrate animal reproduction freezing technology. A$480k service fees plus A$450k milestones. (VFY)

4D Medical (ASX: 4DX | MC: $2.23B) completes $150 million institutional placement. (4DX)

🪑I covered this capital raise yesterday in detail: The Art of the Capital Raise

Clarity Pharmaceuticals (ASX: CU6 | MC: $1.32B) reports that its Phase II SECuRE trial for metastatic prostate cancer continues unchanged after a safety review committee. (CU6)

Data from Neurotech International’s (ASX: NTI | MC: $19M) Phase I/II open-label study on PANS was published in a peer-reviewed journal, Neurotherapeutics. (NTI)

ReNerve (ASX: RNV | MC: $14.5M) secures market approval in Malaysia for its nerve repair device. (RNV)

Atomo Diagnostics (ASX: AT1 | MC: $33M) secures a $502,000 purchase order for HIV Self-Test kits in Africa, funded by the Global Fund. (AT1)

AbbVie Commits US$100 billion in R&D and manufacturing in the US, winning tariff and pricing exemptions. (BioSpace)

Jazz Pharma sells its priority review voucher for US$200 million, the highest price for a PRV in over ten years. (Endpoints)

🪑PRVs are like a ‘thank you’ for developing drugs for tropical and deadly diseases.

This sale increases the upside potential for a company like Island Pharmaseuticals (ASX: ILA | MC: $122M), which is pursuing two PRVs.

Cash Injection

Recce Pharmaseuticals (ASX: RCE | MC: $199M) received A$5.34M in an R&D tax rebate. (RCE)

ECS Botanics (ASX: ECS | MC: $11M) launches a loyalty option offering (1 option for every 6 shares held). Options exercisable at $0.011 with 30 month expiry. ECS is trading at $0.007. (ECS)

Osteopore (ASX: OSX | MC: $2M) drew down a further $250,000 from its $20M convertible note facility. $4.5M drawn to date. (OSX)

Something different…

If you want some long-form coverage of the biotech sector, I was on an episode of Kneppy Invests. My takes on six key companies: NYR, CYP, ILA, AYA, 4DX and CBL.

I am a big fan of Kneppy’s show; he’s been running for 5 years and has over 2,100 episodes, where he talks about stocks every day.

(good effort!)

It was my first time in front of a camera, so go easy on me…

Enjoy the email? Forward this on to a friend.

Under the Microscope

Big Pharma has a problem.

Between now and 2030, more than US$200 billion of annual drug sales will fall off the patent cliff.

Blockbuster expires. Generics arrive. Margins compress.

So Big Pharma is now looking East…

For years, China was viewed as uninvestable for Western pharma due to IP risks, regulatory opacity, and the “cheap science” stigma.

But that view is changing fast.

In 2021, the Chinese government identified biotech as a “national priority” as part of its 14th Five-Year Plan and core industries policies.

This meant aggressive investment and resources from the Chinese government into biotech startups, clinical infrastructure and accelerated regulatory processes.

This focus and deep investment are now starting to pay off.

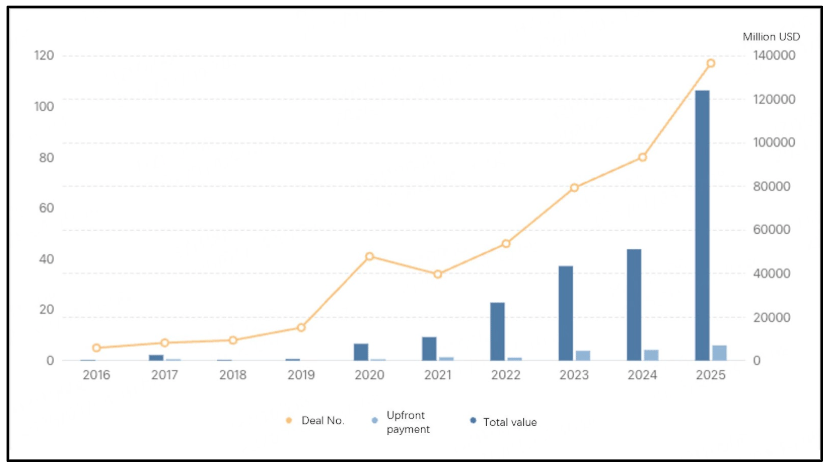

Over the last 12 months, there have been almost US$136 billion in licensing deals or acquisitions between big pharma companies and Chinese drug makers:

(Source, South China Morning Post)

This is nearly as much as the last three years combined:

Big Pharma is starting to realise that China can get to clinical data quickly and efficiently.

At JP Morgan Healthcare, investment managers told a room full of biotech founders exactly what they're funding in 2026: companies that are looking East for efficiency and opportunity.

Clinical trials there cost half as much and move twice as fast.

So while human clinical data in China won’t ever be a substitute for US data to get a drug approved by the FDA…

It can be an incubator for new and emerging science that can enter the human body quickly.

There is one ASX-listed company that noticed this trend, and it is the topic of my story today.

The stock AdAlta (ASX:1AD).

So, what’s the story?

For years, 1AD has been developing a drug for fibrotic diseases like Idopathic Pulmonary Fibrosis (IPF).

(Since before its IPO in 2016)

IPF is a lung disease where the lungs become stiff and scarred, making it hard to breathe.

The prize was big.

Last year, Eli Lilly signed a US$687 million licensing deal for an IPF drug with Mediar Therapeutics, and several other transactions in the space showed that 1AD had the right target.

The problem was that 1AD could never crack the code for an efficient delivery method to patients.

So while 1AD did manage multiple Phase 1 studies for the fibrosis drug, a lot of capital was spent in the labs just trying to get the manufacturing and delivery mechanism right.

1AD had to pivot… and it all started with an idea.

Any asset that 1AD could find in the US or Europe would likely have been picked over by Big Pharma…

But the one area where they weren’t paying attention to was China.

This is where 1AD thought that they could build an edge and find better assets for a better price.

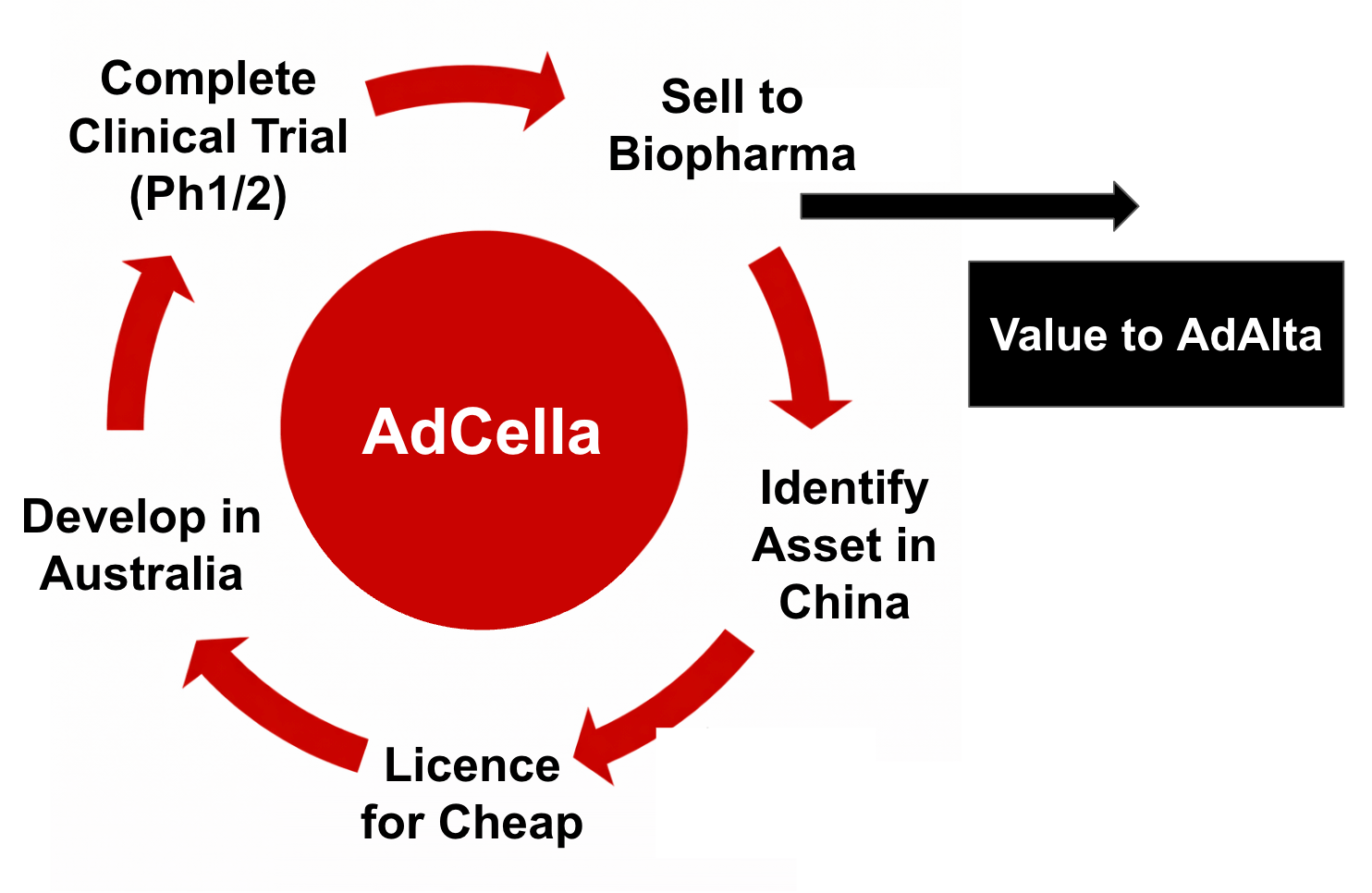

Two years ago, it signed a non-binding MoU with SYNthesis BioVentures to create a new vehicle, AdCella.

SYNthesis BioVentures is led by Andrew Wilks, and a couple of weeks ago, the AFR announced that the fund had raised $60 million (including $7.5 million from the Victorian Government).

(Source)

So after setting up the vehicle, 1AD went to work identifying partners and potential assets to license.

For years, the view was that Chinese mid-tier biotechs couldn’t crack Big Pharma.

Eastern science carried a stigma, and FDA recognition of China-run trials was a real hurdle.

But since the Chinese government's strategic investment in 2021, a lot has changed.

The science is stronger, the clinical trials are more robust, and China is now “investable” for Western companies.

By JP Morgan 2025, the “Rising Sun” theme was impossible to ignore, and it didn’t fade after the conference.

Here were all of the out-licensing deals that happened in 2025:

The strategy for 1AD is simple.

Find a Chinese partner, develop the asset in Australia and sell it on to Big Pharma once it has more robust data on a more familiar patient population:

… well, at least the concept is simple; the execution is a lot harder than that.

Asset selection is a key risk point, and the first asset has been selected: a Phase 1-ready CAR-T cell therapy.

But I did wonder, would Big Pharma’s growing interest crowd out players like 1AD?

I put that directly to CEO Tim Oldham, and he explained…

The pond is big, but the size of the fish Big Pharma is willing to look at right now is limited.

The Chinese partner needs to be amongst a handful of players that already have late-stage, de-risked assets.

Earlier-stage science from mid-tier Chinese biotechs?

That’s still fair game.

I think 1AD deserves credit for moving early on the East-to-West thematic.

But from here it all comes down to asset selection, capital discipline and execution.

1AD is not just a bet on its asset right now…

But a bet on the overall East-to-West strategy and 1AD’s ability to pull it off.

A big thank you to Tim Oldman for the coffee this week and for taking me through the full story.

See you all tomorrow,

The Armchair Analyst