Alright, so I have this idea…

It’s an undertaking that I want to do in 2026 - but I can’t do it by myself.

There are 165 healthcare companies listed on the ASX.

From CSL and ProMedicus to the most speculative microcap, trying to build a spark for a potential business.

And everything in between.

Each one of them has a different story, investment profile, risks, rewards and opportunities.

In 2026, I will profile all of them.

The Armchair Analysts newsletter exists to grow investor interest in ASX stocks and to translate complex companies, macro themes, and announcements into clear, accessible insights.

And this project is the natural next step.

For every ASX-listed healthcare stock in 2026, I want to:

Meet the management (ideally in person)

Capture the essence of the company’s story, risks and opportunities

Write my own personal investment memo on each company

Send that memo to my audience.

Put simply, I want to put every healthcare stock on the ASX in the hotseat.

I’m still looking for a name for this project. If you have any ideas, please reply.

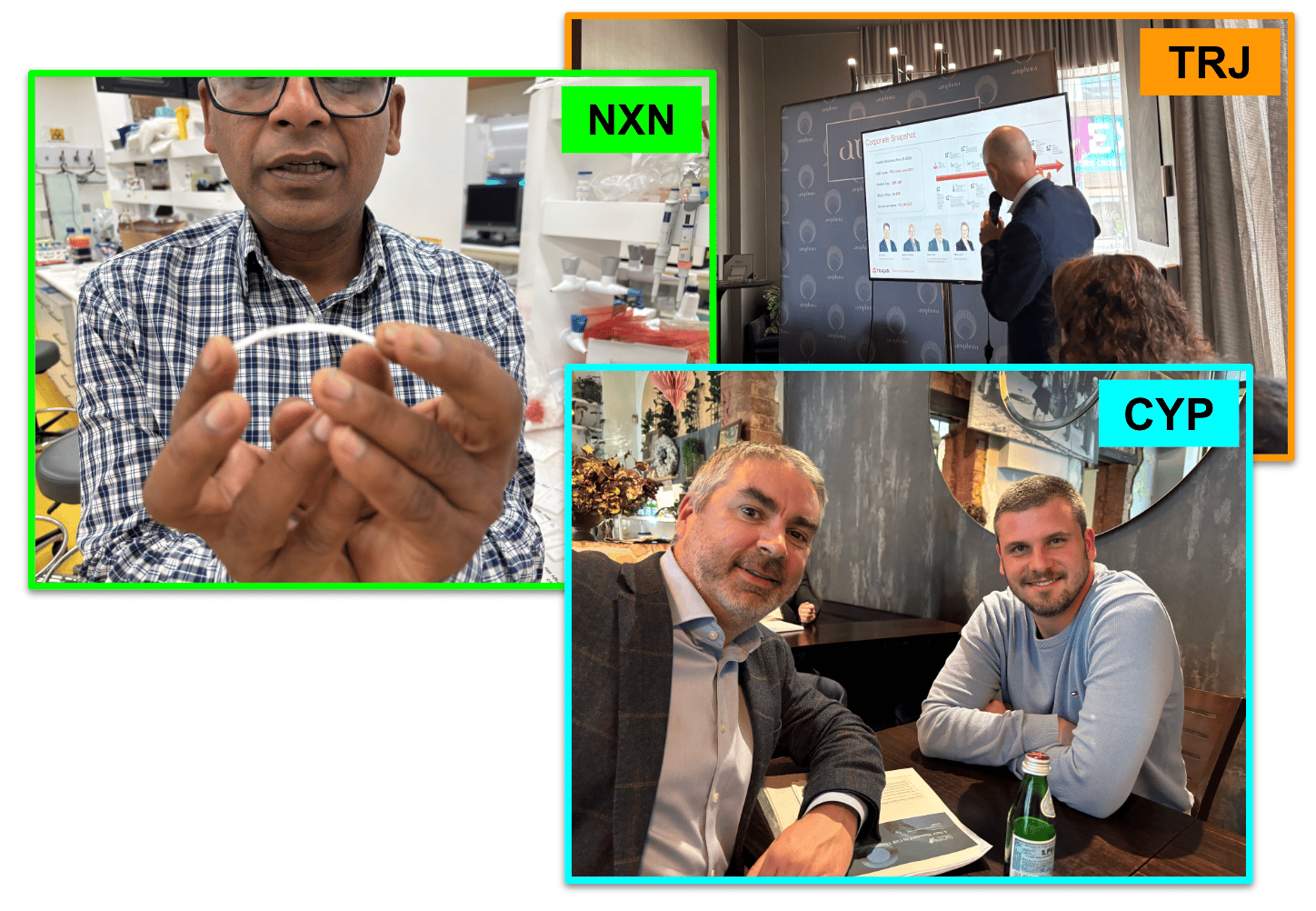

I gave myself a little bit of a head start… and spent the last week meeting with a handful of ASX-listed companies:

These stocks will be part of the first batch of Investment Memos I release early in the new year.

So, how can you help me with this project?

If you are involved with an ASX-listed company or can help facilitate an introduction, please respond to this email.

There are 165 companies to meet… so I’ve got a long way to go.

Keep an eye out for the first Investment Memos to drop early next year.

A few more final bits of housekeeping.

Tomorrow I’ll be speaking at The Stock Network’s ASX Gems Healthcare Spotlight.

You can watch 19 ASX-listed healthcare stocks present live at 11:00 am tomorrow (AEST) on The Stock Network YouTube channel.

Also, tomorrow will be my last newsletter for 2025 - starting back again on January 5th next year.

See you all tomorrow for the last edition of the year.

The Armchair Analyst

Jason

Did someone forward this email to you?

The Daily Check-up

Actinogen (ASX: ACW | MC: $175M) enrols its final patient in its phase 2b Alzheimer’s trial. January 2026 futility analysis, November 2026 topline results. (ACW)

TrivarX (ASX: TRI | MC: $13.5M) reports that its single-lead ECG algorithm detects major depressive episode from sleep with 97% sensitivity and 64% specificity. (TRI)

🪑 I’ve been following TRI for a while, and these results from 57 patients are pretty similar to those from the larger Phase 2 clinical trial it ran last year.

More important than the results of this trial is the data that TRI will collect from patients with a wrist-worn watch. If its algorithm can detect mental health issues from data collected from sleep signals on wearable devices, then it opens up many more commercial applications for TRI’s technology.

I’m not sure if they will report on this data or use it for R&D, but this was the main thing I wanted to see from this trial.

Memphasys’ (ASX: MEM | MC: $10M) Middle East distribution partner has placed an initial 500-unit order (~A$60,000) in anticipation of being granted CE Mark for its sperm separation device in January. (MEM)

Orthocell (ASX: OCC | MC: $271M) hits the 100 sales ‘milestone’ of its Remplir nerve repair device in the US. (OCC)

Results from Anatara's (ASX: ANR | MC: $4.4M) pre-clinical studies on an anti-obesity compound have been delayed. (ANR)

🪑 Pro tip: If a company labels its announcement “Company Update”... the news is generally bad.

If the company says that “it continues to evaluate opportunities for [new assets] in the junior healthcare sector”,... they don’t like their existing asset that much.

This announcement had both.

Wesfarmers Health has informed Priceline Pharmacy franchisees that receivers and administrators have been appointed for 54 Infinity pharmacies. (Pharmacy Daily)

Genentech is teaming up with Caris Life Sciences to collaborate on AI-driven cancer target discovery. $25M upfront, $1.1B milestones (Fierce Biotech)

Pfizer plans 15 obesity trials next year to replace $17 billion in patent-cliff revenue. (Endpoints)

Medline (NASDAQ: MDLN) raised $6.3 billion in the largest IPO of 2025 and is up 40% since its debut on Wednesday. (Financial Times)

🪑It’s a stark contrast between healthcare IPOs on the ASX versus the NASDAQ…

Imugene (ASX: IMU | $99) published a letter to shareholders late yesterday afternoon. (IMU)

🪑 I always like reading the letter to shareholders, as it is generally a candid reflection from the company's management.

Some of the highlight comments that stood out to me:

Imugene now employs 15 staff… at its peak, it had about 100.

Financial discipline is 50% of the scorecard for management performance rights.

The directors and the CEO have forfeited 50% of their approved performance rights.

I think that this letter goes back to my article last week, where I wrote that Imugene’s path to a phase three was clear, but its funding path was not.

This letter is clearly intended to be an olive branch to investors… but does that mean the company will be hat-in-hand again soon with a capital raise?

Or are they just looking to get some more buying on the screen…

Cash Injection

Cleo Diagnostics (ASX: COV | MC: $79M) raises A$5m at A$0.60 per share. (COV)

Micro-X (ASX: MX1 | MC: $56M) raises $6.18M at A$0.08 per share. (MX1)

🪑 Two ‘no options’ deals from both COV and MX1.