Few things test investor patience more than ‘good’ news… and a red share price.

An all-too-familiar feeling in small-cap land.

Just like most things, a company’s share price is a function of supply and demand…

So whether a stock goes up or down depends on whether there are more buyers or sellers.

(maths right)

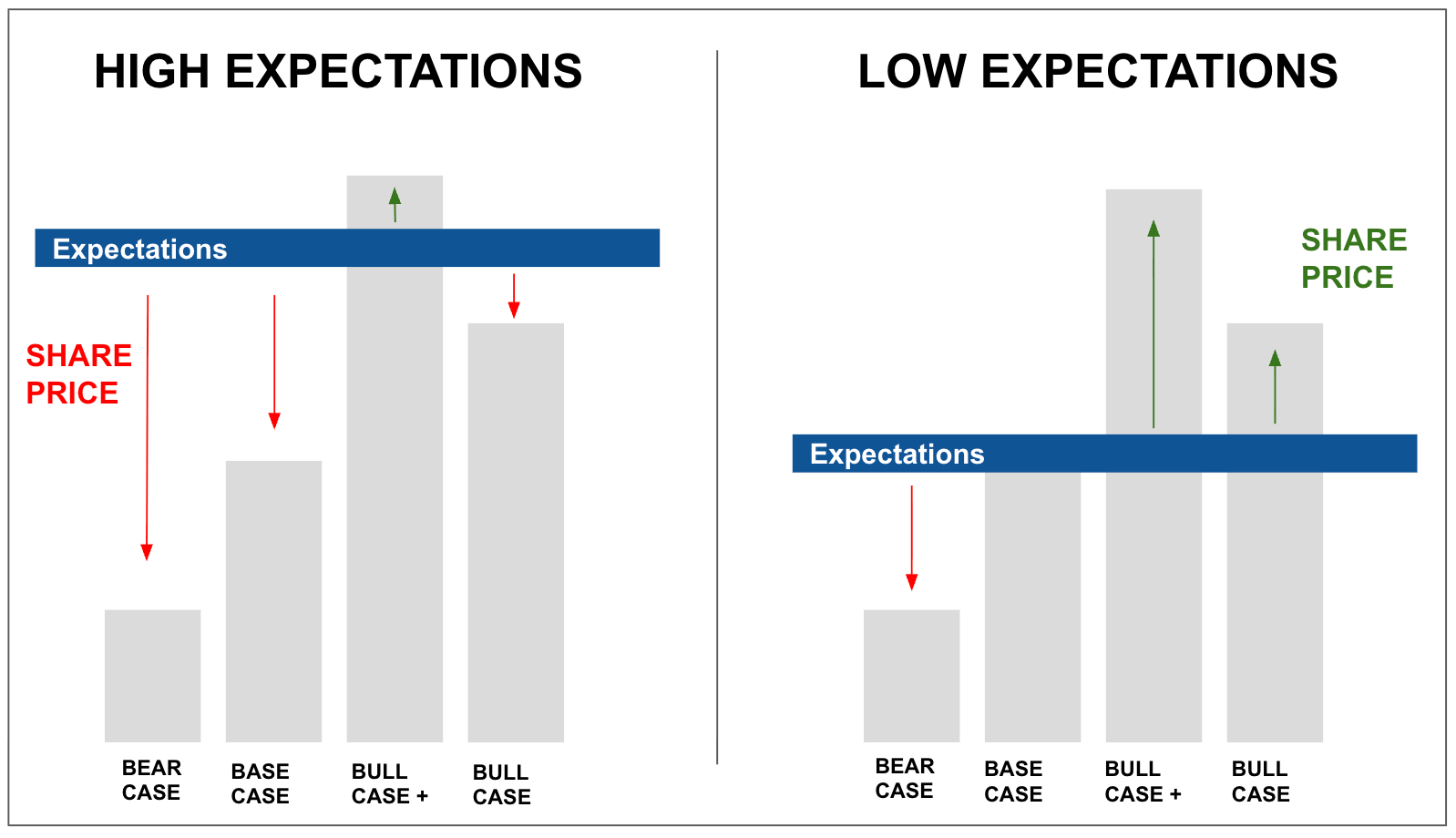

When an announcement triggers a supply or demand response, it is all about the market’s expectations before the announcement and after the announcement.

The higher the expectations, the better the announcement needs to be to keep up the share price.

So when the best-performing stock of 2025, Nyrada (ASX: NYR), announced that it had secured ethics approval for its Phase 2a trial, the stock went… down?

(Source)

So, what’s the story?

First, a little explainer about what NYR does.

NYR is developing a drug to treat reperfusion injuries that occur after a stroke or heart attack.

Reperfusion is the sudden increase in blood flow that follows a heart attack, which can overload oxygen-starved cells in the body.

Kind of like turning the power on after a blackout, only to blow the fuse.

NYR’s drug blocks a recently discovered family of calcium ion channels called TRPC (specifically TRPC 3, 6, and 7), preventing cells from overloading with calcium and from undergoing cell death.

That’s the science, but what about the company?

For those taking a longer-term view on NYR, it’s a “back the jockey” type of bet.

NYR’s CEO, James Bonnar, was formerly head of clinical development at Neuren, and NYR’s director, Christopher Cox, helped shepherd the $10 billion Metsera deal in October last year.

(Yes, that Metsera deal that was announced in October, where Pfizer outbid Novo Nordisk for a $10 billion weight-loss drug).

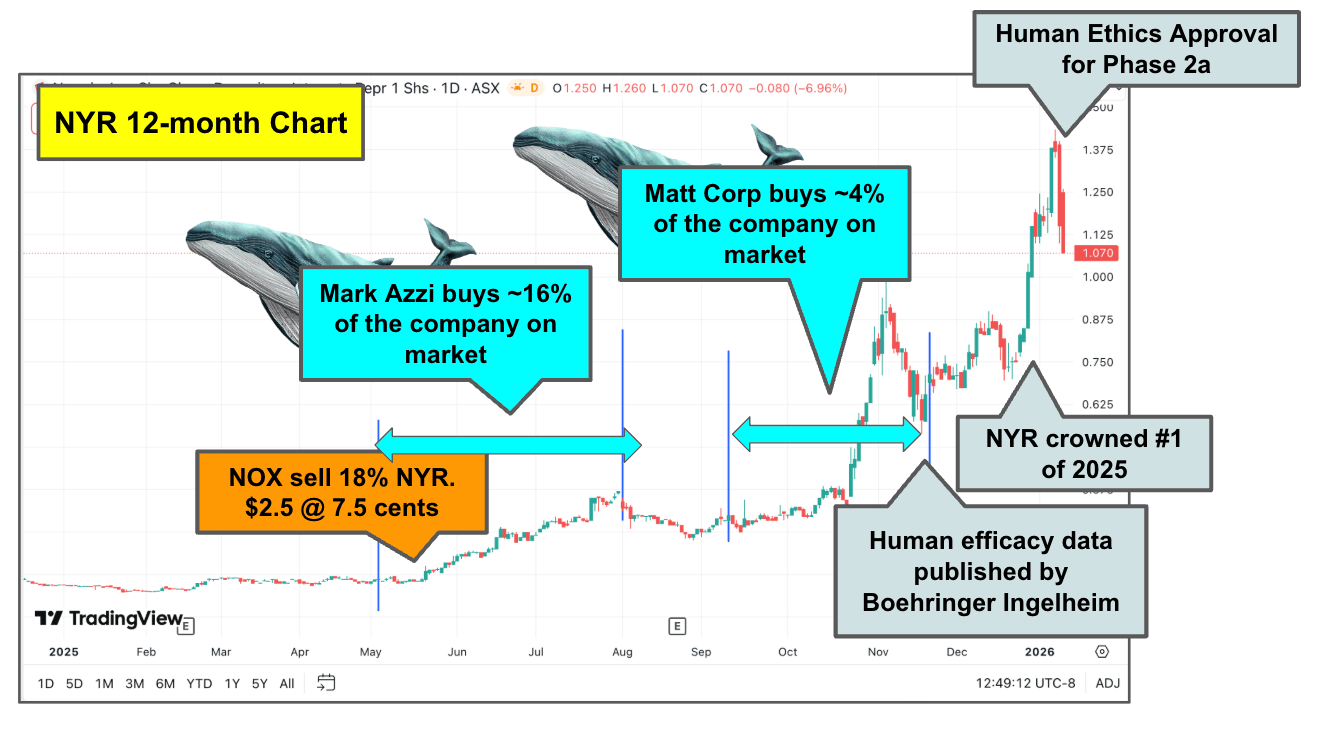

So there are some heavy hitters in management, and the company has been on a monumental run over the last 12 months.

Following the exit of a major shareholder in June last year and the entry of a new “whale” (Mark Azzi), NYR’s share price has moved from ~10 cents to 80 cents.

(I wrote about this last week; you can read the full article here: Selling Too Early: The Trade That Made Nyrada’s Run Possible.)

Then, with a completed Phase 1 clinical trial under its belt, the stock continued to kick on.

In November, another company, Boehringer Ingelheim, published human efficacy data on a TRPC ion channel inhibitor, specifically TRPC-6.

Up until now, there has been very limited human efficacy data on this novel mechanism of action, and this was the first sign of its potential.

This triggered a rally up to $1, and crowned Nyrada as the #1 healthcare stock of 2025.

With this extra attention to the story, and in the first week of 2025, the hot money came in and started trading on the momentum all the way up to $1.435.

All the way up until NYR announced ethics approval on the 8th of January… from then the stock has come off by 25%.

There are essentially seven different reasons why stocks might go down on good news.

Buy the rumour, sell the news

The market was expecting great, but the results were good

Results were good, but delayed

The news is good, but no new information

Reality kicks in

Cheaper shares are floating around

Market sentiment is poor

Because this news wasn’t a “result” but rather a “milestone”, the two main reasons for the share price drop were #5 Reality kicks in and #6 Cheaper shares are floating around.

FIRST, Reality kicks in.

In the Phase 2a announcement, the company said it would be recruiting in March in a 200-patient clinical trial.

While the company has $8 million in the bank and $4.6 million in in-the-money options, this is only just enough to get it to the end of the Phase 2a trial.

It is likely that before that time, the company will do a larger capital raise to support its balance sheet.

Also, the time to the next data catalyst is at least ~12-24 months, which may be too long for some short-term traders.

SECOND, Cheap shares are floating around.

The Nyrada share price has been pushed up by a very tight register and a solid story.

Again, 16-bagger in 12 months and a 75-bagger in 24 months.

While the company has real promise, it is still early in its journey, and there is limited human efficacy data.

So investors likely saw this as an opportunity to take some profits off the table.

The big question is, how does the stock trade now?

Who knows.

But I think the next capital raise will be very important.

If NYR can leverage its large market cap to strengthen its balance sheet and attract more institutional investors, it could position the company for the years ahead.

For what it’s worth, I understand the blue-sky potential that captivates NYR investors.

It has a powerful register, with very supportive shareholders and a heavy-hitter board to boot.

But for me, it is wait-and-see to see how they navigate the next few months with the weight of higher expectations on their shoulders and the mantle of being the #1 performing healthcare company of 2025.

A big thank you to NYR’s head of investor relations, Dimitri Burshtien, for taking me through the full story yesterday.

See you all tomorrow

The Armchair Analyst

The Daily Pulse Check

Tetratherix (ASX: TTX | MC: $165M) reports zero adverse events in Cohort 2 of its 9-patient tissue-healing surgical scar-prevention trial. (TTX)

🪑 This is just one of multiple indications that TTX is going after with its injectable polymer platform technology.

LTR Pharma (ASX: LTP | MC: $116M) begins Australian recruitment for Phase II nasal spray erectile dysfunction medication. Results scheduled for Q2 this year. (LTP)

NeuroScientific Biopharmaceuticals (ASX: NSB | MC: $38M) reports a Clinical Response in 3 of 4 patients using its stem cell treatment for Crohn's disease. The fourth patient achieved a partial response. (NSB)

Singular Health (ASX: SHG | MC: $81M) secured FDA 510(k) clearance for its 3D medical imaging viewer, expanding into X-ray and ultrasound in addition to CT, MRI and PET. (SGH)

Enlitic (ASX: ENL | MC: $15M) completes technical validation of its Ensight medical imaging data standardisation platform on Oracle Cloud Infrastructure. (ENL)

Cash Injection

4D Medical (ASX: 4DX | MC: $2.29B) moves into a trading halt for a capital raise.

AdAlta (ASX: 1AD | MC: $13.7M) completes a $1.2 million raise at $0.005 with 62 Capital. (1AD)

Andreessen Horowitz has just raised over US$15 billion for its next fund, with US$700 million allocated to Biotech and Healthcare. (a16z)

M&A, Big Pharma Wants a Wife

Teva Pharmaceuticals and Royalty Pharma enter US$500M funding agreement to accelerate development of vitiligo treatments. (Teva)

Merck and AbbVie are reportedly in talks to acquire Revolution Medicines for US$28 - US$32 billion amid competing buyout rumours. (BioSpace)