Good morning,

Welcome to today’s edition of The Armchair Analyst, a 5-minute daily update on the ASX life-sciences sector.

Today I'm going whale watching.

Buried in the paperwork of ASX administrative announcements are share price insights; we just have to look.

Specifically, I’m looking at Form 604: Change in Substantial Holder Notice.

But first…

The Pulse Check

Telix Pharmaceuticals (ASX: TLX | MC: $4B) has secured a New Drug Application in China for its prostate cancer imaging agent. (TLX)

Atomo Diagnostics (ASX: AT1 | MC: $31M) secures a global exclusive licence from Burnet Diagnostics for its rapid ALT liver function test. Cost $150k upfront and $650k in milestones. (AT1)

Yesterday, Lumos Diagnostics (ASX: LDX | MC: $202M) secured a contract with Aptatek to manage its FDA-focused 6-month clinical trials for the PKU in-home monitoring device. (LDX)

Genetic Signatures (ASX: GSS | MC: $51M) posts Q2 FY26 sales $3.3M, receipts $4.6M, net operating cash inflow $1.8M and holds $29.7M in cash. (GSS)

Neurizon Therapeutics (ASX: NUZ | MC: $52M) secures global trademark protection for NEURIZON® across major pharmaceutical markets, including the US, EU, UK, Australia, and Japan. (NUZ)

Vitrafy (ASX: VFY | MC: $74M) appoints Dr. Jeannie Joughin as Independent Non-Executive Director. (VFY)

Nanosonics (ASX: NAN | MC: $1.2B) announces the appointment of Sarah Butler as an independent non-executive director. (NAN)

Cash Injection

Cambium Bio (ASX:CMB | MC: $12M) secures $2.4M placement from major shareholder Zheng Yang Biomedical Technology at a 20% premium to the last traded price. (CBM)

AgomAb Therapeutics and SypGlass Pharma file for US IPOs.

🪑 IPO filings are generally a read-through on risk appetite, indicating that the US is “risk on” right now for biotech companies.

M&A, Big Pharma Wants a Wife

AbelZeta, AstraZeneca expand CAR-T therapy partnership with US$630M China rights acquisition. (PR Newswire)

Under the Microscope

Today, I want to go Whale Watching.

Understanding the flow of money is critical to predicting whether a stock will go up or down.

Generally, there is only one reason that someone buys a stock…

To make money.

But there are infinite reasons someone sells a stock…

Buy a new house, tax bill due, divorce settlement payment, ect…

Lucky for us retail investors, we can monitor the movements of whales (substantial shareholders) through the Change in Substantial Shareholding.

These notices often drop in the afternoon and are overlooked by many - BUT they can be gold for retail investors looking for clues on how a stock might behave.

What I am looking for is:

WHO is the substantial shareholder

WHETHER they are a buyer or a seller (look at the number of votes that changes NOT the %)

WHEN did the entity buy and sell (this is generally in an Annexure A, then I like to match it up with the share price volume on those days)

And the most important question we want to ask ourselves is WHY are they buying or selling, and WILL IT CONTINUE in the foreseeable future?

Answering this question, WHY is impossible without some deeper knowledge of the company.

(as I said before, there are infinite reasons that someone would sell a stock)

But we can make an educated guess about what it may be and whether it will continue, and answer some questions about stock movements in the past.

Yesterday, SIX life sciences companies released Changes in Substantial Shareholder notices.

Here is what they revealed:

1. BCAL Diagnostics (ASX: BDX | MC: $47M) (BDX)

Capital Property Group, a family office associated with the Snow Family, BOUGHT ~$1.2M worth of shares over the last 12 months.

INSIGHT: The Capital Group had two key buying windows. First in April and then again since October last year. The buying in October accounted for 47% of the total volume, which is reflected in a big move in the share price:

This appears to be a happy shareholder, buying up stock in anticipation of BCAL going live with its cancer blood diagnostics test.

BCAL was featured last night on Channel 7 as well, take a look at the video here:

2. Vitrafy Life Sciences (ASX: VFY | MC: $74M) (VFY)

Ryder Investments, a listed investment fund BOUGHT ~$1.2 million worth of shares in the last 12 months, including $355,000 since October last year.

INSIGHT: This buying accounted for about 10% of the total 12-month volume for VFY. Not meaningful enough to have an impact on the market. Just a supportive shareholder.

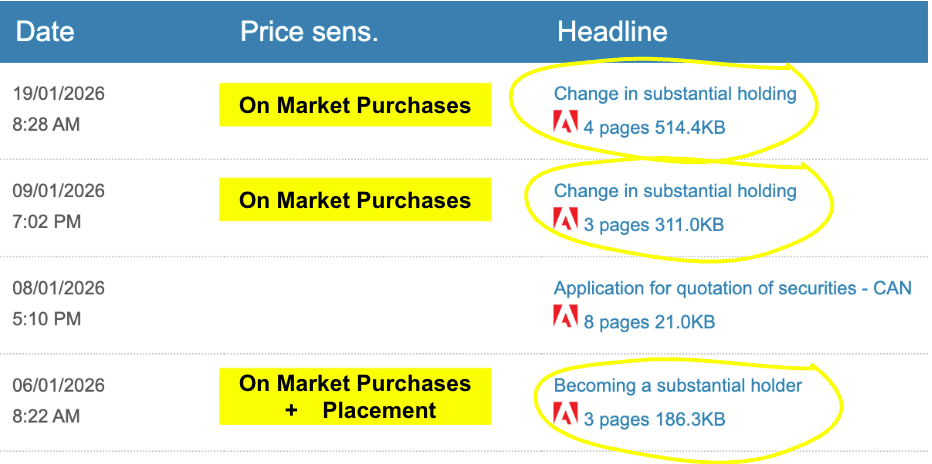

3. CanGroup (ASX: CAN) (CAN)

Nobel Investments, the superannuation fund for Tim Lebon, BOUGHT $260,000 worth of stock between the 12th and 16th of January.

INSIGHT: This is the third second Change in Substantial Notice for Tim Lebon in two weeks. Indicating that this whale may be building a position in the company and supporting on-market.

Two changes.

FIRST, Australian Ethical Fund, an unlisted investment fund, SELLS down its position to under the 5% threshold for reporting substantial notices. It has been a seller since August last year.

SECOND, Australian Retirement Trust, another superfund, BOUGHT shares on the market to move over the 5% threshold for a substantial shareholder.

INSIGHT: One superfund out, another superfund in. ACL has a large enough market cap and daily volume that neither of these movements had a meaningful impact on the company’s share price or momentum.

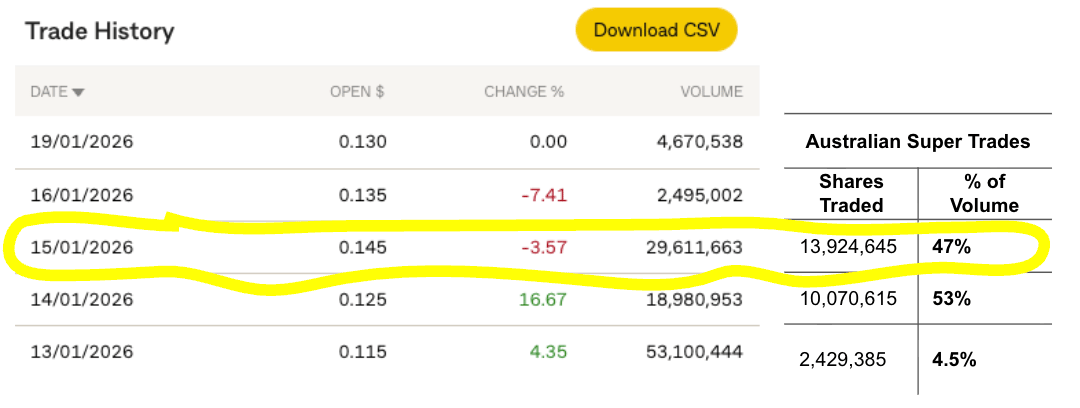

5. Alcidion (ASX: ALC | MC: $174M) (ALC)

Australian Super, another large super fund, SOLD some of its holdings, $3.4 million in three days.

INSIGHT: Now this one is interesting, because ALC actually announced a 4C Quarterly Update report on the 15th of January.

(For what it’s worth, I thought that 4C reflected a good quarter for the company).

However, because there was such a big seller on that day, the share price momentum was effectively snuffed out.

Now, what’s interesting is that Australian Super actually started selling before the 4C was announced, indicating that the report's actual results weren't the cause of the selling, but rather some other factor.

4C was announced on the 15th of Jan.

Shareholder notices from Rubric Capital and investment bank Goldman Sachs.

INSIGHT: This one is a little different with notices from major (and a bit hard to identify exactly what is happening).

What we are seeing is that the folks who were long or short MYX via various instruments are adjusting their positions after the company's takeover bid was withdrawn.

So, no real insight from here about the stock price for retail investors.

BUT a good rule of thumb is that when a big investment banker hits a register (UBS, Goldman Sachs, etc), it is almost always them making a market for a big holder to sell OR for someone to short.

Final thoughts

While our “whale watching” exercise might not give us a full picture of the company, it can help answer some questions about its share price movements.

For example…

Question: Why didn’t Alcidion’s share price go up on the 4C result? Does this mean that it was bad?

Answer: Not necessarily; it was a big investor selling down a position, which snuffed out the stock's momentum.

Question: What has been the cause of the run in BDX’s share price in the last three months? Is this the retail market catching on to the story?

Answer: Big buying from a single supportive existing shareholder indicates that it wasn’t retail that moved this stock.

Question: There are big volumes on the CAN Group Stock, what’s happening?

Answer: A new shareholder has entered the market, mopping up the stock and moving shares from stale holders into one (presumably) more sticky holder.

These answers can provide us with potential insight into how each stock will trade in the future and help us make better investment decisions.

So make sure you go Whale Watching every once in a while and pay attention to the Form 604, Change in Substantial Shareholder Notice…

Because you never know what insight you could get and an edge you could gain by knowing just a little bit more information.

See you all tomorrow.

The Armchair Analyst