If I told you that the former CEO of Zip Pay was on the board and that the founder of Xero was the third-largest shareholder, what would you think the company would look like?

Fintech? The next AI start-up?

Well, it’s not a SaaS company.

It isn’t even a medical software company.

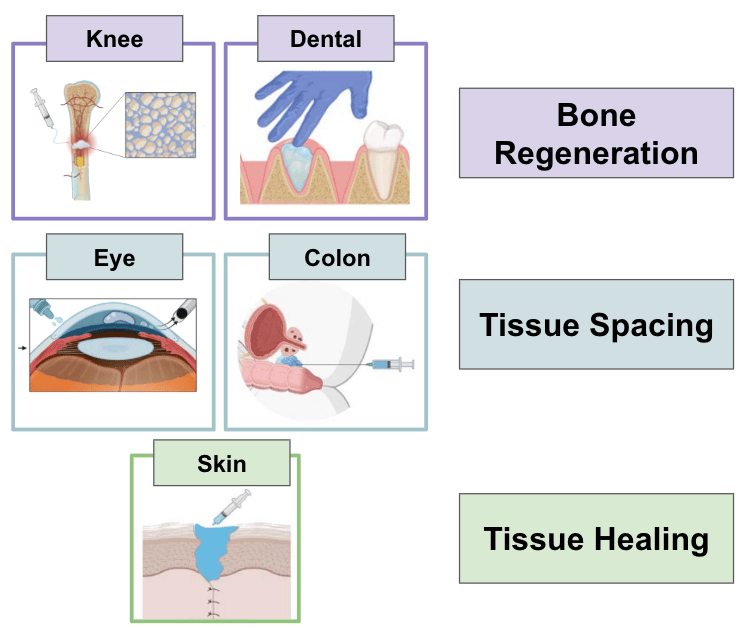

Rather, TTX is a medical platform-first technology: an injectable polymer with a range of applications in grafting inside the body.

All biotechs have an element of being a platform technology…

Drugs can show promise across different applications, indications, and targets.

The problem is that it costs a lot of money and time to navigate the regulatory pathway for an individual application… let alone multiple at once.

Early-stage biotech companies have only so much capital to deploy, so they generally pick ONE lane.

(Also, it makes for an easier story to understand.)

In theory, a platform technology sounds attractive, “sky is the limit,” right? But in practice, it is much harder to execute.

What TTX has done has flipped the entire idea of a platform technology on its head.

Rather than a platform technology pursuing one indication at a time, TTX has built its entire business strategy around being a platform.

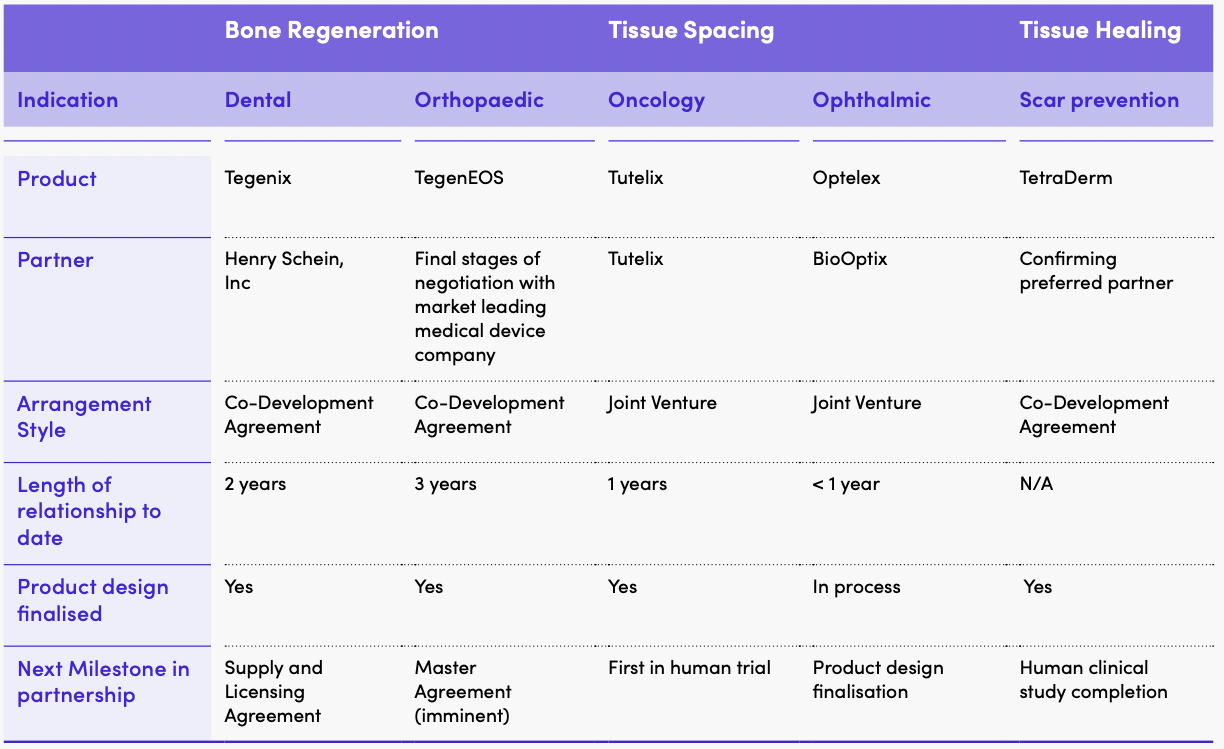

For each new application of TTX’s technology, it will “farm out” the development AND commercialisation to a joint venture partner:

This means that TTX will live and die by its ability to choose the right partnerships to advance its product.

Because it is a medical product, each new indication must undergo a rigorous approval process before it can be sold.

Doing this for one indication is hard enough; doing this for five all at once?

Impossible without partnerships.

(or a bottomless pit of capital, and who has that)...

Essential to the success of this business model is to find the RIGHT partner, one with true strategic alignment.

It needs to be a joint venture, NOT a value-add.

TTX’s most advanced application is for dental bone regeneration; it has a partnership with Henry Schein, a top distributor of dental products in the US.

FDA clearance is scheduled for the first half of this year.

Looking at TTX closely, I wrote up a framework for evaluating whether a company is a strong platform technology:

Does the underlying technology have multiple applications?

Can manufacturing be scaled?

Is the business platform first, or is the indication first?

Is there a capital-light way for the company to navigate multiple regulatory pathways simultaneously?

How aligned are the partners? Does it look like a value add, or is it a true joint venture?

There is a big reason most biotechs go after just one indication and use the idea of “platform technology” to get investors excited, without actually baking it into the strategy.

Focus, money and attention.

BUT, if it works… the platform technology is a compelling business model.

It all comes down to the three most important words: execution, execution, execution.

A big thank you to TTX’s CEO Will for taking the time to meet with me over the Christmas break.

See you all tomorrow.

The Armchair analyst

The Daily Pulse Check

Island Pharmaceuticals (ASX: ILA | MC: $123M) secures a US Patent for its antiviral drug Galidesivir for treating filoviridae viruses (including its main indication, Marburg disease). (ILA)

4D Medical (ASX:4DX | MC: $2.45B) secures its fourth US academic medical centre for the commercial adoption of its CT: VQ CT lung imaging product. (4DX)

The Chinese regulator has approved a $4 million investment into CurveBeam AI's (ASX: CVB | MC: $35M) by its Chinese commercialisation partner. (CVB)

🪑 It’s not every day you see an investment made at a 4x premium. But this investment is being done at $0.405, while CVB closed yesterday at $0.075.

The investment was part of a broader 10-year exclusive commercialisation deal between CVB and this Chinese partner last year.

Maybe that’s why they paid overs…

Novo Nordisk launches oral Wegovy in the US. A new era of obesity treatment has begun.

M&A, Big Pharma Wants a Wife

Amgen has announced it will acquire Dark Blue Therapeutics for up to $840 million, strengthening its early-stage oncology pipeline.

🪑And so begins… 2026 is set to be one of the biggest M&A years for the biotech sector.