One of the most common questions that you’ll get from any retail investor is… Are these results any good?

The short answer… it depends.

The long answer… it depends.

Evaluating whether results are “good” is all about expectations and reality.

What did you (or the market as the collective ‘you’) expect going into the results?

AND what do these results change about the risk and reward profile of the business?

It is often the case that two investors can examine the same result and have wildly different views on whether that result is “good.”

But, it is much more uncommon for two different markets to examine the same result and come up with different takes on whether the results are “good”.

That is the story of Radiopharm Theranostics (ASX: RAD | $102M) this week.

Same news, different market.

The ASX sold it down 5.26%, but the NASDAQ bought it up 149%.

So, what happened?

On Monday, Radiopharm published interim results for its Brain Metastases imaging agent RAD101, showing 92% concordance versus an MRI. (RAD)

Brain Metastases (Brain Mets) is cancer that has spread from another part of the body to the brain.

Common primary cancers include lung cancer, breast cancer, and melanoma.

In the US, there are around 150,000 to 300,000 patients diagnosed each year with Brain Mets.

Radiopharm’s chemical agent binds to the tumours and can potentially be identified earlier than an MRI.

Here is an example from yesterday’s company presentation that shows its chemical identifying the Brain Metastases potentially months before the MRI.

(Source, Company Presentation Thursday 16th December)

RAD is currently undertaking a Phase 2b clinical trial for its chemical in 30 patients.

On Monday, the company announced that interim results show 92% concordance with the MRI.

In the title of the announcement, the company said that it had "achieved its primary endpoint”.

But, given that these are just interim results, labelling it as “on track to achieve its primary endpoint” would have been a more apt description.

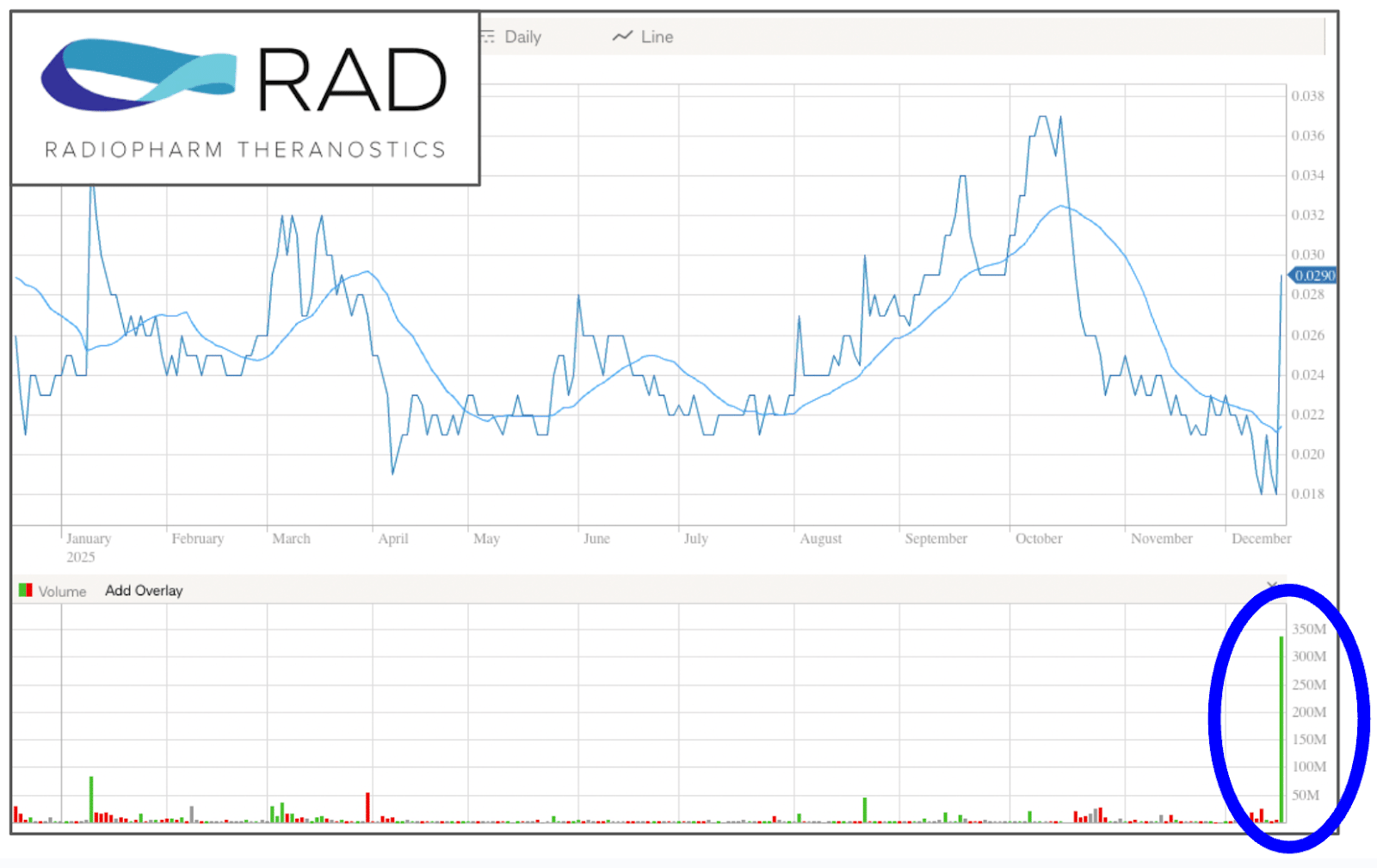

The response on the ASX was, let’s say, pretty limp…

Down 5.26% on small volumes.

THEN, overnight on the NASDAQ ADR, the stock was up 149%:

How does this work?

RAD is listed on both the ASX and NASDAQ through an American Depositary Share or ADS.

This scheme allows US investors to buy a stake in Radiopharm without opening an account with an Australian broker.

So while Australian investors didn’t care for the news, US investors did.

Why do I think this happened?

The sentiment for biotech stocks in the US is VERY strong right now.

Last week, eight US biotech stocks raised a collective US$3.2 billion in capital through multiple upsized stock offerings.

This was the largest single-day raise in the sector’s history.

The NASDAQ Biotech index is up 31.5% over the last six months (the best-performing sector, even better than big tech), and the market is rewarding clinical trial results with share-price action.

So with US investors making money from the sector, they are looking for where the next big rise could come from.

It makes sense that when looking at Radiopharm’s results, the US investors give more credence to the reward, while Australian investors are more cautious about the risk.

The timeline goes like this:

ON MONDAY, Radipharm closed on the NASDAQ at US$10.63 per ADR, implying a price of ~A$0.053.

YESTERDAY, Radiopharm traded up 61% on the ASX, closing at $0.029, with $14 million in volume.

LAST NIGHT, Radiopharm traded on the NASDAQ again and was down ~44%, implying a price of ~A$0.03.

This movement on the NASDAQ was effectively a rebalancing of the price to ASX levels.

So what’s the net result?

It will be interesting to see what the trading looks like on the ASX today, but it appears the market has found a balance around that 2.5c to 3c mark.

It’s also important to note that RAD has had its highest-ever volume days with A$14 million traded on the ASX:

Large-volume days like this are essential to turn over the share register, allow stale holders to exit, and make way for fresh investors to the story.

Okay, but were these results any good?

Well, it depends…

The market is telling us that these results are somewhere between “Better than what an Australian investor thinks and worse than what a US investor thinks”

… which to me is probably about right.

So even though it took trading across two markets to determine the price, it appears to be approaching equilibrium.

It’s funny how these markets work sometimes.

PS: My Dad wanted me to issue a correction to yesterday’s article. He was a broker for 38 years, not 25… he was a bit miffed.

See you all tomorrow.

The Armchair Analyst

Jason Segal

Did someone forward this email to you?

The Daily Check-up

Island Pharmaseuticals (ASX: ILA | MC: $125M) signs a Master Services Agreement with Texas Biomed to conduct non-human primate studies with Galidesivir for Marburg Disease. Galidesivir is an antiviral that ILA looks to get approved under the FDA Animal Rule. (ILA)

Neurotech International (ASX: NTI | MC: $19M) secures $4M at $0.14 per share. (NTI)

🪑 I like when a raise has no options attached for existing investors - it disincentivises the ‘hot money’.

HITIQ (ASX: HIQ | MC: $9M) signs an exclusive partnership with Sportscover to integrate HIQ’s concussion mouthguard technology into its sports insurance offering - starting with Hockey Australia. (HIQ)

🪑 I’ve followed HIQ for about three years now, and this is genuinely good news. The concussion detection technology was always good, but the business model was never proven.

Insurance-funded sales have been part of the company’s commercial strategy since its first deal with Bupa Dental Care after the IPO in 2021.

But finding the RIGHT partner has always been the challenge. Sportscover appears to be more aligned to HIQ consumers than Bupa Dental, so let’s see how this plays out…

Proteomics (ASX: PIQ | MC: $86M) secures a US patent for its blood test technology to diagnose esophageal cancer. (PIQ)

Cleo Diagnostics (ASX: COV | MC: 88M) enters a trading halt for a capital raise. (COV)

Opthea (ASX: OPT | Suspended) remains suspended following the failure of its Phase 3 clinical trial in March this year. The company will be presenting its strategic review and pivot today at 11:00 am. (Presentation Slides, Webinar Link)

🪑: 🍿

Entropy Neurodynamics (ASX: ENP | MC: $51M) completes dosing for its first patient with psilcin for its 12-patient Binge Eating Disorder clinical trial. (ENP)

🪑 I missed this news yesterday. Entropy Neurodymanics is the old Trypthamine Therapeutics (ASX: TYP). The company changed its name a couple of weeks back.

Frankly, I like the old name better.

The FDA has approved a combination therapy by AstraZeneca and Daiichi Sankyo for a first-line breast cancer treatment. (Fierce Pharma)

4D Medical (ASX:4DX | MC: $1.5B) was up another 22% yesterday.

🪑 With a market cap of ~$1.5 billion, the 4DX mania has taken hold. I’ll be very curious to see just how high this one can go…

It is always very good to have “sector champions” succeed. It gives hope to smaller companies and investors alike.

M&A, Big Pharma Wants a Wife

Sanofi signs a US$1.04B deal for worldwide rights to a Phase 1 antibody for Alzheimer’s Disease with the French drugmaker ADEL. (BioSpace)

Adaptive Biotechnologies signs a 2-year non-exclusive deal with Pfizer worth up to US$890M for its rheumatoid arthritis technology. (Reuters)

Report: Fewer deals but bigger bucks $, a look at pharma M&A this quarter. (Pharmaceutical Technology)