Good morning,

Back to normal programing this week…

Quarterly season is over, and most people are back at the desk.

Today, I want to examine how the fates of the mining and biotech sectors are inherently linked.

… and could the pullback in minerals be the start of a biotech run for 2026?

But first…

The Pulse Check

Imagion Biosystems (ASX: IBX) has submitted an IND application to the FDA for its breast cancer Imaging Agent. Phase 2 is expected to start this quarter. (IBX)

🪑I’m looking forward to this trial.

There are some listed IBX options I’m interested in. I traded them last year for a good return… will keep an eye on them to get full leverage to a phase 2 result from IBX.

Neurotech International (ASX: NTI) secures human ethics approval for Phase 3 clinical study in autism spectrum disorder. (NTI)

🪑Another trial that I’m looking forward to.

Been following NTI for quite a while, and I think from all of the cannabis related companies on the ASX, it is set to benefit the most from Trump’s federal downscheduling of cannabis in the US. (My full take here)

Recce Pharmaceuticals (ASX: RCE) will undertake a second study with the U.S. Army Institute of Surgical Research to evaluate Recce’s burn wound care gel. (RCE)

PolyNovo (ASX: PNV) secures a distribution agreement with Arbor Vitae International LLC to sell its wound care product in eight Balkan countries. (PNV)

Emyria (ASX: EMD) reports 67% of patients in remission 1 year after psychedelic PTSD treatment, with 76% showing clinically significant improvements. (EMD)

🪑While the study was small, these are great results and show that EMD’s psychedelic treatment is working to effectively “cure” PTSD.

Insurance payers and WorkCover will be closely reviewing these results.

Argenica Therapeutics (ASX: AGN) secures a waiver for its stroke treatment in paediatric patients, expediting approval timelines in Europe. (AGN)

Memphasys (ASX: MEM) secures major orders for its sperm separation product from Qatar's largest IVF institution. (MEM)

🪑Nice deal, first since securing CE mark for the sale of its product in Europe.

Genetic Signatures (ASX: GSS) appoints Maria Halasz as CEO, former CEO of Anagenics (Cellmid) for 14 years. (GSS)

🪑Good luck, Maria!

Artrya (ASX: AYA) signs Dignity Health Arizona to its SAPPHIRE Study (a pilot program to evaluate its AI product for detecting and managing coronary artery disease). (AYA)

Advanced Opportunities Fund ceased to be a substantial shareholder of Osteopore (ASX: OSX). (OSX)

🪑Looks like the con note was not a good holder after all. Will be careful next time more stock issued under the convertible note deal.

The ASX issued a ‘please explain’ to 4D Medical (ASX: 4DX) for failing to provide financial information in each of the hospital deals announced. (4DX)

🪑This was one of the biggest “please explains” I’ve seen in a long time.

I think the ASX needs to be more consistent in how it allows companies to disclose deals on its exchange, and better understand the “land and expand strategies” for health tech companies.

First and foremost, I think the ASX should err on the side of "more information is better."

This means allowing companies to disclose deals, even when the revenue is not known upfront.

For a company like 4DX, where it is impossible to predict the number of scans at each hospital, the ASX should still allow those deals to be announced, as they showcase the company's service rollout. (A material factor for investors of the company).

The Report Card

Tissue Repair (ASX: TRP) dropped 33% on Friday after releasing its quarterly report. (TRP)

🪑Need to read the management comments to see what happened here. Effectively, patient recruitment for the phase 3 trial has slowed, and the company may even “terminate” the phase 3 trial. Investors don’t like it when things aren’t working.

Cash Injection

Actinogen Medical (ASX: ACW) has raised $12M at $0.042 (no options), with an additional $5 million to be raised in a Share Purchase Plan.

🪑This should fund the company beyond its final trial results in November. Nice work.

PYC Therapeutics (ASX: PYC) raises up to $653M, comprising a $128M placement and $525M entitlement offer at $1.50. (PYC)

🪑That is a huge entitlement offer for a $1 billion capped company. Will be interesting to see how much of the $525 million they can bring in.

Invion (ASX: IVX) has raised $1.3 million through a Convertible Note facility. (IVX)

🪑IVX receives the award for the last quarterly report of the season, at 6:18 pm on Friday night.

Cyclopharm (ASX: CYC) announces a trading halt for a capital raise. (CYC)

CurveBeam AI (ASX: CVB) receives the initial $4 million tranche of a strategic $10 million investment from WEGO Orthopaedics. Shares issued at a 5x premium to the last traded price. (CVB)

AstraZeneca strengthens ties with China in a planned US$15B investment. (Biopharma Dive)

M&A, Big Pharma Wants a Wife

AstraZeneca struck a major licensing pact with CSPC for obesity/metabolic assets: US$1.2B upfront plus up to US$17.3B in milestones. (Reuters)

Repertoire adds Eli Lilly to a range of Big Pharma partners in an autoimmune deal worth up to US$1.9B. (Fierce Biotech)

Formation Bio, Jiangsu Chia Tai Feng Hai Pharmaceutical license autoimmune drug for US$500M in milestone payments. (Fierce Biotech)

Under the Microscope

On Friday, I was chatting with the CEO of an ASX-listed biotech (not Starpharma, another one).

His brokers had delivered him a blunt message:

“Unless you’re digging for gold, silver, or copper right now… you’ll struggle to fill a room full of investors.”

This was Friday afternoon.

Gold at all-time highs.

Silver at all-time highs.

And then, almost on cue, Friday night, the gold and silver markets had a big pullback…

Why am I discussing commodities in a biotech newsletter?

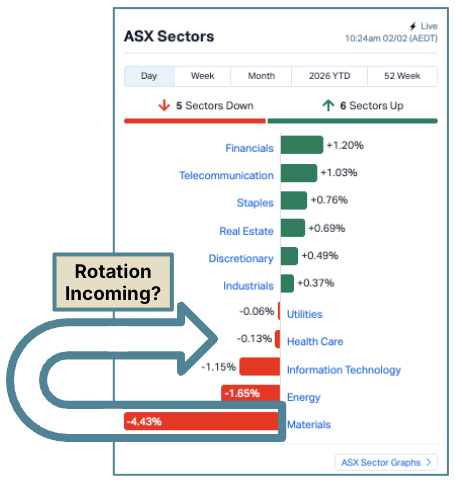

Investor attention on the ASX is scarce and moves in waves.

As someone who likes to invest in biotech stocks, it can be hard to ignore the monumental moves that have been happening right now in the resources sector.

It’s not intuitive, but this is a good thing for small-cap biotechs.

Generalist investors who have made money off the gold or silver may be looking to park their winnings elsewhere.

Worried about the top, and with the FOMO drying up, markets that have been undervalued and underappreciated start to look attractive.

Like biotechs in Australia.

I remember last year at the AusBiotech conference in October, the investment panels lamenting just how hard it was to raise capital for early-stage biotech companies…

It was a far cry from the mining conference I attended three weeks earlier, where there was a pent-up optimism from months of strong performance.

There are roughly 1,900 companies listed on the ASX.

40% of those are resource companies, and only 8% are healthcare.

So generalist investors who hold a portion of their portfolios in mining stocks (which most Australian small-cap punters do) have had a significant tailwind over the last 18 months.

That means there is capital to deploy if the commodities lose momentum.

(based on the pullback on Friday)

But where to park the excess capital…?

In the US, the biotech industry is humming.

(NASDAQ Biotech Index up 30% in 6 months)

The IPO window is open, Big Pharma has its chequebook out, and Eli Lilly is crowned the first $1 trillion pharma company.

That rotation just hasn’t fully reached Australia yet.

My dad always had a saying: "Profits are made in the bear market and harvested in the bull market."

(and he was a stockbroker for 32 years)

That stuck with me.

Because bear markets don’t feel like an opportunity at the time… and usually that’s the point.

Meanwhile, capital has been made elsewhere, with hot money chasing the silver and gold price runs.

If a rotation into biotech does happen, it will reward those who were paying attention before the mood changed.

That’s the lens I’m using heading into 2026.

See you all tomorrow,

The Armchair Analyst