Christmas is less than 10 days away.

Some in the industry have closed up shop for the year, and others are sprinting to the finish line.

Right now, I am in preparation mode.

Not to pluck up the enthusiasm to talk to my mother-in-law at Christmas lunch, but to identify my Boxing Day bargain bin trades.

In my opinion, there are only two times in a calendar year when there are more sellers than buyers (just by virtue of when these trading days occur).

Late June (tax loss season).

Late December (between Christmas and New Year’s)

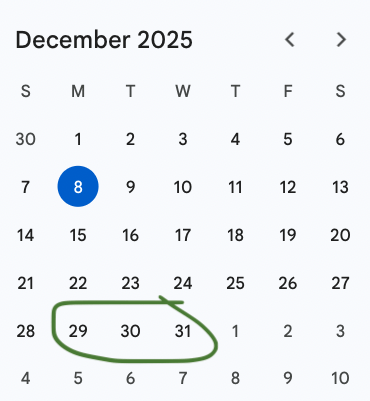

You may be surprised to know that the market is actually open during Christmas time:

(And if you’re a tragic like me, then you might actually be placing some trades during this time)

Those three trading days between Christmas and New Year’s are by FAR the period with the least liquidity in the entire year.

Traders are at the beach, brokers on holidays, and NO ONE is looking at the markets.

… except me.

My Dad was a stockbroker for 25 years, and he had this saying: “There is no such thing as a forced buyer, but there is such a thing as a forced seller”.

So with the buyers AND the sellers packed up for the year, there are opportunities to pick up stocks that have been sold down on low volumes.

Forced sellers exist for many reasons, but generally, around this time of year, it's just to pay for the expensive Christmas holiday.

To find the stock’s best place for this, I ask myself 4 questions:

Is it a stock that I already like or is already on my watch list? If the trade doesn’t work, I should own a stock that I like.

Is the chart looking good, and is the stock primed for a run? I’m not the best charter out there; however, I do have a friend that I use to screen stock charts of companies that I like.

Is there a material catalyst in the first three months of the year? Something that could either move the share price or pique others' interest in the story early in the year.

Does the company have enough cash runway to last them AT LEAST three quarters? I don’t want to run into a capital raise in January.

Once I’ve identified my targets, I track the trades, and if there is any selling volume, I’ll look to pick that up on December 29th, 30th and 31st.

And ride the momentum through to Jan, Feb and March when the market liquidity returns and (hopefully) the stock is re-priced upwards.

I find that biotech stocks tend to work the best for this strategy.

Why?

The biggest biotech conference every year happens in the first week of January: The JP Morgan Healthcare Conference.

This is the largest healthcare conference every year, and it sets the tone for the biotech industry.

M&A deals, new data, and new technologies are all being showcased here.

2025 is already set to be a blockbuster year for M&A with over US$260 billion in deals done so far (source)…

What will 2026 bring?

Who knows, but the macro tailwinds from the event always flow through to the biotech sector in January.

This is not a strategy for everyone, particularly if you’re looking to wind down for the year.

But it is something that I like to do.

If you have any stocks that you think could be targets for this strategy, please let me know.

Wish me luck! And I’ll see you all tomorrow.

The Armchair Analyst

Jason Segal

The Daily Check-up

Immutep (ASX: IMM | MC: $525M) has now enrolled 289 patients out of 756 on its Phase III lung cancer trial. Enrolment is scheduled for completion in the second half of 2026. (IMM)

🪑 Last week, Immutep signed a licensing deal with Dr Ready for non-core markets, up to US$370M. It still has Japan, China, the US and Europe to partner with.

My Immutep trade is still active in anticipation of the futility analysis scheduled for Q1 next year.

Emyria (ASX: EMD | MC: $42M) signs a deal with Avive Health for its first Victorian mental-health clinic for psychedelic-assisted therapy for PTSD and treatment-resistant depression. (EMD)

🪑 Disclosure: I own shares in EMD.

Adherium (ASX: ADR | MC: $10M) reports Q2 FY26 RPM subscription revenue of $187,000 (+103.1% QoQ) from its remote asthma monitoring. (ADR)

🪑 There is a great chart in the announcement that shows the sales growth of the remote asthma monitoring product. One I’ll be watching closely.

Australian Regulators confirm that the R&D activities undertaken by Recce Pharmaceuticals (ASX: RCE | $176M) outside of Australia are eligible for the R&D tax incentive (up to $85M). (RCE)

CONNEQT Health (ASX: CQT | MC: $30M) provides a sales update, 200% QoQ growth guidance is still on track. (CQT)

ECS Botanics (ASX: ECS | MC: $11M) starts strategic review for future US medicinal cannabis market entry. (ECS)

🪑 As I reported yesterday, cannabis stocks were all up in the US on the rumour that Trump would down-schedule marijuana for medical uses. Good timing for this news by ECS.

Micro-X (ASX: MX1 | MC: $53M) entered a trading halt for a capital raise.

Trump says he's 'strongly' considering reclassifying cannabis via executive order. (CNBC)

Biotech poised to outperform bear markets of 2021 to 2024, says William Blair analysts (Fierce Biotech)

Sobi acquires Arthrosi Therapeutics for $950M upfront, adding gout treatment to its product pipeline. (PR Newswire)

Sanofi extends its partnership with Dren Bio, worth up to $1.7 billion, to work on a therapy for multiple autoimmune diseases. (Biospace)